ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

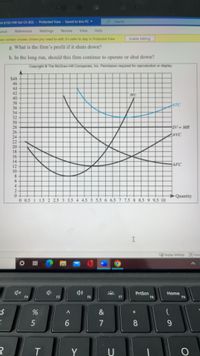

he following graph summarizes the demand and costs for a firm that operates in a

- What level of output should this firm produce in the short run?

- What price should this firm charge in the short run?

- What is the firm’s total cost at this level of output?

- What is the firm’s total variable cost at this level of output?

- What is the firm’s fixed cost at this level of output?

- What is the firm’s profit if it produces this level of output?

- What is the firm’s profit if it shuts down?

- In the long run, should this firm continue to operate or shut down?

problem 123 are solved, this is subparts 4-8

Transcribed Image Text:BA 6150 HW Set Ch 8(3) -

Protected View- Saved to this PC

OSearch

yout

References

Mailings

Review

View

Help

can contain viruses. Uniless you need to edit, it's safer to stay in Protected View.

Enable Editing

g. What is the firm's profit if it shuts down?

h. In the long run, should this firm continue to operate or shut down?

Copyright ©The McGraw-Hill Companies, Inc. Permission required for reproduction or display

$48

46

44

42

40

38

36

34

32

30

28

26

24

22

20

18

16

14

12

10

8.

6.

MC

ATC

Df MR

AVC

AFC

2.

Quantity

0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10

I

Oisplay Settings Focus

o 基

PrtScn

F8

Home

F9

F4

F5

F6

F7

24

&

5

7

8.

9-

T

Y

U

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The graph above shows the perfectly competitive market for apples. The quantity is measured in millions of apples per week. Identify whether each of the following would be true or false and briefly explain your reasoning. The demand curve facing an individual apple grower is perfectly elastic at $4 per apple. If an individual apple grower decided to stop growing apples then the market supply curve for apples would shift to the left and the market price for apples would increase. If an individual apple grower sold one more apple, the price effect would cause the marginal revenue from that apple to be less than the price.arrow_forward7. Short-run supply and long-run equilibrium Consider the competitive market for rhenium. Assume that no matter how many firms operate in the industry, every firm is identical and faces the same marginal cost (MC), average total cost (ATC), and average variable cost (AVC) curves plotted in the following graph. COSTS (Dollars per pound) 100 90 80 70 60 40 20 10 + 0 + 0 MC + 5 ATC AVC D 0 10 15 20 25 30 35 QUANTITY (Thousands of pounds) 40 + 45 50 ?arrow_forwardConsider a perfectly competitive market for wheat in Dallas. There are 110 firms in the industry, each of which has the cost curves shown on the following graph: The following graph shows the market demand for wheat. Use the orange points (square symbol) to plot the short-run industry supply curve for the wheat industry. Specifically, place an orange point at the lowest point of the supply curve and another orange point at the highest point of the supply curve. (Note: You can disregard the portion of the supply curve that corresponds to prices where there is no output, since this is the industry supply curve. Plot your points in the order in which you would like them connected. Line segments will connect the points automatically.) Then, place the black point (plus symbol) on the graph to indicate the short-run equilibrium price and quantity in this market. (Note: Dashed drop lines will automatically extend to both axes.) At the current short-run market price,…arrow_forward

- Suppose the market for peaches is perfectly competitive. The short-run average total cost and marginal cost of growing peaches for an individual grower are illustrated in the figure to the right. Assume that the market price for peaches is $30.00 per box. What is the profit-maximizing quantity for peach growers to produce? boxes. (Enter your response as an integer.) At this level of output, profit will be $. (Enter your response rounded to the nearest dollar.) Peach growers will earn positive economic profit in the short run at any market price above $ per box. (Enter your response rounded to one decimal place.) Price (dollars per box) 40- 36- 32- 28- 24 20 16- 12- 8 4- 10 MC 20 30 40 50 60 70 80 Output (boxes of peaches per day) ▬▬ ATC 90 100 Qarrow_forwardWhat is the most important decision a perfectly competitive firm must make in order to maximize profit? what quantity to produce what price to charge what quality to produce what quantity of labor is neededarrow_forwardQ3arrow_forward

