Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please do fast answer with correct calculation for this accounting question

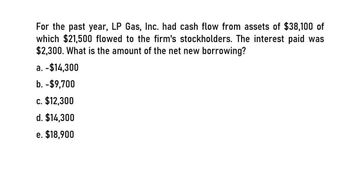

Transcribed Image Text:For the past year, LP Gas, Inc. had cash flow from assets of $38,100 of

which $21,500 flowed to the firm's stockholders. The interest paid was

$2,300. What is the amount of the net new borrowing?

a. -$14,300

b. -$9,700

c. $12,300

d. $14,300

e. $18,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For the past year, LP Gas, Inc.arrow_forwardSuppose an SEVP tells you that last year a bank had total interest expenses on all borrowings of BDT 12 million and noninterest expenses of BDT 5 million, while interest income from earning assets totaled BDT 16 million and noninterest revenues totaled BDT 2 million. Suppose further that assets amounted to BDT 480 million, of which earning assets represented 85 percent of that total asset while total interest-bearing liabilities amounted to 75 percent of total assets. See if you can determine the bank’s net interest and non-interest margins and its earnings base and earnings spread for the most recent year.arrow_forwardBank A has the following balance sheet: A ssets Reserves $50 million Liabilities Deposits $200 million Bank capital 850 million Securities $50 million Loans $150 million Bank B has the following balance sheet: A ssets Liabilities Deposits $225 million Bank capital $25 million Reserves $50 million Securities $50 million Loans $150 million 1. Both banks earn 85 million as an annual after-tax profit. Calculate ROA (return on asset) and ROE (return on equity) for both banks.arrow_forward

- The First National Bank of Trinidad reports a net interest margin of 5.83 percent. It has totalinterest revenues of $275 million and total interest expenses of $210 million. What will be thebank's earning assets total?A. $4,717 millionB. $3,602 millionC. $1,115 millionD. $3,790 millionarrow_forwardDuring the most current year, XYZ Corp paid $55,240 in interest and $80,400 in dividends. In order to fund a large expansion, the company also raised $297,000 in new equity and borrowed &197000 via the bond market, though a portion of the new borrowing was used to pay back $174,000 in bonds that were maturing this year. Calculate the cash flow to Shareholders.arrow_forwardNaperville bank has total assets of $100 million and equity capital of $3 million. Its income statement in 2021 is as elow: Net Interest Income 3 Provision for Loan Losses Non-Interest Income Non-Interest Expense (4.00) 0.9 (2.50) If the bank's tax rate is 30%, what is the new balance of its equity capital? (A) $3 million B $1.82 million $1.18 million D $0.4 million Iarrow_forward

- A company paid $11,310 in interest and $16,500 in dividends last year. The times interest earned ratio is 2.9, the depreciation expense is $7,900, and the tax rate is 21 percent. What is the value of the cash coverage ratio? O a. 3.71 O b. 3.60 O C. 2.78 d. 3.10 O e. 2.58arrow_forwardThe following information has been taken from the income statement and statement of financial position of A Co: Revenue $350m Production expenses $210m Administrative expenses $24m Tax allowable depreciation $31m Capital investment in year $48m Corporate debt $14m trading at 130% Corporate tax is 30% The WACC is 16.6%. Inflation is 6%. These cash flows are expected to continue every year for the foreseeable future. Required: 1. Calculate the value of equity. 2. Critically discuss the Advantages and disadvantages of Discounted Cash Flow Basis Method.arrow_forwardThe First National Bank of Trinidad reports a net interest margin of 5.83 percent. It has total interestrevenues of $275 million and total interest expenses of $210 million. This bank has earnings assetsof $1,115. Suppose this bank's interest revenues rise by 8 percent and its interest expenses andearnings assets rise by 10 percent what is this bank's new net interest margin?A. 5.83 percentB. 7.09 percentC. 3.59 percentD. 5.38 percentarrow_forward

- Bank Three has equity = $250 million, return on equity (ROE) = 15%, interest expense = $105 million, provision for loans (P) = $30 million, noninterest income = $45 million, noninterest expense = $20 million and a tax rate = : 34%. What is the total interest income required? A. $216.82 million. B. $236.82 million. C. $146.82 million. D. $166.82 million.arrow_forwardA company issues $1.1 million of new stock and pays $201,000 in cash dividends during the year. In addition, the company took advantage of falling interest rates to borrow $1.51 million in a new bond issue and paid off existing bonds with a face value of $2.05 million. The company bought 501 of another company's $1,010 bonds at a $101,000 premium. The net cash flow provided by financing activities is: A) An outflow of $201,000. B) An inflow of $359,000. C) An inflow of $540,000. D) An outflow of $101,000arrow_forwardA company issues $1.1 million of new stock and pays $201,000 in cash dividends during the year. In addition, the company took advantage of falling interest rates to borrow $1.51 million in a new bond issue and paid off existing bonds with a face value of $2.05 million. The company bought 501 of another company's $1,010 bonds at a $101,000 premium. The net cash flow provided by financing activities is: A) An outflow of $201,000. B) An inflow of $359,000. C) An inflow of $540,000. D) An outflow of $101,000 Garrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning