Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

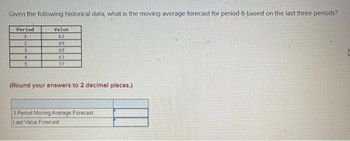

Transcribed Image Text:Given the following historical data, what is the moving average forecast for period 6 based on the last three periods?

Period

1

2

3

4

5

Value

63

69

69

63

77

(Round your answers to 2 decimal places.)

3 Period Moving Average Forecast

Last Value Forecast

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Question 9 Listen Given the following trigonometric ratios and angle measures, match the ratio to the correct angle measure. sine=0 sine -1 cose=-1 cose=0 a. 270° b. 90° C. 180° d. 360°arrow_forwardCan some one please help me to solve this question? Please and thank you!!arrow_forward1. What is the margin for segment A? Enter your number with four decimal points. For example, 5.23% enter as 0.0523. ANSWER: 0.0500: 2. What is the margin for segment B? Enter your number with four decimal points. For example, 5.23% enter as 0.0523. ANSWER: 0.1286: 3. What is the margin for segment C? Enter your number with four decimal points. For examplec, 5.23% enter as 0.0523: 4. Which segment has the best margin?a. Segment Ab. Segment Bc. Segment Cd. Segment A and Carrow_forward

- Use the times and corresponding closing prices of the stock to create coordinate pairs. Let x represent the number of weeks since the first data point, and let y represent the closing price at each time. So, x=0 represents the data point from 5 years ago. There are 52 weeks in a year, and you can write the time for each closing price recorded in terms of weeks that have passed since 5 years ago, when x=0. Fill in the table to represent your data as coordinate pairs. x (weeks since 5 yrs ago) most recent 260 7days ago 259 1 month ago 256 6 months ago 234 1 year ago 208 3 years ago 104 5 years ago 0 y (closing price, in $) most recent 7 days ago 1 month ago 6 months ago 1 year ago 3 years ago 5 years agoarrow_forwardndard deviation of the following annual returns:arrow_forwardCoronado Corporation began operations on December 1, 2019. The only inventory transaction in 2019 was the purchase of inventory on December 10, 2019, at a cost of $ 23 per unit. None of this inventory was sold in 2019. Relevant information is as follows. Ending inventory units December 31, 2019 165 December 31, 2020, by purchase date December 2,2020 165 July 20, 2020 50 215 During the year 2020, the following purchases and sales were made. Purchases Sales March 15 365 units at $28 April 10 265 July 20 365 units at 29 August 20 365 September 4 265 units at 32 November 18 215 December 2 165 units at 35 December 12 265 The company uses the periodicinventory method. (a1)arrow_forward

- Round each z-score to the nearest hundredth.A data set has a mean of x = 6.2 and a standard deviation of 2.2. Find the z-score for each of the following. (a) x = 6.2(b) x = 7.2(c) x = 9.0(d) x = 5.0arrow_forwardGiven the following probability distribution, what are the expected return and the standard deviation of returns for Security J? State Pi ri 1 0.5 11% 2 0.3 8% 3 0.2 5% O 9.40%; 2.04% O 8.90%; 2.34% O 7.40%; 2.94% O 8.40%; 2.64% O 7.90%; 1.74%arrow_forwardConsider the following five monthly returns: 0.04 −0.03 0.03 0.07 −0.02 a. Calculate the arithmetic average monthly return over this period. b. Calculate the geometric average monthly return over this period. c. Calculate the monthly variance over this period. d. Calculate the monthly standard deviation over this period.arrow_forward

- Using the return data on portfolios A and B provided in the accompanying spreadsheet, compute the return volatility for portfolio A. Round off your answer to three digits after the decimal point. State your answer as a percentage point, such as 1.234.arrow_forwardUsing the spot and outright forward quotes in the table below, determine the corresponding bid-ask spreads in points. Spot 1.3508 − 1.3524 One-Month 1.3520 − 1.3541 Three-Month 1.3536 − 1.3562 Six-Month 1.3576 − 1.3610arrow_forwardDarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education