Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

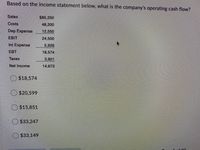

Transcribed Image Text:Based on the income statement below, what is the company's operating cash flow?

Sales

$85,250

Costs

48,200

Dep Expense

12,550

EBIT

24,500

Int Expense

5,926

EBT

18,574

Taxes

3,901

Net Income

14,673

$18,574

O$20,599

$15,851

O $33,247

$33,149

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following information pertains to Peak Heights Company: Income Statement for Current Year Sales $ 85,300 Expenses Cost of goods $ sold 51,675 Depreciation 8,100 expense Salaries 12,000 71,775 expense Net income $ 13,525 Partial Balance Prior Sheet Current year year Accounts $ $ 9,900 receivable 14,400 Inventory 13,700 8,300 Salaries payable 1,550 850 Required: Present the operating activities section of the statement of cash flows for Peak Heights Company using the indirect method. Note: List cash outflows as negative amounts. PEAK HEIGHTS COMPANY Statement of Cash Flows (Partial) Cash flows from operating activities: Accounts receivable increasearrow_forwardusing the income statement for chester corp below, what is operating cash flow (OCF) for the company? sales- 925,000 COGS- 458,000 Dep Exp- 195,000 EBIT- 272,000 Int exp- 55,800 EBT- 216,200 Taxes- 45,402 NI- 170,798arrow_forwardWhat is the Total Asset Turnover Ratio for a company with $120,000 in annual sales, beginning Assets of $250,000 and ending Assets of $200,000? .48 1.34 .26 .53 please give the correct answswer but only one is right.e xplain the correct naswer The efficiency ratio that shows how efficiently a company uses its cash to generate revenue is: Accounts Receivable Turnover Ratio. Total Asset Receivable Turnover Ratio. Cash Turnover Ratio. Inventory Turnover Ratio. please give the correct answswer but only one is right.e xplain the correct naswerarrow_forward

- 10. Umlauf Corporation had $237,190 of net operating cash inflows, total cash inflows of $866,010 and average total assets of $4,865,225. Its cash flow on total assets was: O A. 4.9% В. 17.8% ОС. 20.5% OD. 48.8% O E. 95.1%arrow_forwardMoby Dick Corporation has sales of $4,920,229; income tax of $574,192; the selling, general and administrative expenses of $265,391; depreciation of $374,888; cost of goods sold of $2,777,705; and interest expense of $195,023. Calculate the amount of the firm’s after-tax cash flow from operations?arrow_forwardOgden Corporation has a projected balance sheet that includes the following accounts. What is the projected cash balance? Cash $ ? Marketable securities 405,000 Accounts receivable 980,000 Inventory 785,000 Non-current assets, net 2,110,000 Total liabilities 1,636,000 Total equity 3,220,000arrow_forward

- Large Company $ Net sales 379,420 163,100 216,320 Cost of sales Gross profit Selling, general, and administrative $ 146,610 expenses Operating income $ 69,720 Net income 41,610 50,480 Cash and cash equivalents Net receivables 17,400 Inventories 223,430 315,160 Total current assets Property and equipment 81,880 Other assets 66,040 Total assets 463,090 29,540 Accounts payable Stockholder equity 261,130 What is the value of C2C in weeks? (Choose the closest) 31.47 -12.81 -5.82 64.20 4.arrow_forwardCost of goods sold: Investment income: Net sales: Operating expense: Interest expense: Dividends: Tax rate: Current liabilities: Cash: Long-term debt: Other assets: Fixed assets: Other liabilities: Investments: Operating assets: $ 169,000 $ 1,300 $ 282,000 $ 44,000 Book value per share Earnings per share Cash flow per share $ 7,400 $5,000 21% $ 22,000 $ 21,000 $ 92,000 $ 37,000 $ 120,000 $ 6,000 $ 33,000 $ 64,000 During the year, Smashville, Incorporated, had 20,000 shares of stock outstanding and depreciation expense of $15,000. Calculate the book value per share, earnings per share, and cash flow per share. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. $ 7.75arrow_forwardconsider a company with sales of $18,000.0 million, cost of goods sold of 42% of sales, other expenses including salaries ( we usually call this SG&A for selling, general and administrative) of 1750.0million, depreciation of 2250.0 million, and interest expense of 2300 million. tax rate =21%. a. generate an income statement and show net income b. what is the company's operating cash flow? c. if there are 775.2 million shares outstanding, what is the EPS? d. if the company has a payout ratio of 20%, what is the dividends per share?arrow_forward

- Presented below is the income statement of Coming Company: Sales Cost of goods sold Gross profit Operating expenses Income before income taxes $305,000 180,000 $125,000 68,000 57,000 21,400 $35,600 Income taxes Net income In addition, the following information related to net changes in working capital is presented: Cash Accounts receivable Inventories Salaries payable (operating expenses) Accounts payable Income tax payable Debit $9,600 10,000 $15,620 6,400 9,500 2,400 Credit The company also indicates that depreciation expense for the year was $12,360 and that the deferred tax liability account increased $3,080. Required: (a) Compute the net cash flow from operating activities that would be shown on a statement of cash flows using the indirect method. (b) Compute the net cash flow from operating activities that would be shown on a statement of cash flows using the direct method. P47 PPT (c) State the major difference between the two methods in handling statement of cash flows.arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education