FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

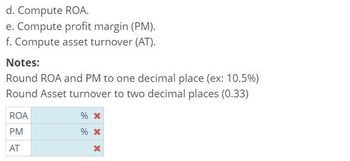

Transcribed Image Text:d. Compute ROA.

e. Compute profit margin (PM).

f. Compute asset turnover (AT).

Notes:

Round ROA and PM to one decimal place (ex: 10.5%)

Round Asset turnover to two decimal places (0.33)

ROA

PM

AT

% *

% *

X

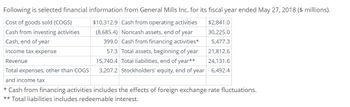

Transcribed Image Text:Following is selected financial information from General Mills Inc. for its fiscal year ended May 27, 2018 ($ millions).

Cost of goods sold (COGS)

$10,312.9 Cash from operating activities

(8,685.4) Noncash assets, end of year

Cash from investing activities

Cash, end of year

399.0 Cash from financing activities*

57.3 Total assets, beginning of year

Income tax expense

Revenue

15,740.4 Total liabilities, end of year**

Total expenses, other than COGS

3,207.2 Stockholders' equity, end of year

and income tax

$2,841.0

30,225.0

5,477.3

21,812.6

24,131.6

6,492.4

* Cash from financing activities includes the effects of foreign exchange rate fluctuations.

** Total liabilities includes redeemable interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 450,600 298,350 152,250 99,300 4,500 Cost of goods sold Gross profit Operating expenses Interest expense. Income before taxes Income tax expense Net income $ 10,000 Accounts payable Accrued wages payable 9,200 31,400 Income taxes payable 30,150 Long-term note payable, secured by mortgage on plant assets 3,050 Common stock 152,300 Retained earnings $ 236,100 Total liabilities and equity CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity 48,450 19,518 $ 28,932 $ 17,500 3,800 4,700 69,400 88,000 52,700 $ 236,100 Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total…arrow_forwardSimon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity For Year Ended December 31 Sales Cost of goods sold Other operating expenses Current Year $ 31,800 89,500 112,500. 10,700 278,500 $ 523,000 Interest expense Income tax expense Total costs and expenses Net income. Earnings per share $ 129,900 98,500 163,500 131,100 $ 523,000 Current Year $ 411,225 209,550 1 Year Ago $ 35,625 62,500 82,500 9,375 255,000 $ 445,000 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: 4 12,100 9,525 $ 75,250 101,500 163,500 104,750 $ 445,000 $ 673,500 2 Years Ago 642,400 $ 31,100 $ 1.90 $ 37,800 50,200 54,000 5,000 230,500 $ 377,500 $51,250 83,500 163,500 79,250 $ 377,500 1 Year Ago $ 345,500…arrow_forwardCABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 297,150 151,450 98,600 5,000 47,850 19,276 $ 28,574 Cost of goods sold Gross profit Operating expenses Interest expense Profit before taxes Income tax expense Net profit Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Property, plant and equipment, net Total assets Req 1 and 2 Req 3 Req 4 CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity Req 5 8,000 Accounts payable 8,800 Accrued wages payable 32,400 Income taxes payable 2,750 Share capital 150,300 Retained earnings $ 238,400 Total liabilities and equity Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio. 36,150 Long-term note payable, secured by mortgage on property, plant and equipment Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days'…arrow_forward

- Use the appropriate information from the data provided below to calculate operating income for the year ended December 31, 2014. Cost of Goods Sold 117,000 Inventory 125,000 General & Administrative Expenses 48,000 Net Cash Provided from Financing Activities 48,000 Dividends Paid 16,000 Net Sales 278,000 Selling & Marketing Expense 65,000 Interest Expense 23,000 Income Tax Expense 7,500arrow_forwardSelected balance sheet information and the income statement for Pioneer Industries for the current year are presented below. Selected Balance Sheet Accounts Accounts Receivable Prior Year Current Year $ 24,000 $ 16,000 Inventory 32,000 35,200 Prepaid Rent 1,600 0 Accounts Payable 17,600 22,400 Salaries and Wages 3,200 4,800 Payable 04:23 Depreciation Expense Salaries Expense Income Statement Sales Revenue $ 480,000 Expenses: Cost of Goods Sold 288,000 32,000 48,000 19,200 19,200 17,600 16,000 $ 40,000 Rent Expense Insurance Expense Interest Expense Utilities Expense Net Income Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. (Enter any deductions and cash outflows as a negative value.) Pioneer Industries Cash Flows from Operating Activities Adjustments to reconcile net income to net cash provided by operating activities: Changes in current assets and current liabilities: $ 0arrow_forwardThe following information relates to SE10-5 through SE10-7: (in millions) Net sales... Cost of goods sold SE10-7. Gross profit. Selling and administrative expenses Income from operations Interest expense.. EVANS & SONS, INC. Income Statement For Years Ended December 31, 2019 and 2018 Income before income taxes Income tax expense. Net income (in millions) Assets Current assets Cash and cash equivalents Accounts receivable Inventory.. Other current assets. Total current assets Property, plant, & equipment (net) Other assets. