ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

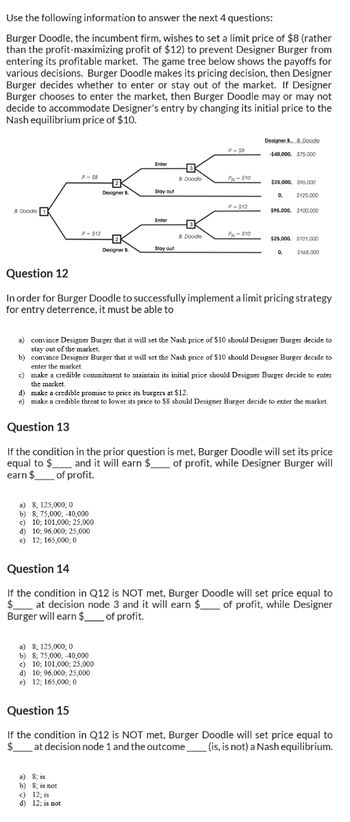

Transcribed Image Text:Use the following information to answer the next 4 questions:

Burger Doodle, the incumbent firm, wishes to set a limit price of $8 (rather

than the profit-maximizing profit of $12) to prevent Designer Burger from

entering its profitable market. The game tree below shows the payoffs for

various decisions. Burger Doodle makes its pricing decision, then Designer

Burger decides whether to enter or stay out of the market. If Designer

Burger chooses to enter the market, then Burger Doodle may or may not

decide to accommodate Designer's entry by changing its initial price to the

Nash equilibrium price of $10.

B. Doodle

P-$12

Designer B., B. Doodle

P-58

-$40,000, $75.000

Enter

B. Doodle

PN-$10

$25,000, $96,000

Designer B.

Stay out

0.

$125,000

P-$12

$95,000, $100,000

Enter

B. Doodle

PN-$10

$25,000, $101,000

Designer B.

Stay out

0. $165.000

Question 12

In order for Burger Doodle to successfully implement a limit pricing strategy

for entry deterrence, it must be able to

a) convince Designer Burger that it will set the Nash price of $10 should Designer Burger decide to

stay out of the market.

b) convince Designer Burger that it will set the Nash price of $10 should Designer Burger decide to

enter the market.

c) make a credible commitment to maintain its initial price should Designer Burger decide to enter

the market.

d) make a credible promise to price its burgers at $12.

e) make a credible threat to lower its price to $8 should Designer Burger decide to enter the market.

Question 13

If the condition in the prior question is met, Burger Doodle will set its price

equal to $ and it will earn $ of profit, while Designer Burger will

earn $of profit.

a) 8; 125,000; 0

b) 8; 75,000; -40,000

c) 10; 101,000; 25,000

d) 10; 96,000; 25,000

e) 12; 165,000; 0

Question 14

If the condition in Q12 is NOT met, Burger Doodle will set price equal to

$ at decision node 3 and it will earn $_ of profit, while Designer

Burger will earn $ _____ of profit.

a) 8; 125,000; 0

b) 8; 75,000; -40,000

c) 10; 101,000; 25,000

d) 10; 96,000; 25,000

e) 12; 165,000; 0

Question 15

If the condition in Q12 is NOT met, Burger Doodle will set price equal to

$at decision node 1 and the outcome (is, is not) a Nash equilibrium.

a) 8; is

b) 8; is not

c) 12; is

d) 12; is not

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- where is the nash equilibrium? find out the dominant strategy. it was discovered that two domestic manufacturing companies were fixing prices. if each company is silent, there is no penalty, but production and business are disrupted due to continuous investigation by the Fair Trade Commission. The penalty for revealing the estimated loss due to the investigation and collusion is as follows: Firm 2 Silence Disclosure Silence -200, -200 -590, 0 Firm 1 Disclosure 0, -590 -450, -450 fine( a hundred million won)arrow_forwardO Cell A O Cell C O Cell E O Cell I None of the abovearrow_forwardTwo rival companies competing in the same market need to decide their plans for future expansion of their stores. The Table below shows the possible outcomes of their mutually interdependent actions (payoffs are profits in £m) Giga Company Titanic Conglomerate No Change Refurbishment of existing stores Large Expansion No Change 30, 40 25, 35 15, 24 Refurbishment of existing stores 35, 30 28, 32 18, 33 Large Expansion 12, 22 18, 20 20, 25 The Nash equilibrium: (A) does not exist. (B) occurs when both firms choose Refurbishment of existing stores. (C) occurs when both firms choose Large Expansion. (D) occurs when both firms choose No Change.arrow_forward