- A perfectly competitive firm produces the level of output at which MR=MC on the rising portion of the firm’s marginal cost curve. At that output level, it has the following costs and revenues: TC = $830,000 VC = $525,000 TR = $428,000 Given that the firm produces the level of output at which MR=MC, calculate the amount of profit (loss) this firm earns. is it Profit=TR-TC?arrow_forwardIn Problem 5, the market demand decreases and the demand schedule becomes: If firms have the same costs set out in Problem 5, what is the market price and the firm’s economic profit or loss in the short run? Problem 5 The market for paper is perfectly competitive and 1,000 firms produce paper. The table sets out the market demand schedule for paper. The table in the next column sets out the costs of each producer of paper. Calculate the market price, the market output, the quantity produced by each firm, and the firm’s economic profit or loss.arrow_forwardThe following graph plots the market demand curve for ruthenium. Use the orange points (square symbol) to plot the initial short-run industry supply curve when there are 10 firms in the market. (Hint: You can disregard the portion of the supply curve that corresponds to prices where there is no output since this is the industry supply curve.) Next, use the purple points (diamond symbol) to plot the short-run industry supply curve when there are 20 firms. Finally, use the green points (triangle symbol) to plot the short-run industry supply curve when there are 30 firms. PRICE (Dollars per pound) 100 90 80 60 50 20 10 0 Demand equilibrium. ■ 0 125 250 375 500 625 750 875 1000 1125 1250 QUANTITY (Thousands of pounds) ☐ O True Δ O False 0 Supply (10 firms) ♦ If there were 10 firms in this market, the short-run equilibrium price of ruthenium would be would earn zero profit . Therefore, in the long run, firms would Supply (20 firms) Supply (30 firms) Because you know that competitive firms…arrow_forward

- Suppose Amari operates a handicraft pop-up retail shop that sells phone cases. Assume a perfectly competitive market structure for phone cases with a market price equal to $20 per phone case. The following graph shows Amari's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for phone cases for quantities zero through seven (including zero and seven) that Amari produces. TOTAL COST AND REVENUE (Dollars) 200 150 125 100 75 50 25 0 0 O Search Total Cost 20 Total Revenue Profit C Ccc Uarrow_forwardFor each price in the following table, use the graph to determine the number of lamps this firm would produce in order to maximize its profit. Assume that when the price is exactly equal to the average variable cost, the firm is indifferent between producing zero lamps and the profit-maximizing quantity. Also, indicate whether the firm will produce, shut down, or be indifferent between the two in the short run. Lastly, determine whether it will make a profit, suffer a loss, or break even at each price. Price (Dollars per lamp) 15 20 PRICE (Dollars per lamp 80 RS232 70 26 25 55 70 85 10 588 288 8 COSTS (Dolars) 20 On the following graph, use the orange points (square symbol) to plot points along the portion of the firm's short-run supply curve that corresponds to prices where there is positive output. (Note: You are given more points to plot than you need.) (? 10 0 10 D Quantity (Lamps) 0 0 Either 0 or 45,000 10 60,000 65,000 70,000 MC-D 20 D 20 30 40 50 60 75 NO QUANTITY (Thousands of…arrow_forward7. Short-run supply and long-run equilibrium Consider the competitive market for ruthenium. Assume that no matter how many firms operate in the industry, every firm is identical and faces the same marginal cost (MC), average total cost (ATC), and average variable cost (AVC) curves plotted in the following graph. COSTS (Dollars per pound) 100 90 80 70 60 50 40 30 20 10 0 0 MC 5 ATC AVC + + 10 15 20 25 30 35 QUANTITY (Thousands of pounds) 40 45 H 50 image 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education