FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

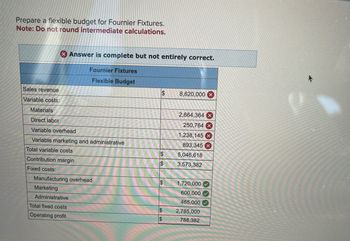

Transcribed Image Text:Prepare a flexible budget for Fournier Fixtures.

Note: Do not round intermediate calculations.

Sales revenue

Variable costs:

Answer is complete but not entirely correct.

Fournier Fixtures

Flexible Budget

Materials

Direct labor

Variable overhead

Variable marketing and administrative

Total variable costs

Contribution margin

Fixed costs:

Manufacturing overhead

Marketing

Administrative

Total fixed costs

Operating profit

$

$

$

$

$

$

8,620,000 x

2,664,364 x

250,764 X

1,238,145 x

893,345 x

5,046,618

3,573,382

1,720,000

600,000

465,000

2,785,000

788,382

Transcribed Image Text:Mc

Graw

Hill

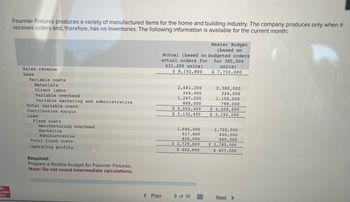

Fournier Fixtures produces a variety of manufactured items for the home and building industry. The company produces only when it

receives orders and, therefore, has no inventories. The following information is available for the current month:

Sales revenue

Less

Variable costs

Materials

Direct labor

Variable overhead

Variable marketing and administrative

Total variable costs

Contribution margin

Less

Fixed costs

Manufacturing overhead

Marketing

Administrative

Total fixed costs

Operating profits

Required:

Prepare a flexible budget for Fournier Fixtures.

Note: Do not round intermediate calculations.

Master Budget

(based on

Actual (based on budgeted orders

actual orders for for 385,000

431,200 units)

units)

$ 8,192,800 $ 7,700,000

< Prev

TACTI

2,681,200

244,000

1,247,200

888,000

$ 5,060,400

$ 3,132,400

1,686,000

617,800

426,000

$ 2,729,800

$ 402,600

3 of 10

⠀

2,380,000

224,000

1,106,000

798,000

$ 4,508,000

$ 3,192,000

1,720,000

600,000

465,000

$ 2,785,000

$ 407,000

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not Give solution in image formatarrow_forwardA bhaliyaarrow_forwardThe Panda Group Ltd has recently acquired Zorba Inc. which manufactures concrete imitations of ancient Greek artefacts which are sold to garden and home decorator retail outlets. You have been asked to prepare a 5 year budget forecast for Zorba Inc. For cost accounting reporting and budgeting, the Zorba Inc. factory employs a traditional manufacturing cost flow inventory and accounting system, however the company does not operate a Work-in-Process Inventory account. Financial and production data from the Zorba Inc plant's 2023 calendar year trading results are as follows: 2023 Year data Sales (Units) Price (average 2023 price received) Prime Costs (per unit) Raw Materials Direct Labour Closing Inventory: Raw Materials (15,000 units) Finished Goods (14,600 units) 172,680 $65.00 $16.65 $11.95 $1,760,000 $1,626,000 Variable Manufacturing Costs (per unit) $6.10 Factory Management Salaries (per annum) $313,000 Factory Plant & Equipment Depreciation (per annum) $75,000 Sales and Marketing…arrow_forward

- ABC Company produces a line of watches. The company uses a normal costing system and allocates manufacturing overhead using direct manufacturing labor cost. The following data are for 2018: Budgeted manufacturing overhead cost Budgeted direct manufacturing labor cost Actual manufacturing overhead cost Actual direct manufacturing labor cost $150,000 $300,000 $142,000 $276,000 Inventory balances on December 31, 2018, were as follows: Direct manufacturing labor cost in ending balance Accounts Work in process Finish goods Ending Balance 205,000 30,360 256,000 55,200 Cost of goods sold 609,000 190,440 By using the (Write-off Approach) to adjust the under- or overallocated manufacturing overhead amount, what is the ending balance of "Cost of Goods Sold"? 1. O617,000. 2. O613,000. 3. O 620,000. 4. O 633,000. 5. ONone of the above. Next OType here to searcharrow_forwardParker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($378,000 ÷ 900,000 units) Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost Direct Labor Rate Variance Direct Labor Efficiency Variance IF TI 1,000,000 11,800,000 $ 8,260,000 $ Required: Calculate Parker Plastic's direct labor rate and efficiency variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). F 245,000 2,891,000 $ 318,500 $ 355,000 Standard Quantity 12 square…arrow_forwardDazzle Party is a small business that produces decorative balloons for events. Dazzle Party uses normal costing and assigns manufacturing overhead (MOH) costs using labour hours as the allocation base. Budgeted and actual production data for the year 2023 is provided below. Budget $60,000 120,000 Actual $52,000 MOH costs Labour-hours 110,000 Required: Calculate the difference between the allocated MOH cost and the actual MOH cost incurred in 2023. Clearly state whether this difference represents a case of under-allocation or over-allocation of MOH.arrow_forward

- Please help me with show all calculations don't provide Excel workarrow_forwardi Data Table 1. Quantity of lamps to be produced 2. Number of lamps to be produced per batch 3. Setup time per batch Variable cost $70 per setup-hour Fixed cost = $75,000 Print Knox 23,000 lamps 250 lamps/batch 4 hours/batch Done Ayer 15,000 lamps - 200 lamps/batch 5 hours/batch Xarrow_forwardI have a few questions from the last chapter that still don't understand can i get help.arrow_forward

- Glencoe, Inc., costs products using a normal costing system. The following data is available for last year: Budgeted: 4.1 4.2 4.3 Overhead Machine hours Direct labour hours 4.4 Actual: Overhead Machine hours Direct labour hours Prime cost Number of units R476 000 140 000 17 000 Overhead is applied on the basis of direct labour hours. Required: R475 000 137 000 16 550 R1 750 000 250 000 Calculate the predetermined overhead rate. Calculate the applied overhead for last year. Was the overhead over- or under-applied, and by how much? Calculate the total cost per unit produced (to 2 decimal places).arrow_forwardDavis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and market the stoves at the company's normal volume of 6,000 units per month are shown in the following table. Unit manufacturing costs Variable materials Variable labor Variable overhead Fixed overhead Total unit manufacturing costs Unit marketing costs Variable Fixed Total unit marketing costs Total unit costs. $ 41 66 16 51 16 61 $ 174 77 $ 251 Unless otherwise stated, assume that no connection exists between the situation described in each question; each is independent. Unless otherwise stated, assume a regular selling price of $408 per unit. Ignore income taxes and other costs that are not mentioned in the table or in the question itself. Required: a. Market research estimates that volume could be increased to 7,000 units, which is well within production capacity limitations if the price were cut from $408 to $363 per unit. Assuming that the cost behavior patterns implied by the data in the…arrow_forwardPlease do not give solution in image format and show calculation thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education