ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Q8

Transcribed Image Text:Even though they're separated, Paul and Camille decide to

study a price-fixing agreement that will mutually benefit

them. The idea is that they both agree to a price higher than

the Bertrand equilibrium price, using the Grim Trigger strategy

(if they detect a deviation from the agreed-upon price, they

switch to playing the static Bertrand prices forever). What is

the weakest assumption on the discount factor d e (0, 1) that

supports the existence of a SPNE with collusion in this market

(that is, a SPNE with a price strictly higher than the Bertrand

equilibrium price from the previous question)?

Collusion CANNOT be supported with any d e (0, 1)

6 2 9/17

8 2 1/2

Collusion can be supported with any & e (0, 1)

O 823 - 1

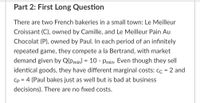

Transcribed Image Text:Part 2: First Long Question

There are two French bakeries in a small town: Le Meilleur

Croissant (C), owned by Camille, and Le Meilleur Pain Au

Chocolat (P), owned by Paul. In each period of an infinitely

repeated game, they compete a la Bertrand, with market

demand given by Q(pmin) = 10 - Pmin- Even though they sell

identical goods, they have different marginal costs: cc = 2 and

Cp = 4 (Paul bakes just as well but is bad at business

decisions). There are no fixed costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Prospect X = ($4, 0.04 ; $15, 0.05 ; $24, 0.01 ; $38, p) What is the expected value of prospect X? (Hint 1: To answer this question, you'll need to first determine the value of "p"). (Hint 2: To determine "p", remember that probabilities sum to 1). (Note: The answer may not be a whole number; please round to the nearest hundredth) (Note: The numbers may change between questions, so read carefully)arrow_forwardSuppose you have a house worth $200,000 (wealth). Your utility of wealth is given by U(w) = ln(w). There is a small chance that a fire will damage your house causing a loss of $75,000. You estimate there is a 2% chance of fire. a) What is your expected wealth? b) What is your expected utility from owning the house? c) Suppose you can add a fire detection/prevention system to your house. This would reduce the chance of a bad event to 0 but it would cost you $C to install. What is the most you are willing to pay for the security system? (Here is an identity you will find usefularrow_forwardBilly John Pigskin of Mule Shoe, Texas, has a von Neumann-Morgenstern utility function of the form u(c) = √c. Billy John also weighs about 300 pounds and can outrun jackrabbits and pizza delivery trucks. Billy John is beginning his senior year of college football. If he is not seriously injured, he will receive a $1,000,000 contract for playing professional football. If an injury ends his football career, he will receive a $10,000 contract as a refuse removal facilitator in his home town. There is a 10% chance that Billy John will be injured badly enough to end his career. If Billy John pays $p for an insurance policy that would give him $1,000,000 if he suffered a career-ending injury while in college, then he would be sure to have an income of $1,000,000 − p no matter what happened to him. Write an equation that can be solved to find the largest price that Billy John would be willing to pay for such an insurance policy. Here is my question: Why is Billy's income 1,000,000 - p even…arrow_forward

- Suppose you bought a condo for $100,000 financing it with a $20,000 down payment of your own funds and an $80,000 mortgage loan from a bank. Now, instead of (a) or (b), suppose the value of the condo fell from $100,000 to $70,000. Assuming you paid $100,000, financing it with $20,000 of your own money and $80,000 with a mortgage loan, and ignoring interest and other costs, calculate your rate of return on your asset (ROA) and your rate of return on equity (ROE). What is the value of your equity stake in the condo after the price fall?arrow_forwardRobin Hood is 23 years old and has accumulated $4,000 in her self-directed defined contribution pension plan. Each year she contributes $2,000 to the plan, and her employer contributes an equal amount. Robin thinks she will retire at age 67 and figures she will live to age 81. The plan allows for two types of investments. One offers a 3.5% risk-free real rate of return. The other offers an expected return of 10% and has a standard deviation of 23%. Robin now has 5% of her money in the risk-free investment and 95% in the risky investment. She plans to continue saving at the same rate and keep the same proportions invested in each of the investments. Her salary will grow at the same rate as inflation. What is the expected value of Robin's risky assets at retirement?arrow_forwardYou are presented 2 investment options. Which one gives you a better return? In option A, you pay $3,000 today and receive $750 at the end of the year for the next 5 years. In option b, you pay $2,000 today and receive $3,000 at the end of five yearsarrow_forward

