Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

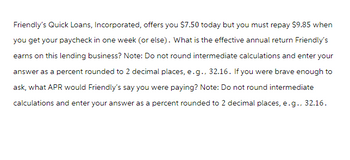

Transcribed Image Text:Friendly's Quick Loans, Incorporated, offers you $7.50 today but you must repay $9.85 when

you get your paycheck in one week (or else). What is the effective annual return Friendly's

earns on this lending business? Note: Do not round intermediate calculations and enter your

answer as a percent rounded to 2 decimal places, e.g., 32.16. If you were brave enough to

ask, what APR would Friendly's say you were paying? Note: Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- For the car loan described, give the following information. A car dealer will sell you the $30,750 car of your dreams for $6,000 down and payments of $665.06 per month for 60 months. (a) amount to be paid $ 39903.60 (b) amount of interest $ 9153.60 (c) interest rate (Round your answer to two decimal places.) 20.67 % (d) APR (rounded to the nearest tenth of a percent) %arrow_forwardA non-traditional lending source offers Megan a loan for $5,400. They require the loan to be repaid in 3 end-of-year payments of $2,100 each at the end of years 1, 2, and 3. What interest rate is this non-traditional lending source charging Megan? Click here to access the TVM Factor Table calculator. % Round entry to 1 decimal place. The tolerance is ±0.5.arrow_forwardPart c) Not using excel!arrow_forward

- For the car loan described, give the following information. A car dealer will sell you the $30,750 car of your dreams for $6,000 down and payments of $665.06 per month for 60 months. (a) amount to be paid $ 512.5 (b) amount of interest $ (c) interest rate (Round your answer to two decimal places.) 1.72 X % (d) APR (rounded to the nearest tenth of a percent) 20.7 X %arrow_forwardNeed hood explanation, don’t use excel please. Tsinoor takes out a loan of $6800. He will repay the loan over 5-years with semi-annual payments of $816 (first payment due in 6-months). Using linear interpolation, what rate of interest, j2 is being charged on the loan?arrow_forwardThe Second National Bank of Fullerton advertises an APR of 15%, but it indicates in the “small print” that compounding occurs on a monthly basis for personal loans with no collateral required. This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Determine the APY you would pay using an equation. The APY paid would be % per year.arrow_forward

- Ricky Ripov’s Pawn Shop charges an interest rate of 18.25 percent per month on loans to its customers. Like all lenders, Ricky must report an APR to consumers. a. What rate should the shop report? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the effective annual rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardFor the car loan described, give the following information. A car dealer will sell you the $30,350 car of your dreams for $6,000 down and payments of $669.06 per month for 60 months. (a) amount to be paid $ (b) amount of interest $ (c) interest rate (Round your answer to two decimal places.) % (d) APR (rounded to the nearest tenth of a percent)arrow_forwardPLEASE Use the correct function on EXCELarrow_forward

- (1)If compounding monthly, how would I find percent and intrest of a problem? (2) How do I compute if I paid $5 weekly for cofee and $175 monthly for food? What percentage of coffe did I pay over food? (3) suppose you start saving today for a $45,000 down payment that you plan to make on a house in 6 years. Assume you make no deposits in the account after initial deposit. For the account below, how much would you have to deposit now to reach $45000 in 6 years : an account with daily compounding and apr of 7%arrow_forwardRadhubhaiarrow_forwardHow do we work out how much was saved by making the partial payment? I know the answer is $26.91, but I don't know how to get there. Please help me. Polly Flynn borrowed $6,000 for 90 days at 7%. On day 20, Polly made a $2000 partial payment. (Assume ordinary interest) What is Polly’s ending balance due? How much did Polly save by making the partial payment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education