Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

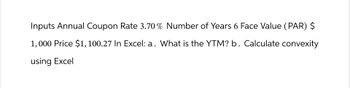

Transcribed Image Text:Inputs Annual Coupon Rate 3.70% Number of Years 6 Face Value (PAR) $

1,000 Price $1,100.27 In Excel: a. What is the YTM? b. Calculate convexity

using Excel

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 39. Consider the following information. Assuming this represents the Population. Investment X 4% -10% 8% 8 Year 1 2 3 14% Investment Y -6% 8% 12% -2% Risk Free Rate: 2% The Covariance of Investment X and Investment Y is (Hint: Covariance = 1/nΣ(xi — Xavg)(yi - Yavg) A. -32.60 B. -21.00 C. +144.82 D. -103.50 E. +114.34arrow_forwardColonel Motors (C) Separated Edison (S) Expected Return 10% 8% Standard Deviation 6% 3% Please represent graphically all potential combinations of stocks C and S, if the correlation coefficient between the returns of stocks C and S is: A) 1 B) 0 C) -1 Please report these investment opportunity sets in the corresponding Excel sheets.arrow_forwardConsider the following returns and states of the economy for TZ.Com.: Economy ProbabilityReturn Weak 15% Normal 50% Strong 35% -9% 2% 6% What is the standard deviation of TZ's returns? SET YOUR CALCULATOR TO FOUR DECIMAL PLACES AND ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE %. FOR EXAMPLE, IF YOUR ANSWER IS 7.7011% ENTER IT AS 7.70.arrow_forward

- Please answer all 4 parts with explanations thxarrow_forwardUNIT 7-5arrow_forwardConsider the following portfolio of assets: Loan Weight 1 0.30 2 0.70 Expected returni ம σ2 13% 11% 9.06% 82.0% P12=-0.87 8.72% 76.0% 012-75.0% What is the variance of the portfolio (round to two decimals)? Note: a^2 denotes the square of a. For example, 2^2 = 4, 3^2=9 (0.3)^2*(82.0%) + (0.7)^2*(76.0%) + (0.3) (0.7)(-0.87) (9.06%) (8.72%) = 30.19 (0.3)^2 (82.0%) + (0.7)^2*(76.0%) + 2(0.3) (0.7)(-0.87) (9.06 %) (8.72%) = 15.75 (0.3)^2*(82.0%) + (0.7)^2*(76.0%) + [(0.3) (0.7)]^2 (-0.87) (9.06%) (8.72%) = 41.59 (0.3) (82.0%) + (0.7) (76.0%) + 2(0.3) (0.7)(-0.87) (9.06 %) (8.72%) = 48.93arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education