- 0 Masterful Pocketwatches; the larger standard deviation indicates that Masterful Pocketwatches has less variability in its closing prices than Perfect Plungers Plus. O Perfect Plungers Plus; the smaller standard deviation indicates that Perfect Plungers Plus has a greater mean closing price than Masterful Pocketwatches. O Masterful Pocketwatches; the larger standard deviation indicates that Masterful Pocketwatches has a greater mean closing price than Perfect Plungers Plus. O Perfect Plungers Plus; the smaller standard deviation indicates that Perfect Plungers Plus has less variability in its closing prices than Masterful Pocketwatches.arrow_forwardI get a stock tip that Canada Goose is about to diversify their products by releasing a line of summer swimwear. I have $3,000 of my own money that I invest in Canada Goose stock. Suppose that their swimwear does very well and the value of their stock rises by 50%. How much money have I made (in dollar terms)?arrow_forwardImagine that at age 25 you have the choice to begin to deposit $8000 per year into your 401k. You will retire at 65. The 401k grows at (an average of) 6% per year (it compounds yearly). Say that your utility for money is just the value of money: u(x) = x. Say that you have a “standard” discount rate of 0.95, which choice would an individual make? What is the implied break-even \beta if you have quasi-hyperbolic preferences?arrow_forward

- Sylvie lives in Ontario and has always contributed to the Canada Pension Plan (CPP). She is ready to retire at age 65 and is looking to receive the maximum CPP benefit. Joan is Sylvie's twin sister, who moved to Quebec when she was 18 to go to Concordia and has been there since. Both know that the Canada Pension Plan (CPP) and Quebec Pension Plan (QPP) are contributory pension plans that you receive based on the dollar value of contributions and the number of years that you contribute to the plan during your employment years. Since contributions can fluctuate over the years (ie. loss of employment, years in university etc.), you can exclude certain amounts in order to receive a higher pension at retirement based on drop-out provisions. Name three exclusions that Sylvie and Joan may be eligible for to increase their CPP/QPP pension at retirement under the pension drop-out provisions. Sylvie (CPP)- 1. 2. 3. Joan (QPP) 1. 2. 3.arrow_forwardYou live in an area that has a possibility of incurring a massive earthquake, so you are considering buyingearthquake insurance on your home at an annual cost of $180. The probability of an earthquake damagingyour home during one year is 0.001. If this happens, you estimate that the cost of the damage (fully coveredby earthquake insurance) will be $160,000. Your total assets (including your home) are worth $250,000.arrow_forwardAdam is considering what skills to study in online school. Her utility function is based on the income she earns, and is defined by U(I) = I0.8. If she learns the skill of SPSS, she will earn $145,000 per year with probability 1. If she learns the skill of Tableau, she will earn $300,000 per year with probability 0.6 (assuming that she gets the certificate) and $30,000 with probability 0.4 (if she learns without earning a certificate and she has to find a waiter job). a. Is she risk averse, risk neutral, or risk loving? Explain.b. Write out the equation for her expected utility for each skill. c.Which skill will she learn? Show your work. d.Suppose someone offers her insurance for the possibility that she does not get a Tableau certificate. This insurance will provide her an amount of income in addition to the waiter job wages that makes her indifferent between learning SPSS and Tableau. What is this amount, and what is the cost of the insurance? (note: many possible answers)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education