Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

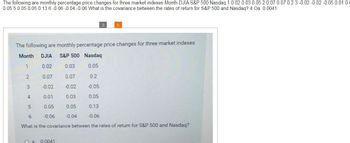

Transcribed Image Text:The following are monthly percentage price changes for three market indexes Month DJIA S&P 500 Nasdaq 1 0.02 0.03 0.05 2 0.07 0.07 0.23 -0.02 -0.02 -0.05 0.01 0.0

0.05 5 0.05 0.05 0.13 6-0.06 -0.04 -0.06 What is the covariance between the rates of return for S&P 500 and Nasdaq? 4 Oa. 0.0041

The following are monthly percentage price changes for three market indexes

Month DJIA S&P 500 Nasdaq

1

0.02

0.05

0.07

0.2

-0.02

-0.05

0.01

0.05

5

0.05

0.13

6

-0.06

-0.06

What is the covariance between the rates of return for S&P 500 and Nasdaq?

2

3

4

a 0.0041

0.03

0.07

-0.02

0.03

0.05

-0.04

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- D Question 4 A firm has an ROE of 18% and a market-to-book ratio of 1.82. Based on this information, calculate the firm's P/E. Note: Enter your answer rounded to the nearest second digit after the decimal point. For example, if the calculated P/E is 11.78429, enarrow_forward1. credit terms : 5, 1/15, n/45 what is the rate of the trade discount? 2. credit terms :5, 1/15, n/45. When will be the maturity period if sold Feb 19?arrow_forwardNonearrow_forward

- Study Tools ons cess Tips cess Tips pack The following graph shows the contingency graph for sellers of euro call options, with a premium of $0.02 and an exercise price of $1.48. NET PROFIT PERUNT (Delars per un 0.03 0.02 O 0.01 -001 600 -0.01 14 145 180 182 154 155 156 180 182 FUTURE SPOT RATE (Dollars per euro) ? According to the graph, if the spot rate turns out to be $1.50, and the option is exercised, the seller will According to the graph, break-even price is per unit.arrow_forwardCalculate Duolingo’s underpricing if the offer price equals $102 and the closing price on the first trading day equals $134.26.arrow_forwardForward premium: a) The current price of a pound in Toronto is 1.2345. The 30 days price of the pound in Toronto's forward market is 1.1357. What is the annualized forward premium for Canarian dollars? b) Spot and 60 days forward dollar indirect quotes for yen are 100.2468 and 101.0305. What is the annualized dollar forward premium?arrow_forward

- ssume that prices for the items below increased at the average annual rates shown in the table. Use the inflation proportion to find the missing price the last column of the chart Item Evening dress Price $176 The missing price in 2009 is $ Round up to the nearest dollar.) Year Purchased 2000 Price in 2009 GID Year 2000 2009 Average CPI-U 172.7 214.4arrow_forwardExhibit 4.1 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Year 2000 2001 2002 2003 2004 9.7800% 0.0970% 0.0978% 3.6400% % Price Change for GB Industries C 9.0700% 10.0% Refer to Exhibit 4.1. Calculate the average annual rate of change for GB Industries for the five- year period using the geometric mean. 12.0% 10.0% 11.0% 6.0%arrow_forwardPW vs Interest Rate 90,000 80,000 70,000 IRR = 9.41% IRR = 20.21% 60,000 %3D 50,000 IRR = 17.26% 40,000 30,000 20,000 10,000 Interest Rate, % -10,000 Do DOT SOLID -20,000 Referring to the graph, write the Decision Table telling which alternative to choose as a function of the interest rate. Present Worth, $arrow_forward

- Calculate the final selling price to the nearest cent and markdown percent to the nearest hundredth percent: First markdown Final markdown Original selling price $5,000 Second markdown Markup 12% 20% 10% 5% Final selling price Markdown percent :%arrow_forwardCalculate the final selling price to the nearest cent and markdown percent to the nearest hundredth percent: Original selling price $6,500 Markup 10% Final selling price Markdown percent First markdown 35% % Second markdown 20% Final markdown 20%arrow_forwardUntil recently, Augean Cleaning Products sold its products on terms of net 70, with an average collection period of 85 days. In an attempt to induce customers to pay more promptly, it has changed its terms to 1/10, EOM, net 70. Assume current sales of $100, costs of $90, an interest rate of 12%, and no defaults. Assume each month has 30 days and a year has 360 days. The initial effect of the changed terms is as follows: Percent of Sales with Cash Discount 70 Average Collection Periods (Days) Cash Discount 40a Net present value Net 90 Some customers deduct the cash discount even though they pay after the specified date. a. Calculate the NPV per $100 of sales based on the original terms. (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education