Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

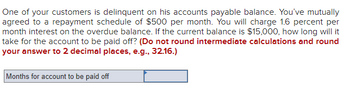

Transcribed Image Text:One of your customers is delinquent on his accounts payable balance. You've mutually

agreed to a repayment schedule of $500 per month. You will charge 1.6 percent per

month interest on the overdue balance. If the current balance is $15,000, how long will it

take for the account to be paid off? (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.)

Months for account to be paid off

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- On January 1, Yumati Electric borrows $700,000 at an interest rate of 6% today and will repay this amount by making 14 semiannual payments beginning May 31. What is the approximate amount of each payments that Yumati will need to make? (Use spreadsheet software or a financial calculator to calculate your answer. Do not round any intermediary calculations, and round your final answer to the nearest dollar.)arrow_forwardAssume that you start with a balance of $3900 on your credit card. During the first month you charge $400 and during the second month you charge $650 Assume that you credit card charges a 29% APR and that each month only the minimum payment of 2.5% of the balance. Table round to the nearest cent 1 month Previous balance, Finance charge- Purchase- New balance 2 month Previous balance, Finance charge- Purchase- New balancearrow_forwardThe annual interest rate on a credit card is 17.99%. If a payment of $400.00 is made each month, how many months will it take to pay off an unpaid balance of $2584.16? Assume that no new purchases are made with the credit card. (Don't Hand writing in solution) .arrow_forward

- A particular credit card calculates interest using the unpaid balance method. The monthly interest rate is 1.57% on the unpaid balance on the first day of the billing period minus any payment. At the beginning of the month you owed $1352. You made a payment of $300. a) During the month you bought theatre tickets for $37, went out to eat for $80, and bought a television for $350. What's your new balance (include what your balance was after your payment + new purchases + finance charges)?arrow_forwardPlease solve this questionarrow_forwardCalculate the monthly finance charge for the credit card transaction. Assume that it takes 10 days for a payment to be received and recorded, and that the month is 30 days ong. (Round your answers to the nearest cent.) $3000 balance, 17%, $2,500 payment (a) previous balance method (b) adjusted balance method (c) average daily balance methodarrow_forward

- Which one?arrow_forwardCalculate the monthly finance charge for the credit card transaction. Assume that it takes 10 days for a payment to be received and recorded, and that the month is 30 days long. (Round your answers to the nearest cent.) $200 balance, 17%, $50 payment (a) previous balance method$ (b) adjusted balance method$ (c) average daily balance methodarrow_forwardYou have an account with a $1500 credit limit that charges 13.25% interest using the average daily balance method. Assuming a 30-day month, you start with a balance of $350 on Day 1. On Day 5, you charge $100, and you pay $60 on Day 15. What is your average daily balance, assuming charges and payments begin the next day? Round your answer to 2 decimal places and do not include the dollar signarrow_forward

- One of your customers is delinquent on his accounts payable balance. You’ve mutually agreed to a repayment schedule of $590 per month. You will charge .99 percent per month interest on the overdue balance. If the current balance is $14,810, how long will it take for the account to be paid off? Number of months:arrow_forwardCalculate the monthly finance charge for the credit card transaction. Assume that it takes 10 days for a payment to be received and recorded, and that the month is 30 days long. (Round your answers to the nearest cent.) $400 balance, 16%, $50 payment (a) previous balance method $ (b) adjusted balance method $ (c) average daily balance method $arrow_forwardAssume you have a balance of $1000 on a credit card with an APR of 24%, or 2% per month. You start making monthly payments of $200, but at the same time you charge an additional $90 per month to the credit card. Assume that interest for a given month is based on the balance for the previous month. The following table shows how you can calculate your monthly balance. Complete and extend t the debt is paid off. How long does it take to pay off the credit card debt?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education