Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

vn

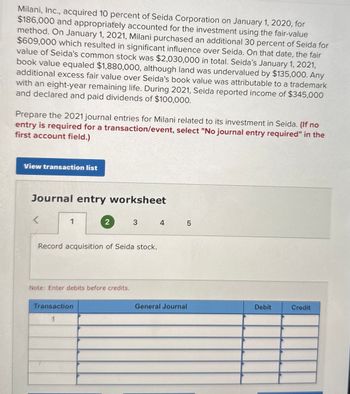

Transcribed Image Text:Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for

$186,000 and appropriately accounted for the investment using the fair-value

method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for

$609,000 which resulted in significant influence over Seida. On that date, the fair

value of Seida's common stock was $2,030,000 in total. Seida's January 1, 2021,

book value equaled $1,880,000, although land was undervalued by $135,000. Any

additional excess fair value over Seida's book value was attributable to a trademark

with an eight-year remaining life. During 2021, Seida reported income of $345,000

and declared and paid dividends of $100,000.

Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no

entry is required for a transaction/event, select "No journal entry required" in the

first account field.)

View transaction list

Journal entry worksheet

<

1

2

3

4

LO

5

Record acquisition of Seida stock.

Note: Enter debits before credits.

Transaction

1

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $187,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $618,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,060,000 in total. Seida’s January 1, 2021, book value equaled $1,910,000, although land was undervalued by $132,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $258,000 and declared and paid dividends of $101,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardMilani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $183,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $606,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,020,000 in total. Seida’s January 1, 2021, book value equaled $1,870,000, although land was undervalued by $136,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $315,000 and declared and paid dividends of $106,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $183,000 and appropriately…arrow_forwardMilani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $193,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $603,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,010,000 in total. Seida's January 1, 2021, book value equaled $1,860,000, although land was undervalued by $138,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $262,000 and declared and paid dividends of $118,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X: > 1 Record acquisition of Seida stock. Record the 40% income earned during period by…arrow_forward

- Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $189,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $612,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,040,000 in total. Seida’s January 1, 2021, book value equaled $1,890,000, although land was undervalued by $131,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $288,000 and declared and paid dividends of $108,000. Record 2021 amortization for trademark excess fair valuearrow_forwardMilani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida’s common stock was $2,000,000 in total. Seida’s January 1, 2021, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida’s book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $300,000 and declared and paid dividends of $110,000. Prepare the 2021 journal entries for Milani related to its investment in Seida 4. Record dividend declaration from Seida.arrow_forwardMilani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida’s common stock was $2,000,000 in total. Seida’s January 1, 2021, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida’s book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $300,000 and declared and paid dividends of $110,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. 1. Record acquisition of Seida stock.arrow_forward

- Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida’s common stock was $2,000,000 in total. Seida’s January 1, 2021, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida’s book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $300,000 and declared and paid dividends of $110,000. Prepare the 2021 journal entries for Milani related to its investment in Seida 5. Record collection of dividend from investee.arrow_forwardMilani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida’s common stock was $2,000,000 in total. Seida’s January 1, 2021, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida’s book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $300,000 and declared and paid dividends of $110,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 3. Record 2021 amortization for trademark excess fair value.arrow_forwardMilani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida’s common stock was $2,000,000 in total. Seida’s January 1, 2021, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida’s book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $300,000 and declared and paid dividends of $110,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. 2. Record the 40% income earned by Seida.arrow_forward

- Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $195,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $624,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,080,000 in total. Seida’s January 1, 2021, book value equaled $1,930,000, although land was undervalued by $130,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $342,000 and declared and paid dividends of $100,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record acquisition of Seida stock. Record the 40% income earned during period by Seida. Record 2021…arrow_forwardMilani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $195,000 and appropriately accounted for the investment using the fair - value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $624,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $ 2,080,000 in total. Seida's January 1, 2021, book value equaled $1,930,000, although land was undervalued by $130,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $342,000 and declared and paid dividends of $100,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record acquisition of Seida stock. Record the 40% income earned during period by Seida. Record 2021…arrow_forwardMilani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $199,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $624,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,080,000 in total. Seida’s January 1, 2021, book value equaled $1,930,000, although land was undervalued by $136,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $286,000 and declared and paid dividends of $100,000. Prepare the 2021 journal entries for Milani related to its investment in Seida.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning