FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Gardner company produces plastic that is used for injection solve this question ❓

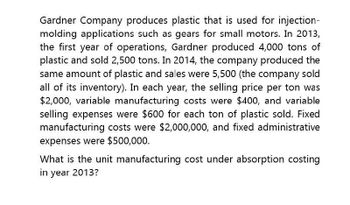

Transcribed Image Text:Gardner Company produces plastic that is used for injection-

molding applications such as gears for small motors. In 2013,

the first year of operations, Gardner produced 4,000 tons of

plastic and sold 2,500 tons. In 2014, the company produced the

same amount of plastic and sales were 5,500 (the company sold

all of its inventory). In each year, the selling price per ton was

$2,000, variable manufacturing costs were $400, and variable

selling expenses were $600 for each ton of plastic sold. Fixed

manufacturing costs were $2,000,000, and fixed administrative

expenses were $500,000.

What is the unit manufacturing cost under absorption costing

in year 2013?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jordon Company produced and sold 50,000 units in 2014. The units sold for $140 each. During the period, the following cost were incurred. Variable selling and administrative expenses per unit Variable manufacturing overhead per unit Direct labor per unit $ 15 20 30 Direct materials per unit 25 Fixed selling and administrative expenses $ 5,50,000 Fixed manufacturing overhead 6,50,000 Tax rate is 40%. Calculate the gross margin per unit for Jordon Company.arrow_forwardCarney Company manufactures cappuccino makers. For the first eight months of 2010, the company reported the following operating results while operating at 80% of plant capacity: Sales (500,000 units) Cost of goods sold Gross profit Operating expenses Net income Revenues Cost of Goods Sold Operating Expense $90,000,000 54,000,000 36,000,000 An analysis of costs and expenses reveals that variable cost of goods sold is $95 per unit and variable operating expenses are $35 per unit. In September, Carney Company receives a special order for 30,000 machines at $135 each from a major coffee shop franchise. Acceptance of the order would result in $10,000 of shipping costs but no increase in fixed expenses. Prepare an incremental analysis for the special order Reject Order Net Income 24,000,000 $12,000,000 Accept Orderarrow_forwardDo not give answer in imagearrow_forward

- Jaroni Inc. produces specialty quilts and blankets using a partly manual, partly automated manufacturing process. Total sales for the previous period were $60,000. Wages, materials, and variable manufacturing overhead totaled $10,200. Salaries, depreciation, rent, and other fixed expenses amounted to $14,940. Jaroni charges $500 per customized blanket.What is Jaroni's break-even point in Sales Dollars?arrow_forwardBlossom Motors is a division of Blossom Products Corporation. The division manufactures and sells an electric switch used in a wide variety of applications. During the coming year, it expects to sell 180,000 units for $8.00 per unit. Donna Clark is the division manager. She is considering producing either 180,000 or 280,000 units during the period. Other information is as follows: Beginning inventory Expected sales in units Selling price per unit Variable manufacturing cost per unit Fixed manufacturing cost (total) Fixed manufacturing overhead costs per unit Based on 180,000 units Based on 280,000 units Manufacturing cost per unit Based on 180,000 units (a) Based on 280,000 units Variable selling and administrative expenses Fixed selling and administrative expenses (total) - Your answer is partially correct. Units produced Units sold (b) Sales Less Prepare an absorption-costing income statement, with one column showing the results if 180,000 units are produced and one column showing…arrow_forwardNorthwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball Is manufactured In a small plant that relles heavly on direct labor workers. Thus, varlable expenses are high, totallng $15.00 per ball, of which 60% Is direct labor cost. Last year, the company sold 58,000 of these balls, with the following results: $ 1,450,000 Sales (58,800 balls) variable expenses Contribution margin Fixed expenses 870,000 580,000 374,000 Net operating income 206,000 Required: 1. Compute (a) last year's CM ratio and the break-even polnt in balls, and (b) the degree of operating leverage at last year's sales level. 2. Due to an Increase in labor rates, the company estimates that next year's varlable expenses will Increase by $3.00 per ball. If this change takes place and the selling price per ball remalns constant at $25.00, what will be next year's CM ratio and the break-even polnt in balls? 3. Refer to the data in (2) above. If the expected change in varlable…arrow_forward

