Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

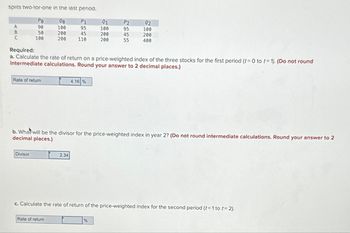

Transcribed Image Text:splits two-tor-one in the last period.

00

P1

100

95

200

45

110

A

B

C

Po

90

50

100

Rate of return

Divisor

200

Rate of return

Required:

a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t=0 to t= 1). (Do not round

intermediate calculations. Round your answer to 2 decimal places.)

4.16 %

2.34

91

100

200

200

P2

95

45

55

b. What will be the divisor for the price-weighted index year 2? (Do not round intermediate calculations. Round your answer to 2

decimal places.)

%

92

100

200

400

c. Calculate the rate of return of the price-weighted index for the second period (t = 1 to t=2).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Expected Returns: Discrete Distribution The market and Stock J have the following probability distributions: Probability rM rJ 0.3 15% 20% 0.4 9 7 0.3 18 10 Calculate the expected rates of return for the market and Stock J. Round your answers to one decimal place. Expected rate of return (Market): % Expected rate of return (Stock J): % Calculate the standard deviations for the market and Stock J. Do not round intermediate calculations. Round your answers to two decimal places. Standard deviation (Market): % Standard deviation (Stock J): %arrow_forwardThe following table contains data on market advances and declines: Market Advances and Declines Day Advances(in millions) Declines(in millions) 1 906 704 2 653 986 3 721 789 4 503 968 5 497 1,095 6 970 702 7 1,002 609 8 903 722 9 850 748 10 766 766 Required: a. Calculate cumulative breadth. (Enter your answers in millions. Negative values should be indicated by a minus sign.) b. Is this technical signal bearish or bullish?arrow_forward3 is not the right answer can someone help?arrow_forward

- You have the following information: t1 t2 t3 t4 TSLA Returns 0.05 -0.04 0.1 -0.01 Market Returns 0 -0.04 0.01 0.01 What is the Covariance of TSLA and the Market? Type your answer as decimal (i.e. 0.052 and not 5.2%). Round your answer to the nearest four decimals if needed.arrow_forwardYou have the following information: t1 t2 t3 t4 TSLA Returns 0.05 -0.04 0.1 -0.01 Market Returns 0 -0.04 0.01 0.01 What is the Covariance of TSLA and the Market? Type your answer as decimal (i.e. 0.052 and not 5.2%). Round your answer to the nearest four decimals if needed.arrow_forwardam. 134.arrow_forward

- Bhupatbhaiarrow_forwardpm.3arrow_forwardConsider the following information: Rate of Return if State Occurs State of Economy Probability of State of Economy Stock A Stock B Recession 21 .06 21 Normal 58 109 08 Boom 21 14 25 a. Calculate the expected return for Stocks A and B. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation for Stocks A and B. (Do not round Intermedlate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a. Stock A expected return a. Stock B expected return b. Stock A standard deviation b. Stock B standard deviation 196 96 96 %arrow_forward

- Consider the following information: Probability of State of Economy .22 .57 .21 Economy Recession Normal Boom Rate of Return if State Occurs. Stock A Stock B a. Expected return of A Expected return of B b. Standard deviation of A Standard deviation of B .020 .100 160 a. Calculate the expected return for the two stocks. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the standard deviation for the two stocks. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. % % -.27 .17 .40 % %arrow_forwardConsider the following information: State of Economy Recession. Normal Boom Probability of State of Economy .17 .58 .25 Rate of Return if State Occurs Stock A Stock B .08 -.12 11 .17 .34 a. Stock A expected return a. Stock B expected return b. Stock A standard deviation b. Stock B standard deviation a. Calculate the expected return for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) .16 Answer is complete but not entirely correct. 9.86 % 21.46 % 7.70 % 9.50 %arrow_forwardPlease answer the correct calculation please ASAP Don't answer by pen paperarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education