FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:i

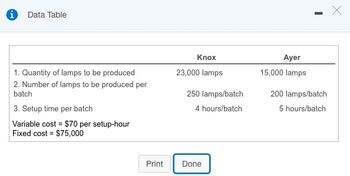

Data Table

1. Quantity of lamps to be produced

2. Number of lamps to be produced per

batch

3. Setup time per batch

Variable cost $70 per setup-hour

Fixed cost = $75,000

Print

Knox

23,000 lamps

250 lamps/batch

4 hours/batch

Done

Ayer

15,000 lamps

-

200 lamps/batch

5 hours/batch

X

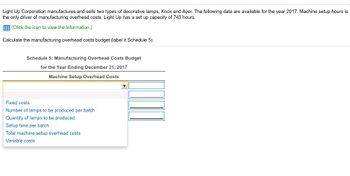

Transcribed Image Text:Light Up Corporation manufactures and sells two types of decorative lamps, Knox and Ayer. The following data are available for the year 2017. Machine setup-hours is

the only driver of manufacturing overhead costs. Light Up has a set up capacity of 743 hours.

EEE (Click the icon to view the information.)

Calculate the manufacturing overhead costs budget (label it Schedule 5).

Schedule 5: Manufacturing Overhead Costs Budget

for the Year Ending December 31, 2017

Machine Setup Overhead Costs

Fixed costs

Number of lamps to be produced per batch

Quantity of lamps to be produced

Setup time per batch

Total machine setup overhead costs

Variable costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- BARC Shannon Corporation manufactures custom cabinets for kitchens. It uses an actual costing system with two direct cost categories-direct materials and direct manufacturing labor-and one indirect-cost pool, manufacturing overhead costs. It provides the following information for 2017. E (Click the icon to view the information for 2017.) Read the requirement. Data table Begin by calculating the actual manufacturing overhead rate. (Assume the cost allocation base is direct labor hours.) Actual manufacturing Budgeted manufacturing overhead costs 1,368,000 overhead rate Budgeted direct manufacturing labor-hours 38.000 hours Actual manufacturing overhead costs 2$ 1,260,000 Actual direct manufacturing labor-hours 28,000 hours Print Donearrow_forwardRequired Information [The following information applies to the questions displayed below.] Patel and Sons Inc. uses a standard cost system to apply factory overhead costs to units produced. Practical capacity for the plant is defined as 55,200 machine hours per year, which represents 27,600 units of output. Annual budgeted fixed factory overhead costs are $276,000 and the budgeted variable factory overhead cost rate is $3.70 per unit. Factory overhead costs are applied on the basis of standard machine hours allowed for units produced. Budgeted and actual output for the year was 21,500 units, which took 44,200 machine hours. Actual fixed factory overhead costs for the year amounted to $264,800 while the actual variable overhead cost per unit was $3.60. Based on the Information provided above, calculate the following factory overhead variances for the year. Indicate whether each variance is favorable (F) or unfavorable (U). (Do not round Intermediate calculations. Round your final…arrow_forwardBullseye Company manufactures dartboards. Its standard cost information follows: Direct materials (cork board) Direct labor Standard Quantity 0.50 square feet 0.90 hour Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($21,750/87,000) Bullseye has the following actual results for the month of September: Number of units produced and sold Number of square feet of corkboard purchased and used Cost of corkboard used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 0.90 hour Standard Price (Rate) $ 1.30 per square feet $5.00 per hour $0.50 per hour 74,000 43,000 $ 47,200 80,000 $ 98,000 $ 103,880 $ 33,000 Standard Unit Cost $ 0.65 4.50 0.45 0.25 Required: 1. Calculate the fixed overhead spending variance for Bullseye. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). 2. Calculate the fixed overhead volume variance…arrow_forward

- Cruise Manufacturing has two direct cost categories direct materials and direct labor costs. The company's variable manufacturing overhead is allocated to products based on standard direct labor hours. The following information indicates the standards of Cruise's manufacturing costs Direct Cost Categories. Standard Quantity Cost per Input Unit pound Direct Materials 12 pounds per output unit $15 per Direct Labor 3 hours per output unit $21 per hour Manufacturing Overhead Cost per Input Unit Variable Manufacturing Overhead $12 per Direct Labor Hour By the end of Apr 2019 Cruise Manufacturing records indicated the following Direct materials purchased and used Direct labor Total actual variable manufacturing overhead Actual production $11.44 per pound 95,000 pounds $22 per hour 48,000 labor hours Do not enter dollar signs or commas in the input boxes Round all answers to the nearest whole number Enter the variances as positive values. Calculate the following variances. al Direct materials…arrow_forwardRequired information [The following information applies to the questions displayed below.] Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,600 units, and monthly production costs for the production of 1,300 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($110 fixed) Supervisor's salary Maintenance ($270 fixed) Depreciation Total Cost $ 2,500 8,100 650 3,000 510 750 Suppose it sells each birdbath for $24. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,500 units.arrow_forwardCheck my work Required information [The following information applies to the questions displayed below.] Patel and Sons Inc. uses a standard cost system to apply factory overhead costs to units produced. Practical capacity for the plant is defined as 55,200 machine hours per year, which represents 27,600 units of output. Annual budgeted fixed factory overhead costs are $276,000 and the budgeted variable factory overhead cost rate is $3.70 per unit. Factory overhead costs are applied on the basis of standard machine hours allowed for units produced. Budgeted and actual output for the year was 21,500 units, which took 44,200 machine hours. Actual fixed factory overhead costs for the year amounted to $264,800 while the actual variable overhead cost per unit was $3.60. Based on the information provided above, calculate the following factory overhead variances for the year. Indicate whether each variance is favorable (F) or unfavorable (U). (Do not round intermediate calculations. Round…arrow_forward

- The following product costs are available for Arrez Company on the production of DVD cases: direct materials, $1,120; direct labor, $15.50; manufacturing overhead, applied at 150% of direct labor cost; selling expenses, $1,450; and administrative expenses, $950. The direct labor hours worked for the month are 90 hours. Round your answers to two decimal places. A. What are the prime costs? $fill in the blank 1 B. What are the conversion costs? $fill in the blank 2 C. What is the total product cost? $fill in the blank 3 D. What is the total period cost? $fill in the blank 4 E. If 1,400 equivalent units are produced, what is the equivalent material cost per unit? $fill in the blank 5 F. What is the equivalent conversion cost per unit?arrow_forwardDeep Sea manufactures flotation vests in Charleston, South Carolina. Deep Sea's contribution margin income statement for the month ended March 31, 2024, contains the following data: (Click the icon to view the cost information.) Read the requirements. Requirement 1. Identify each cost in the income statement as either relevant or irrelevant to Deep Sea's decision. Variable Manufacturing Costs Variable Selling and Administrative Costs Fixed Manufacturing Costs Fixed Selling and Administrative Costs Requirement 2. Prepare a differential analysis to determine whether Deep Sea should accept this special sales order. (Enter decreases to revenue or increases to costs with a parentheses or minus sign.) Decision: in operating income ▼ Suppose Overboard wishes to buy 4,000 vests from Deep Sea. Deep Sea will not incur any variable selling and administrative expenses on the special order. The Deep Sea plant has enough unused capacity to manufacture the additional vests. Overboard has offered $7…arrow_forwardVikramarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education