FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

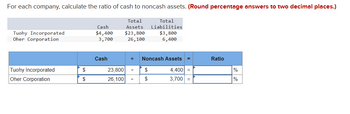

Transcribed Image Text:For each company, calculate the ratio of cash to noncash assets. (Round percentage answers to two decimal places.)

Total

Assets

$23,800

26,100

Tuohy Incorporated

Oher Corporation

Tuohy Incorporated

Oher Corporation

$

$

Cash

$4,400

3,700

Cash

23,800

26,100

÷

÷

=

Total

Liabilities

$

$

$3,800

6,400

Noncash Assets

4,400 =

3,700 =

Ratio

%

%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The following information pertains to Peak Heights Company: Income Statement for Current Year Sales $ 85,300 Expenses Cost of goods $ sold 51,675 Depreciation 8,100 expense Salaries 12,000 71,775 expense Net income $ 13,525 Partial Balance Prior Sheet Current year year Accounts $ $ 9,900 receivable 14,400 Inventory 13,700 8,300 Salaries payable 1,550 850 Required: Present the operating activities section of the statement of cash flows for Peak Heights Company using the indirect method. Note: List cash outflows as negative amounts. PEAK HEIGHTS COMPANY Statement of Cash Flows (Partial) Cash flows from operating activities: Accounts receivable increasearrow_forwardVictor Corporation's comparative balance sheet for current assets and liabilities was as follows: Line Item Description Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $13,400 $12,800 Inventory 57,300 58,000 Accounts payable 13,600 11,800 Dividends payable 29,000 27,000 Adjust net income of $123,400 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.fill in the blank 1 of 1$arrow_forwardusing the income statement for chester corp below, what is operating cash flow (OCF) for the company? sales- 925,000 COGS- 458,000 Dep Exp- 195,000 EBIT- 272,000 Int exp- 55,800 EBT- 216,200 Taxes- 45,402 NI- 170,798arrow_forward

- Cash Flow RatiosSpencer Company reports the following amounts in its annual financial statements: Cash flow from operating activities $90,000 Capital expenditures $59,500* Cash flow from investing activities (68,000) Average current assets 136,000 Cash flow from financing activities (8,500) Average current liabilities 102,000 Net income 42,500 Total assets 255,000 * This amount is a cash outflowa. Compute Spencer's free cash flow.b. Compute Spencer's operating-cash-flow-to-current-liabilities ratio.c. Compute Spencer's operating-cash-flow-to-capital-expenditures ratio. Round ratios to two decimal points. a. Free cash flow Answer b. Operating-cash-flow-to-current-liabilities ratio Answer c. Operating-cash-flow-to-current-expenditures ratio Answerarrow_forwardYou are provided the following working capital information for the Ridge Company: Account Inventory $ $12,890 Accounts receivable 12,800 Accounts payable 12,670 Net sales $124,589 99,630 Cost of goods sold What is the cash conversion cycle for Ridge Company? a. 38.3 days b. 129.9 days c. 83.5 days d. 46.4 daysarrow_forwardYou are given the following income statement and balance sheet: Income Statement Sales EBT Taxes (40%) Net Income Cash A/R Inventories Total CA Fixed Assets Total Assets $15,000 $800 $320 $480 Balance Sheet $100 $2,000 $4.000 Accounts Payable Debt Common Stock Retained Eamings $6,100 $1,900 $8,000 Total Claims $1,000 $4,000 $2,000 $1,000 $8,000 Now make the following forecast and assumptions for the upcoming year: Sales are expected to increase by $5.400 over the coming year. All assets and accounts payable can be expressed as a percentage of sales. The firm's profit margin will remain at 3.2 percent. The firm has a dividend payout rate of 75 percent. Using the equation method, determine the additional funds needed for the coming yeaarrow_forward

- Mazaya Company has the following information available: Net Income R.O. 55,000; Cash Provided by Operations R.O. 68,200; Cash Sales R.O. 143,000; Capital Expenditures R.O.24,200; Dividends Paid R.O. 6,600. What is Mazaya's free cash flow? Select one: a. R.O.61,600 b. R.O.37,400 c R.O.44,000 d. R.O.24,200arrow_forwardThe following data apply to the next six problems. Consider Fisher & Company's financial data as follows (unit: millions of dollars except ratio figures):Cash and marketable securities $100Fixed assets $280Sales $1,200Net income $358Inventory $180Current ratio 3.2Average collection period 45 daysAverage common equity $500 Calculate the amount of current assets.(a) $223 (b) $248(c) $280 (d) $428arrow_forwardCash Flow RatiosSpencer Company reports the following amounts in its annual financial statements: Cash flow from operating activities $65,000 Capital expenditures $42,000* Cash flow from investing activities (48,000) Average current assets 96,000 Cash flow from financing activities (6,000) Average current liabilities 72,000 Net income 30,000 Total assets 180,000 * This amount is a cash outflowa. Compute Spencer's free cash flow.b. Compute Spencer's operating-cash-flow-to-current-liabilities ratio.c. Compute Spencer's operating-cash-flow-to-capital-expenditures ratio. Round ratios to two decimal points. a. Free cash flow Answer b. Operating-cash-flow-to-current-liabilities ratio Answer c. Operating-cash-flow-to-current-expenditures ratio Answerarrow_forward

- Niantic reported the following financial information (amounts in millions). $ 8,550 11,977 950 4,900 201 Current assets Total assets Current liabilities Net sales Net Income Compute the current ratio and profit margin. Note: Round your answers to 2 decimal places. Current ratio Profit margin %arrow_forward(in millions) Net Income Total Assets Total Liabilities Total RevenuesExpedia $ 723 $ 15,504 $ 10,574 $ 6,672Priceline 2,551 17,421 8,625 9,224How would I figure out the net profit margin for thesearrow_forwardcalculate the following ratiosarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education