FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

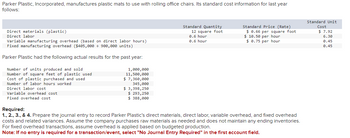

Transcribed Image Text:Parker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year

follows:

Direct materials (plastic)

Direct labor

Variable manufacturing overhead (based on direct labor hours)

Fixed manufacturing overhead ($405,000 ÷ 900,000 units)

Parker Plastic had the following actual results for the past year:

Number of units produced and sold

Number of square feet of plastic used

Cost of plastic purchased and used

Number of labor hours worked

Direct labor cost

Variable overhead cost

Fixed overhead cost

1,000,000

11,500,000

$ 7,360,000

345,000

$ 3,398,250

$ 293,250

$ 388,000

Standard Quantity

12 square foot

0.6 hour

0.6 hour

Standard Price (Rate)

$ 0.66 per square foot

$10.50 per hour

$ 0.75 per hour

Required:

1., 2., 3., & 4. Prepare the journal entry to record Parker Plastic's direct materials, direct labor, variable overhead, and fixed overhead

costs and related variances. Assume the company purchases raw materials as needed and does not maintain any ending inventories.

For fixed overhead transactions, assume overhead is applied based on budgeted production.

Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.

Standard Unit

Cost

$7.92

6.30

0.45

0.45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Parker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Standard Standard Price Standard Quantity 10 sq ft. $ 0.82 per sq. ft. 0.25 hr. (Rate) Unit Cost $ 8.20 Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead $270,600 + 902,000 units) $10.20 per hr. 2.55 0.25 hr. $ 1.40 per hr. 0.35 0.30 Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used 1,020,000 11,000,000 $ 8,800,000 300,000 $ 3,000,000 $ Number of labor hours worked Direct labor cost Variable overhead cost 400,000 357,000 Fixed overhead cost $ Required: Calculate Parker Plastic's direct materials price and quantity variances. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for…arrow_forwardJorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports. The company provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) 210 160 190 Ending (units) 160 190 230 Variable costing net operating income $ 300,000 $ 269,000 $ 260,000 The company’s fixed manufacturing overhead per unit was constant at $560 for all three years. Required: 1. Calculate each year’s absorption costing net operating income. Note: Enter any losses or deductions as a negative value.arrow_forwardActivity-Based Costing Slack Corporation has the following predicted indirect costs and cost drivers for the year for the given activity cost pools: Maintenance Materials handling Machine setups Inspections Machine hours Material moves Machine setups Inspection hours Fabrication Department Finishing Department Cost Driver $50,000 30,000 70,000 $40,000 Machine hours 15,000 Material moves 5,000 Machine setups 25,000 Inspection hours $85,000 The following activity predictions were also made for the year. Fabrication Department Finishing Department Direct materials cost Direct labor cost Machine hours (Fabrication) Machine hours (Finishing) Materials moves Machine setups Inspection hours It is assumed that the cost per unit of activity for a given activity does not vary between departments. Slack's president, Charles Slack, is trying to evaluate the company's product mix strategy regardin two of its five product models, ZX300 and SL500. The company has been using a company-wide overhead…arrow_forward

- Parker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Standard Quantity Standard Price (Rate) Standard Unit Cost Direct materials (plastic) 12 sq ft. $ 1.45 per sq. ft. $ 17.40 Direct labor 0.3 hr. $ 11.90 per hr. 3.57 Variable manufacturing overhead (based on direct labor hours) 0.3 hr. $ 2.30 per hr. 0.69 Fixed manufacturing overhead ($461,000 ÷ 922,000 units) 0.50 Parker Plastic had the following actual results for the past year: Number of units produced and sold 1,160,000 Number of square feet of plastic used 12,000,000 Cost of plastic purchased and used $ 16,800,000 Number of labor hours worked 320,000 Direct labor cost $ 3,744,000 Variable overhead cost $ 1,100,000 Fixed overhead cost $ 377,000 Required:Calculate Parker Plastic’s direct labor rate and efficiency variances. (Do not round intermediate calculations. Indicate the…arrow_forwardParker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Standard Quantity Standard Price (Rate) Standard Unit Cost $ 5.04 $ 0.63 per sq. ft. $10.50 per hr. 2.73 $ 1.50 per hr. 0.39 Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($308,040 906,000 units) 8 sq ft. 0.26 hr. 0.26 hr. Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost Direct Labor Rate Variance Direct Labor Efficiency Variance 1,220,000 11,200,000 $ 6,720,000 305,000 $ $ 3,233,000 540,000 361,000 $ 0.34 Required: Calculate Parker Plastic's direct labor rate and efficiency variances. (Do not round intermediate calculations. Indicate the effect of each…arrow_forwardUse the information below on Direct Labor costs to answer question#33. GIVEN: Management at the Best Ceramic Vase Company wishes to analyze its Direct Labor costs. During September, company management noted that it used 3,400 hours of Direct Labor at a cost of $76,500 to produce 2,300 vases. The company set the following Direct Labor standard. 1.5 hours of Direct Labor per unit at an hourly wage rate of $22.00 33) Determine the actual wage rate (using the Given information above). A) $15.00 B) $22.00 C) $22.18 D) $22.50arrow_forward

