Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Required:

Using Table 5.3 as your guide, what is your estimate of the expected annual HPR on the market index stock portfolio if the current risk-

free interest rate is 5.4 % ? ( Round your answer to 2 decimal places.)

Expected annual HPR

%

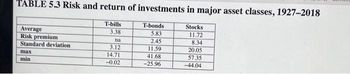

Transcribed Image Text:TABLE 5.3 Risk and return of investments in major asset classes, 1927-2018

Average

Risk premium

Standard deviation

max

min

T-bills

3.38

na

3.12

14.71

-0.02

T-bonds

5.83

2.45

11.59

41.68

-25.96

Stocks

11.72

8.34

20.05

57.35

-44.04

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Pls help ASAParrow_forwardO Considering the following information regarding the performance of a portfolio manager in a recent quarter, (i) identify the Alpha of the manager's portfolio compared to benchmark (ii) identify the contributions of asset allocation and security selection to relative performance. Stocks Bonds Treasury bills Manager's Manager's Benchmark Benchmark Return Weight Relarn 1% 2% 2% 1.5% 0.75% 0.5% 0.50 0.30 0.20 weight 0.30 0.30 0.40arrow_forwardProblem 11-1 Stock Market History (LO1) Use the data in the tables below to answer the following questions: Average rates of return on Treasury bills, government bonds, and common stocks, 1900-2020. Average Premium (Extra Portfolio Treasury bills Treasury bonds Common stocks Average Annual Rate of Return (%) return versus Treasury bills) (%) 3.7 5.4 11.5 1.7 7.8 Standard deviation of returns, 1900-2020. Portfolio Treasury bills Long-term government bonds Common stocks Standard Deviation (%) 2.8 8.9 19.5 a. What was the average rate of return on large U.S. common stocks from 1900 to 2020? b. What was the average risk premium on large stocks? c. What was the standard deviation of returns on common stocks? Note: Enter your answer as a percent rounded to 1 decimal place. a. Average rate of return b. Average risk premium c. Standard deviation of returns % % %arrow_forward

- 8. A portfolio consists of bonds, stocks, commodities and real estates. The portfolio weightings, expected returns, variances and correlation matrix are shown below. Bonds Stocks Commodities Real Estate Correlation Matrix Bonds Stocks Commodities Real Estate Weight 50% 10% 15% 25% Bonds 1.0 Stocks -0.2 1.0 Expected Return 8% 12% 20% 16% Commodities 0.1 0.4 1.0 Variance (%²) 10 30 15 20 Real Estate 0.3 0.6 0.2 1.0 a. Calculate the expected return and the standard deviation of the return of the portfolio.arrow_forwardNonearrow_forwardThe following return series comes from Global Financial Data. US T-bills CPI Year Large Stocks LT Gov Bonds (Rf asset) (inflation) 2017 21.83% 6.24% 0.80% 2.07% 2018 -5.28% -1.25% 1.81% 2.10% 2019 25.45% 3.35% 2.15% 1.10% 2020 18.16% 10.25% 4.50% 1.88% 2021 28.70% -1.54% 0.40% 7.00% 2022 -19.78% -8.55% 2.20% 6.50% Calculate the average rate of inflation. (Enter percentages as decimals and round to 4 decimals)arrow_forward

- 8. A portfolio consists of bonds, stocks, commodities and real estates. The portfolio weightings, expected returns, variances and correlation matrix are shown below. Weight Expected Return Variance (%2) Bonds 50% 10% 15% 25% 8% 12% 20% 16% 10 30 15 20 0.1 0.3 0.4 0.6 1.0 0.2 1.0 Stocks Commodities Real Estate Correlation Matrix Bonds 1.0 -0.2 1.0 Stocks Commodities Real Estate Bonds Stocks Commodities Real Estate Calculate the standard deviation of the return of the portfolio.arrow_forwardAm. 408.arrow_forwardProblem 9-27 Asset Allocation (LG9-2, LG9-5) Annual and Average Returns for Stocks, Bonds, and T-Bills, 1950 to 2017 You have a portfolio with an asset allocation of 39 percent stocks, 40 percent long-term Treasury bonds, and 21 percent T-bills. Use these weights and the returns given in the above table to compute the return of the portfolio in the year 2010 and each year since. Then compute the average annual return and standard deviation of the portfolio. Note: Do not round intermediate calculations. Round your answers to 2 decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education