Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

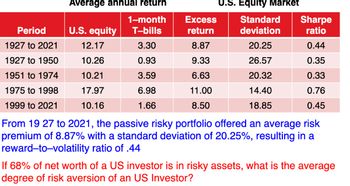

Transcribed Image Text:Period

1927 to 2021

1927 to 1950

1951 to 1974

1975 to 1998

1999 to 2021

Average annual return

1-month

U.S. equity T-bills

3.30

0.93

3.59

6.98

1.66

12.17

10.26

10.21

17.97

10.16

Excess

return

8.87

9.33

6.63

11.00

8.50

U.S. Equity Market

Standard Sharpe

deviation

ratio

20.25

0.44

26.57

0.35

20.32

0.33

14.40

0.76

18.85

0.45

From 19 27 to 2021, the passive risky portfolio offered an average risk

premium of 8.87% with a standard deviation of 20.25%, resulting in a

reward-to-volatility ratio of .44

If 68% of net worth of a US investor is in risky assets, what is the average

degree of risk aversion of an US Investor?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- am. 48.arrow_forwardAnnual and Average Returns for Stocks, Bonds, and T-Bills, 1950 to 2019 Stocks Long - Term Treasury Bonds T-bills 1950 to 2019 Average 12.7% 6.6% 4.2% 1950 to 1959 Average20.9 0.0 2.0 1960 to 1969 Average 8.7 1.6 4.0 1970 to 1979 Average 7.5 5.7 6.3 1980 to 1989 Average18.2 13.5 8.9 1990 to 1999 Average 19.0 9.5 4.9 2000 to 2009 Average 0.9 8.0 2.7 2010 Annual Return15.1 9.4 0.01 2011 Annual Return 2.1 29.9 0.02 2012 Annual Return 16.0 3.6 0.02 2013 Annual Return32.4-12.7 0.07 2014 Annual Return 13.7 25.10.05 2015 Annual Return 1.4-1.2 0.21 2016 AnnualReturn 12.0 1.2 0.51 2017 Annual Return 21.8 8.4 1.39 2018 Annual Return -4.4 1.8 1.94 2019 Annual Return 31.5 14.8 2.06 2010 to 2019 Average 14.2 7.7 0.63 You have a portfolio with an asset allocation of 62 percent stocks, 30 percent long-term Treasury bonds, and 8 percent T-bills. Use these weights and the returns given in the above table to compute the return of the portfolio in the year 2010 and each year since. Then compute the…arrow_forwardBook Problem 9-13 Portfolio Return (LG9-7) Year-to-date, Oracle had earned a-1.39 percent return. During the same time period, Valero Energy earned 7.65 percent and McDonald's earned 0.42 percent If you have a portfolio made up of 15 percent Oracle, 20 percent Valero Energy, and 65 percent McDonald's, what is your portfolio retum? (Round your answer to 2 decimal places.) Portfolio return el t Priarrow_forward

- The following return series comes from Global Financial Data. US T-bills CPI Year Large Stocks LT Gov Bonds (Rf asset) (inflation) 2017 21.83% 6.24% 0.80% 2.07% 2018 -5.28% -1.25% 1.81% 2.10% 2019 25.45% 3.35% 2.15% 1.10% 2020 18.16% 10.25% 4.50% 1.88% 2021 28.70% -1.54% 0.40% 7.00% 2022 -19.78% -8.55% 2.20% 6.50% Calculate the average real risk premium earned on large-company stocks using the approximate Fisher equation. (Enter percentages as decimals and round to 4 decimals)arrow_forwardWhat is the return on the following investment? Original Cost or Selling Price of Distributions Percent Investment Invested $ Investment Received $ Return Stock $34.00 $26.00 $2.00 -16.11% -14.5% -17.65% -19.35% -21.23%arrow_forwardNonearrow_forward

- Consider the following 3 assets portfolio: Asset US Equity Intl. Equity US Corporate Bonds Correlations US Equity Intl. Equity US Corporate Bonds 18% O 14.95% O 13.36% Weights O 1.79% 50% 30% 20% US Equity What is the portfolio's standard deviation? 1 0.8 0.1 St. Dev. 18% 16.50% 5% Intl. Equity 1 -0.1 US Corporate Bonds 0.1 -0.1 1arrow_forward48 The Sunland Products Co. currently has debt with a market value of $300 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15 years and are currently priced at $1,434.63 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $10 per share. The preferred shares pay an annual dividend of $1.20. Sunland also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 5 percent per year forever. If Sunland is subject to a 40 percent marginal tax rate, then what is the firm's weighted average cost of capital? Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen…arrow_forwardN7arrow_forward

- 470 - 35 you have concluded that the following relationships are possible next year: economic status probability rate of return weak economy .15 -5% static economy .6 5% strong economy .25 15% What is the standard deviation of the rate of return for the one year period? a. .65 % b. 1.45% c. 4% d. 6.25% e. 6.4%arrow_forward4 - Based on economistsAc€?c forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = .90% E(2r1) = 2.05% L2 = 0.09% E(3r1) = 2.15% L3 = 0.12% E(4r1) = 2.45% L4 = 0.14% Using the liquidity premium theory, plot the current yield curve. Make sure you label the axes on the graph and identify the four annual rates on the curve both on the axes and on the yield curve itself. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year Current (Long-term) Rates 1 % 2 % 3 % 4 % 6 - On March 11, 20XX, the existing or current (spot) 1-, 2-, 3-, and 4-year zero coupon Treasury security rates were as follows: 1R1 = 0.90%, 1R2 = 1.50%, 1R3 = 1.90%, 1R4 = 2.05% Using the unbiased…arrow_forwardTABLE 5.3 Risk and return of investments in major asset classes, 1927-2018 Average Risk premium Standard deviation max min T-bills 3.38 na 3.12 14.71 -0.02 T-bonds 5.83 2.45 11.59 41.68 -25.96 Stocks 11.72 8.34 20.05 57.35 -44.04arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education