- QUESTION 13 Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by D₁(P₁, P2) = 140 - 2p1 + P2 and demand for firm 2's product is D2 (P1, P2) 140 - 2p2 + P1 Both firms have a constant marginal cost of 20. What is the Nash equilibrium price of firm 1? (Only give a full number; if necessary, round to the lower integer; no dollar sign.)arrow_forwardMCQ 27 Consider the following game in which two firms (OLD and NEW) are considering whether or not to advertise to increase sales. Each firm knows that the impact on profits depends on what the other firm chooses to do. The possible profit outcomes of the game are shown below, with OLD's profits shown as the first number in each pair and NEW's profits shown as the second number: NEW Advertise Not Advertise Advertise 10, 5 15, 1 OLD Not Advertise 5, 8 20, 3 Assuming the firms aim to earn as much profit as possible, which of the following is TRUE for the game? A I do not want to answer this question. OLD's dominant strategy is to advertise C OLD's dominant strategy is not to advertise NEW's dominant strategy is not to advertise E NEW's dominant strategy is to advertise F the dominant strategy for both OLD and NEW is to advertisearrow_forwardhere are two firms in the market, Pepsi and Coke. Strategies: Low price (price promotion, LP), Medium price (regular price, RP), high price (new price strategy, HP). Payoffs: Coke, Pepsi’s Net Profits; LP, LP: $1.4m, $1.2m; LP, RP: $3.1m, $0.6m; LP, HP: $3.9m, -$1.3m. RP, LP: $1.3m, $1.8m; RP, RP: $2.0m, $1.8m; RP, HP: $4.3m, $-0.3m. HP, LP: -$1.2m, $3.6m; HP, RP: $0.8m, $3.9m; HP, HP: $2.8m, $2.5m. In this game, the NE is (are): (HP, HP) (LP, LP) and (HP, HP) (LP, LP) There is no NE in this game (RP, RP)arrow_forward

- AP CollegeBoard Test Booklet Unit 4 Problem Set Include correctly labeled diagrams, if useful or required, in explaining your answers. A correctly labeled diagram must have all axes and curves clearly labeled and must show directional changes. If the question prompts you to “Calculate," you must show how you arrived at your final answer. Use the graph provided below to answer parts (a)-(e). Marginal Cost Average Total Cost Average Variable Cost 108 100 55 Demand 0 10 21 31 44 57 77 Quantity Marginal Revenue BigMed, a profit-maximizing firm, has a patent on a medical device, making it the only producer of that device. The graph above shows BigMed's demand, marginal revenue, average total cost, average variable cost, and marginal cost curves. (a) Calculate BigMed's total revenue if the firm produces the allocatively efficient quantity. Show your work. (b) Starting at a price of $100, if BigMed were to increase the price by 2%, will the quantity demanded decrease by more than 2%, by less…arrow_forwardTo advertise or not to advertise Suppose that Creamland and Dairy King are the only two firms that sell ice cream. The following payoff matrix shows the profit (in millions of dollars) each company will earn depending on whether or not it advertises: Dairy King Advertise Doesn't Advertise Creamland Advertise 10, 10 18, 2 Doesn't Advertise 2, 18 11, 11 For example, the upper right cell shows that if Creamland advertises and Dairy King doesn't advertise, Creamland will make a profit of $18 million, and Dairy King will make a profit of $2 million. Assume this is a simultaneous game and that Creamland and Dairy King are both profit-maximizing firms. If Creamland decides to advertise, it will earn a profit of _________ million if Dairy King advertises and a profit of ________ million if Dairy King does not advertise. If Creamland decides not to advertise, it will earn a profit of __________ million if Dairy King advertises and a profit of _________…arrow_forward40arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education