- Mariposa, Inc., produces machine tools and currently uses a plantwide overhead rate, based on machine hours. Harry Whipple, the plant manager, has heard that departmental overhead rates can offer significantly better cost assignments than can a plantwide rate. Mariposa has the following data for its two departments for the coming year: Department A Department B Overhead costs (expected) $528,000 $132,000 Normal activity (machine hours) 110,000 55,000 Required: 1. Compute a predetermined overhead rate for the plant as a whole based on machine hours.$fill in the blank 1 per machine hour 2. Compute predetermined overhead rates for each department using machine hours. Round your answers to one decimal place. Department A $fill in the blank 2 per machine hour Department B $fill in the blank 3 per machine hour 3. Suppose that a machine tool (Product X75) used 60 machine hours from Department A and 140 machine hours from Department B. A second machine tool (Product Y15)…arrow_forwardParker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($500,040 926,000 units) Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of Labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 1.200,000 12,200,000 $7,320,000 324,000 $3,855,600 $1,300,000 $ 381,000 Required: Calculate Parker Plastic's direct labor rate and efficiency variances Direct Labor Rate Variance Direct Labor Efficiency Vince Standard Quantity 13 square foot 0.25 hour 0.25 hour Standard Price (Rate) $ 0.70 per square foot $ 12.20 per hour $ 1.40 per hour Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting…arrow_forwardParker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Standard Quantity Standard Price (Rate) Standard Unit Cost Direct materials (plastic) 12 sq ft. $ 1.00 per sq. ft. $ 12.00 Direct labor 0.25 hr. $ 12.80 per hr. 3.20 Variable manufacturing overhead (based on direct labor hours) 0.25 hr. $ 2.00 per hr. 0.50 Fixed manufacturing overhead ($559,200 ÷ 932,000 units) 0.60 Parker Plastic had the following actual results for the past year: Number of units produced and sold 1,260,000 Number of square feet of plastic used 12,500,000 Cost of plastic purchased and used $ 11,250,000 Number of labor hours worked 330,000 Direct labor cost $ 4,026,000 Variable overhead cost $ 1,480,000 Fixed overhead cost $ 387,000 Required:Calculate Parker Plastic’s variable overhead rate and efficiency variances and its over- or underapplied variable overhead.…arrow_forward

- Jorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports. The company provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) 210 160 190 Ending (units) 160 190 230 Variable costing net operating income $ 300,000 $ 269,000 $ 260,000 The company’s fixed manufacturing overhead per unit was constant at $560 for all three years. 2. Assume in Year 4 the company’s variable costing net operating income was $250,000 and its absorption costing net operating income was $310,000. Did inventories increase or decrease during Year 4? How much fixed manufacturing overhead cost was deferred or released from inventory during Year 4?arrow_forwardParker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Direct materials (plastic) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($378,000 ÷ 900,000 units) Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost Direct Labor Rate Variance Direct Labor Efficiency Variance IF TI 1,000,000 11,800,000 $ 8,260,000 $ Required: Calculate Parker Plastic's direct labor rate and efficiency variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). F 245,000 2,891,000 $ 318,500 $ 355,000 Standard Quantity 12 square…arrow_forwardDiego Company manufactures one product that is sold for $77 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 1,298,000 Fixed selling and administrative expense $ 662,000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education