Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Need help

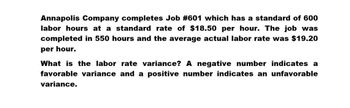

Transcribed Image Text:Annapolis Company completes Job #601 which has a standard of 600

labor hours at a standard rate of $18.50 per hour. The job was

completed in 550 hours and the average actual labor rate was $19.20

per hour.

What is the labor rate variance? A negative number indicates a

favorable variance and a positive number indicates an unfavorable

variance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Accounting Annapolis company completed job #601 which has a standard of 650arrow_forwardThe standard number of hours that should have been worked for the output attained is 6,000 direct labor hours and the actual number of direct labor hours worked was 6,300. If the direct labor price variance was $3,150 unfavorable, and the standard rate of pay was $9 per direct labor hour, what was the actual rate of pay for direct labor? Select one: a. $7.50 per direct labor hour b. $8.50 per direct labor hour c. $9.50 per direct labor hour d. $9.00 per direct labor hour e. $9.80 per direct labor hourarrow_forwardFor a simple regression analysis model that is used to allocate factory overhead, an internal auditor finds that the intersection of the line of best fit for the overhead allocation with the y-axis is $14,000. The slope of the line is 0.2. The independent variable, factory wages, amounts to $810,000 for the month. What is the estimated amount of factory overhead to be allocated for the month? Multiple Choice $289,400. $162.000. $68,000. $88,000.arrow_forward

- The standard number of hours that should have been worked for the output attained is 6,000 direct labor hours and the actual number of direct labor hours worked was 6,300. If the direct labor price variance was $3,145 unfavorable, and the standard rate of pay was $9 per direct labor hour, what was the actual rate of pay for direct labor? Do not round intermediate calculations and round your answer to 2 decimal places.arrow_forwardNeed help. accountingarrow_forwardStandard time allowed to complete one unit is 2 hours. A worker during a week (48 hours) completed 20 units and drawn a salary of Rs. 6000. The standard rate per day of 8 hours shift is Rs. 1000. Which one of the following is true? A.Labour efficiency variance is Zero B.Labour rate variance is zero C.Labour cost variance is zero D.None of the abovearrow_forward

- Provide correct answer. accountingarrow_forwardA company shows a $24,000 unfavorable direct labor rate variance and a $18,000unfavorable direct labor efficiency variance. The company's standard cost of direct labor is $370,000. What is the actual cost of direct labor? Actual cost of direct laborarrow_forwardBeverly Company has determined a standard variable overhead rate of $3.90 per direct labor hour and expects to incur 0.50 labor hour per unit produced. Last month, Beverly incurred 1,650 actual direct labor hours in the production of 3,400 units. The company has also determined that its actual variable overhead rate is $2.40 per direct labor hour. Calculate the variable overhead rate and effeciency variances as well as the total amount of over-or underapplied variable overhead. . Variable Overhead Rate Variance=2,475 Favorable Variable Overhead Effeciency Variance=195 Favorable Variable Overhead Cost Variance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,