FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need help

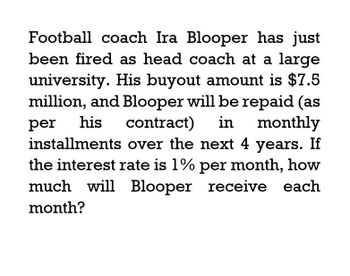

Transcribed Image Text:Football coach Ira Blooper has just

been fired as head coach at a large

university. His buyout amount is $7.5

million, and Blooper will be repaid (as

per his contract) in monthly

installments over the next 4 years. If

the interest rate is 1% per month, how

much will Blooper receive each

month?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Football coach Ira Blooper has just been fired as head coach at a large university. His buyout amount is $7.5 million, and Blooper will be repaid (as per his contract) in monthly installments over the next four years. If the interest rate is 1% per month, how much will Blooper receive each month?arrow_forwardHow much will blooper receive each month?arrow_forwardTim is retiring from his job soon at which time his employer willmake the following offer:1. A lumpsum amount of $200,0002. A sum of $15,000 at the beginning of each year for the next 25years.If the average interest rate is likely to be 5.5% p.a. for the next25 years, which option should Tim choose?arrow_forward

- Tommy is retiring from his job soon at which time his employer willmake the following offer:1. A lumpsum amount of $200,0002. A sum of $15,000 at the beginning of each year for the next 25years.If the average interest rate is likely to be 5.5% p.a. for the next25 years, which option should Timothy choose?arrow_forwardFord Motor Company is considering an early retirement buyout package for some employees. The package involves paying out today's fair value of the employee's final year of salary. Shelby is due to retire in one year. Her salary is at the company maximum of $72,000. If prevailing interest rates are 6.75% compounded monthly, what buyout amount should Ford offer to Shelby todayarrow_forwardLuis has $140,000 in his retirement account at his present company. Because he is assuming a position with another company, Luis is planning to "roll over" his assets to a new account. Luis also plans to put $3000/quarter into the new account until his retirement 25 years from now. If the new account earns interest at the rate of 2.5%/year compounded quarterly, how much will Luis have in his account at the time of his retirement? Hint: Use the compoundarrow_forward

- Carl Hightop, a popular basketball player, has been offered a four-year salary deal. He can either accept $4,000,000 now or accept monthly amounts of $90,000 payable at the end of each month. If money can be invested at 3.4% compounded quarterly, which option is the better option for Carl and by how much?arrow_forwardEarl Miller, owner of a Papa Gino’s franchise, wants to buy a new delivery truck in 6 years. He estimates the truck will cost $30,000. If Earl invests $20,000 now at 5% interest compounded semiannually. How much more or less will Earl have for the truck at the end of 6 years? (Round your answers to the nearest cent.)arrow_forwardTimothy is retiring from his job soon at which time his employer will make the following offer: A lump sum amount of $200,000 A sum of $15,000 at the beginning of each month for the next 25 years. If the average interest rate is likely to be 5.5% p.a. for the next 25 years, which option should Timothy choose? Show working without using spreadsheet compuations.arrow_forward

- Timothy is retiring from his job soon at which time his employer will make the following offer: A lump sum amount of $200,000 A sum of $15,000 at the beginning of each month for the next 25 years. If the average interest rate is likely to be 5.5% p.a. for the next 25 years, which option should Timothy choose?arrow_forwardAssume that you will have a 10-year, $10,000 loan to repay to your parents when you graduatefrom college next month. The loan, plus 8 percent annual interest on the unpaid balance, is to berepaid in 10 annual installments of $1,490 each, beginning one year after you graduate. You haveaccepted a well-paying job and are considering an early settlement of the entire unpaid balance injust three years (immediately after making the third annual payment of $1,490).Prepare an amortization schedule showing how much money you will need to save to pay yourparents the entire unpaid balance of your loan three years after your graduation. (Round amountsto the nearest dollar.)arrow_forwardLuis has $170,000 in his retirement account at his present company. Because he is assuming a position with another company, Luis is planning to "roll over" his assets to a new account. Luis also plans to put $3000/quarter into the new account until his retirement 30 years from now. If the new account earns interest at the rate of 4.5%/year compounded quarterly, how much will Luis have in his account at the time of his retirement? (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education