Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

I need help with answering question B: A car loan offered by Bank One requires quarterly payments and has an APR of 4.8 percent, whereas a the same loan amount may be obtained from Bank Two at an APR of 5 percent with monthly payments. Which loan would you choose and why?

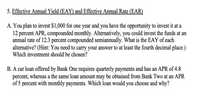

Transcribed Image Text:5. Effective Annual Yield (EAY) and Effective Annual Rate (EAR)

A. You plan to invest $1,000 for one year and you have the opportunity to invest it at a

12 percent APR, compounded monthly. Alternatively, you could invest the funds at an

annual rate of 12.3 percent compounded semiannually. What is the EAY of each

alternative? (Hint: You need to carry your answer to at least the fourth decimal place.)

Which investment should be chosen?

B. A car loan offered by Bank One requires quarterly payments and has an APR of 4.8

percent, whereas a the same loan amount may be obtained from Bank Two at an APR

of 5 percent with monthly payments. Which loan would you choose and why?

Transcribed Image Text:Step 1

Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one

question when multiple questions posted under single question. Hence, the solution for the first

question is provided below. Please repost the remaining questions separately. One of our experts will

help you on this.

Step 2

A. Calculate the EAY of each alternative as follows:

Effective annual yield=(1+

питber of compоиndings

- 1

rate

питber of compoоundings

=(1+ )" - 1

12%

=(1.01)12 – 1

=1. 126825 – 1

=0. 126825 or 12. 6825%

Therefore, EAY of first alternative is 12.6825%

Effective annual yield=(1+

питber of compоиndings

1

rate

питber of compоиndings

2

12.3%

=(1+

-

=(1.06150)? – 1

=1. 126782 – 1

=0. 126782 or 12. 6782%

Therefore, EAY of second alternative is 12.6782%.

The investor should choose to invest in option 1 (12% compounded monthly) as the EAY is more

compared to option 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A savings and loan charges 2.075 points for a home buyer to obtain a loan of $255,000. To calculate the discount points, what value should be multiplied by the loan amount? Also, calculate the discount points.arrow_forwardQuestion 5. Attached is a similar question answeredarrow_forwardChoose the best answer to the following question. Explain your reasoning with one or more complete sentences. What does a loan of $400,000 that carries a 4-point origination fee require as an advance payment? Choose the correct answer below. A. An advance payment of $1,600 is required. Each point is 1% of the loan amount, so the advance payment amount is 4% of $400,000. B. An advance payment of $16,000 is required. Each point is 1% of the loan amount, so the advance payment amount is 4% of $400,000. OC. An advance payment of $8,000 is required. Each point is 1% of the loan amount, so the advance payment amount is 4% of $400,000. OD. An advance payment of $16,000 is required. Each point is 10% of the loan amount, so the advance payment amount is 40% of $400,000. E. An advance payment of $8,000 is required. Each point is 10% of the loan amount, so the advance payment amount is 40% of $400,000. OF. An advance payment of $1,600 is required. Each point is worth between 50 and 100 points…arrow_forward

- Answer the Financial Literacy question below in the screenshot.arrow_forwardA car dealer will sell you a used car for $6798 with $798 down and payments of $162.51 per month for 47 month for 48 months. What is the simple interest rate ?arrow_forward(Q) You would like to purchase a home and are interested to find out how much you can borrow. When your lender calculates your debt to income ratio, he determines that your maximum monthly payment can be no more than $3, 200. You would like to have a 30 year fully amortizing loan and the interest rate offered on such a loan is currently 8.5%. Given these constraints, what is the largest loan you can obtain?arrow_forward

- For the Questions 3-5 assume you want to finance (borrow) $12,000 for your next car and your interest rate will be 6%. 3. What will be your monthly payment and the total amount paid over the life of the loan if you finance for 48 months? Provide the car payment and the TVM inputs you used to calculate the payment. Рayment Total of all payments PV FV RATE/INTEREST PERIODS/N (See next page for Questions 4 and 5)arrow_forwardH5.arrow_forwardAfter examining the various personal loan rates available to you, you find that you can borrow funds from a finance company at 8 percent compounded or from a bank at 9 percent compounded . Which alternative is more attractive?arrow_forward

- You want to financed a car that advertised at $31318 but you don't have money. However after checking your credit the dealer offered you that if you pay $571 per month for 6 years, they will give you the car. What is the total amount you will have to pay to the dealer if you finance the car? Write the answer without the "$" sign. Add your answer Iarrow_forwardPlease answer with explanation. I will really upvotearrow_forwardPlease answer it in a comprehensive and detail manner with step by step algorithm. No excel's sheet solution.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education