- Ceder Company has compiled the following data for the upcoming year: Sales are expected to be 14,500 units at $50.00 each. Each unit requires 3 pounds of direct materials at $2.60 per pound. Each unit requires 1.4 hours of direct labor at $17.00 per hour. Manufacturing overhead is $3.60 per unit. Beginning direct materials inventory is $4,100.00. Ending direct materials inventory is $5,000.00. Selling and administrative costs totaled $136,770. Required: 1. Determine Ceder's budgeted cost of goods sold. (do not round intermediate values) 2. Complete Ceder's budgeted income statement.arrow_forwardA company uses components at the rate of 15,000 units per year, whichare bought in at a cost of $3.90 each from the supplier. The companyorders 8,000 units each time it places an order and the averageinventory held is 500 units. It costs $30 each time to place an order,regardless of the quantity ordered.The total holding cost is 21% per annum of the average inventory held.Required:-Calculate the total holding cost and total ordering cost?arrow_forwardCeder Company has compiled the following data for the upcoming year:Sales are expected to be 14,000 units at $60.00 each.Each unit requires 3 pounds of direct materials at $3.50 per pound.Each unit requires 1.7 hours of direct labor at $18.00 per hour.Manufacturing overhead is $4.50 per unit.Beginning direct materials inventory is $5,000.00.Ending direct materials inventory is $6,350.00.Selling and administrative costs totaled $138,120.Required:1. Determine Ceder's budgeted cost of goods sold.2. Complete Ceder's budgeted income statement. Required 1 Required 2 Complete this question by entering your answers in the tabs below.Determine Ceder's budgeted cost of goods sold. (Do not round the intermediate values.)arrow_forward

- Legrand Company produces hand cream. In 2018, their financial information is as follows:Each jar sells for: $3.40Total variable cost (materials, labor, and overhead) per jar: $2.55Total fixed cost: $58,140Total jars sold in 2018: 81,6001. Calculate the break-even point in units for Legrand?arrow_forwardBell Company, a manufacturer of audio systems, started its production in October 2017. For the preceding 3 years, Bell had been a retailer of audio systems. After a thorough survey of audio system markets, Bell decided to turn its retail store into an audio equipment factory.Raw materials cost for an audio system will total $75 per unit. Workers on the production lines are on average paid $15 per hour. An audio system usually takes 7 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $5,120 per month. Indirect materials cost $6 per system. A supervisor was hired to oversee production; her monthly salary is $3,840.Factory janitorial costs are $1,410 monthly. Advertising costs for the audio system will be $8,750 per month. The factory building depreciation expense is $7,200 per year. Property taxes on the factory building will be $9,000 per year. Assuming that Bell manufactures, on average, 1,520 audio systems per month, enter…arrow_forwardCarbondale Corporation is a manufacturer of converters sold on a private label basis to large discount chains. The company has capacity to produce 45,000 converters a year. Planned production for the current year is 20,000 units and involves working the plant for a single shift. An analysis of the company’s cost records reveals the following information for the 20,000 units production level:Variable manufacturing cost per unit: Ksh 8Variable Selling and Administration costs per unit: Ksh2Fixed manufacturing costs: Ksh60, 000Fixed Selling and Administration costs: Ksh40, 000Current selling price per unit: Ksh18Required:i) Determine the contribution margin and the contribution margin ratio ii) Determine the profits arising from the sales revenue of Ksh 9,000,000 iii) Determine the sales required in units and value to yield a profit of Ksh, 500,000iv) Determine the breakeven point in units and value v) Plot the cost-volume-profit chartarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education