Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting Question please provide correct solution this question

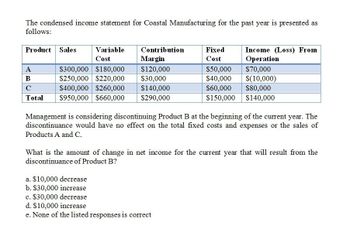

Transcribed Image Text:The condensed income statement for Coastal Manufacturing for the past year is presented as

follows:

Product Sales

A

Variable

Cost

$300,000 $180,000

Contribution

Margin

Fixed

Cost

Income (Loss) From

Operation

$120,000

$50,000

$70,000

B

$250,000 $220,000

$30,000

$40,000

$(10,000)

C

$400,000 $260,000

$140,000

$60,000 $80,000

Total

$950,000 $660,000

$290,000

$150,000

$140,000

Management is considering discontinuing Product B at the beginning of the current year. The

discontinuance would have no effect on the total fixed costs and expenses or the sales of

Products A and C.

What is the amount of change in net income for the current year that will result from the

discontinuance of Product B?

a. $10,000 decrease

b. $30,000 increase

c. $30,000 decrease

d. $10,000 increase

e. None of the listed responses is correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- need answer as per requiredarrow_forwardRevlon Company provided the following data for the current Problem 13-16 (IAA) year. Segment Revenue Profit (loss) Assets 620,000 100,000 340,000 190,000 180,000 70,000 120,000 380,000 200,000 20,000 70,000 ( 30,000) ( 25,000) 10,000 ( 20,000) ( 25,000) 400,000 80,000 300,000 140,000 180,000 120,000 140,000 140,000 Others * The "others" category includes five operating segments, none of which has revenue or assets greater than P80,000 and none with an operating profit. Operating Segments 1 and 2 produce very similar products and use very similar production processes, but serve different customer types and use quite different product distribution system. These differences are due in part to the fact that Segment 2 operates in a regulated environment while Segment 1 does not. *. Operating Segments 6 and 7 have very similar products, production processes, product distribution systems, but are organized as separate divisions since they serve substantially different types of customers.…arrow_forwardNeed helparrow_forward

- Give correct answerarrow_forwardProvide answer pleasearrow_forwardLL Required Information The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: $ 2,300,00e 670,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income 000'09 Average operating assets $1,437,500 At the beginning of this year, the company has a $287,500 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses S0% of sales $ 161,000 The company's minimum required rate of return is 15%. 5. What is the turnover related to this year's investment opportunity? (Round your answer to 1 decimal place.) e here to search 近。 F4 F5 F7 F8 F10 F11 て2 24 4 % 9 08.arrow_forward

- i Requlred Informatlon The following information applies to the questions displayed below] Westerville Company reported the following results from last year's operations: $ 2,300,000 Contribution margin Fixed expenses 1,170,000 Net operating income Average operating assets S1,437,500 At the beginning of this year, the company has a $287,500 investment opportunity with the following cost and revenue characteristics: Sales $ 460,000 50% of sales Contribution margin ratio Fixed expenses, $ 161,000 The company's minimum required rate of return is 15%. 8. If the company pursues the investment opportunity and otherwise performs the same as last year, what turnover will it earn this year? (Round your answer to 2 decimal places.) < Prev Next 15. here to search, 近。 F4 F5 F7 F8 F12 $ & V 4.arrow_forwardThe condensed income statement for a Fletcher Inc. for the past year is as follows: Product F G H Total Sales $300,000 $210,000 $340,000 $850,000 Costs: Variable costs $180,000 $180,000 $220,000 $580,000 Fixed costs 50,000 50,000 40,000 140,000 Total costs $230,000 $230,000 $260,000 $720,000 Income (loss) $ 70,000 $(20,000) $ 80,000 $130,000 Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G? a.$30,000 decrease b.$30,000 increase c.$20,000 decrease d.$20,000 increasearrow_forwardGeneral accountingarrow_forward

- Problem 11-17 (Algo) Return on Investment (ROI) and Residual Income [LO11-1, LO11-2] Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc.Balance Sheet BeginningBalance EndingBalance Assets Cash $ 138,000 $ 134,000 Accounts receivable 342,000 483,000 Inventory 580,000 473,000 Plant and equipment, net 810,000 820,000 Investment in Buisson, S.A. 400,000 435,000 Land (undeveloped) 248,000 250,000 Total assets $ 2,518,000 $ 2,595,000 Liabilities and Stockholders' Equity Accounts payable $ 375,000 $ 340,000 Long-term debt 1,046,000 1,046,000 Stockholders' equity 1,097,000 1,209,000 Total liabilities and stockholders' equity $ 2,518,000 $ 2,595,000 Joel de Paris, Inc.Income Statement Sales $ 5,103,000 Operating expenses 4,235,490 Net operating income 867,510 Interest and taxes:…arrow_forwardProvide correct answer general accountingarrow_forwardSecurity First Income Statement For the Year Ended May 31, 2018 Product Line Industrial Household Systems Systems Total Net Sales Revenue $310,000 $330,000 $640,000 Cost of Goods Sold: Variable 35,000 43,000 78,000 Fixed 240,000 64,000 304,000 Total Cost of Goods Sold 275,000 107,000 382,000 Gross Profit 35,000 223,000 258,000 Selling and Administrative Expenses: Variable 68,000 70,000 138,000 Fixed 40,000 22,000 62,000 Total Selling and Administrative Expenses 108,000 92,000 200,000 Operating Income (Loss) $(73,000) $131,000 $58,000 Members of the board of directors of Security First have received the following operating income data for the year ended may 31, 2018. Requirement 1. Prepare a differential analysis to show whether Security First should…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning