Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

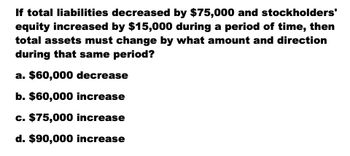

Transcribed Image Text:If total liabilities decreased by $75,000 and stockholders'

equity increased by $15,000 during a period of time, then

total assets must change by what amount and direction

during that same period?

a. $60,000 decrease

b. $60,000 increase

c. $75,000 increase

d. $90,000 increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If total assets are $20,000 and total liabilities are $12,000, the amount of stockholders’ equity is: A. $32,000. B. $(32,000). C. $(8000). D. $8,000.arrow_forward6arrow_forwardIf accounts receivable increase by R500, inventory increases by R200 and accounts payable increase by R400, net working capital would... Select one: decrease by R300. a. b. increase by R700. C. increase by R300. O d. remain unchanged. Clear my choicearrow_forward

- A return on assets of 5.15% means that a company is earning: O a. a $5.15 return on every $100 of assets minus liabilities. O b. a $5.15 return on every $100 of total assets. O c. a $5.15 return on every $100 of current assets. O d. a $5.15 return on every $100 invested in long-term assets.arrow_forwardA return on assets of 5.15% means that a company is earning: a.a $5.15 return on every $100 invested in long-term assets. b.a $5.15 return on every $100 of total assets. c.a $5.15 return on every $100 of assets minus liabilities. d.a $5.15 return on every $100 of current assets.arrow_forwardCompute the amount of liabilities for Company E at the beginning of the year. End of Year $ Assets Equity, beginning of year Add: Stock issuances Add: Net income 115,920 Less: Cash dividends Equity, end of year Beginning of Year Assets $ = = = 101,010 = $ $ $ Liabilities + 91,576 + 6,500 8,642 15,142 11,000 24,344 Liabilities 101,010 + + GA $ Equity 24,344 Equityarrow_forward

- If accounts receivable increase by R500, inventory increases by R200 and accounts payable increase by R400, net working capital would ... Select one: decrease by R300. a. b. increase by R700. C. increase by R300. Od. remain unchanged. Clear my choicearrow_forwardSelect the correct answerarrow_forwardCash account (millions of dollars) Projected sales (millions of dollars) Stock price per share (monthly average) Capital structure (equity/debt ratio in percent) Liquidity ratio (current assets/ current liabilities) Earnings before interest and taxes (EBIT; in millions of dollars) Return on assets (ROA; percent) Sales revenue (millions of dollars) Current Month $33 $298 $6.60 32.8% 1.10x $15 3.32% $290 One Month Ago $57 $295 $6.50 33.9% 1.23x $14 3.25% $289 Two Three Months Months Ago Ago $51 $294 $6.40 34.6% 1.35x $13 2.98% $290 $44 $291 $6.25 34.9% 1.39x $11 3.13% $289 Four Months Ago $43 $288 $6.50 35.7% 1.25x $13 3.11% $287 Butell has announced within the past 30 days that it is switching to new methods for calculating depreciation of its fixed assets and for valuing inventories. The firm's board of directors is planning to discuss at its next meeting a proposal to reduce stock dividends in the coming year. 6. Identify which of the following loan covenants are affirmative and which…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College