Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:K

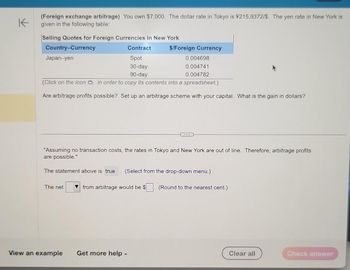

(Foreign exchange arbitrage) You own $7,000. The dollar rate in Tokyo is ¥215.9372/$. The yen rate in New York is

given in the following table:

Selling Quotes for Foreign Currencies in New York

Country-Currency

Japan-yen

Contract

Spot

30-day

90-day

(Click on the icon in order to copy its contents into a spreadsheet.)

Are arbitrage profits possible? Set up an arbitrage scheme with your capital. What is the gain in dollars?

The net

View an example

$/Foreign Currency

"Assuming no transaction costs, the rates in Tokyo and New York are out of line. Therefore, arbitrage profits

are possible."

The statement above is true (Select from the drop-down menu.)

0.004698

0.004741

0.004782

Get more help -

...

from arbitrage would be $ (Round to the nearest cent.)

Clear all

Check answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Alpesharrow_forwardDeferred Annuity Elmo is thinking of establishing a fund for his daughter’s college education. He wants his daughter to be able to withdraw P60,000 from the fund on her 18th birthday, again on her 19th birthday, again on her 20th birthday, up to her 23rd birthday. If the fund earns interest at 12% per year, compounded annually, how much should Elmo deposit at the end of each year, from the time his daughter reaches 5 years old up to her 17th birthday? Find the value after 20 years in pesos of an annuity of P120,000 payable annually for 8 years, with the first payment at the end of 2 years if money is worth 5%.arrow_forwardRequired: Calculate the contribution to total performance from currency, country, and stock selection for the manager in the example below. All exchange rates are expressed as units of foreign currency that can be purchased with 1 U.S. dollar. (Do not round intermediate calculations. Round your percentage answers to 2 decimal places. Input all amounts as positive values.) Europe Australasia Far East EAFE Weight 0.60 0.10 0.30 Return on Equity Index 20% 18 25 Profit/Loss Currency Selection % relative to EAFE Country Selection % relative to EAFE Stock Selection % relative to EAFE E1/E 1.10 0.50 1.30 Manager's Weight Manager's Return 0.48 18% 0.20 16 0.32 16arrow_forward

- You have the following quotations for the Chinese yuan (CNY) and the Australian dollar (A$) at the HSBC Bank in China and National Australia Bank in Australia. Can you make a locational arbitrage profit? If yes, calculate the arbitrage profit if you have A$1.76 million or CNY3.42 million. (enter the whole number without sign or symbol) Currency HSBC in China National Australia Bank in Australia Bid Ask Bid Ask Chinese yuan A$0.2010 A$0.2230 A$0.2420 A$0.2673 Australian dollar CNY4.4221 CNY4.9632 CNY3.8255 CNY4.1641arrow_forwardAn example of transaction exposure is when Question 4 options: companies have obligations for the purchase of goods at previously agreed prices. companies borrow funds in domestic currency. there is an impact of currency exchange rate changes on the reported financial statements of a company. there is a long-term effect of changes in exchange rates. changing exchange rates persists on future prices, sales, and costsarrow_forwardAssume the bid rate of an Yen dollar is $ 1.8 while the ask rate is $ 3.5 at Arab Bank.Assume the bid rate of an Yen dollar is $3.4 while the ask rate is $5.7 at Palestine Bank. Given this information, what would be your gain if you use $8876.7 and execute locational arbitrage? =8876.713.5^ * 3.4b =8876.7/5.7^ * 3.5c =8876.7/3.4^ * 1.8d = 8876.7 /3.5^ * 5.7arrow_forward

- What is the expected percentage change in the value of the foreign currency (e) if you combine all three techniques, which are equally weighted? Method Technical forecasting Fundamental forecasting Market-based forecasting O 0.3% O 4.6% O 4.7% 2.0% Forecasted e 2% -4% 8%arrow_forwardH3. The Central Bank of the Bahamas pegs the Bahamian Dollar to the United States Dollar at a price of 1 BSD per USD. As an analyst for XYZ Consulting Inc., you have been asked to predict the behavior of key macroeconomic variables in the Bahamas for different policy scenarios. Using all the appropriate diagrams, your analysis must describe the Bahamian money and output markets, as well as the foreign exchange market. To perform this task, you must assume that prices are sticky: fixed in the short-run and flexible in the long-run. The scenarios are: a) A temporary restrictive monetary policy in the Bahamas. b) A temporary restrictive fiscal policy in the Bahamas.arrow_forwardFrom your course of study, you can see that the U.S. dollar and the Euro are the largest functional currencies in the world. What is another popular functional currency? Where is the currency popular? How many firms worldwide use the currency as their functional currency?arrow_forward

- Suppose the quotes for currencies in the three money centers are given as follows: At London center: 1GBP = 150 JPY At Tokyo center: 1USD = 115 JPY At New York center: 1USD = 0.86GBP An investor has 100,000 USD. Is there any opportunity for arbitrage? If yes, explain how does the investor use arbitrage to take advantage of these data? And how much could he or she earn from this?arrow_forward8arrow_forwardAssume your firm has transferred you to Zurich Switzerland. You work in the triangular arbitrage division. View the following exchange rates. Is an arbitrage opportunity available? If not, explain why an opportunity does not exist. If so, from the Swiss point of view show how to exploit the opportunity. CHF .8976 = $1.00, $.0130 = INR 1.00, INR 92.7904 = CHF 1 Now say instead of working in Zurich, you were employed in Mumbai, India. How does that change your thinking on the arbitrage? PLEASE ANWSER CORRECTLY AND SHOW WORKarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education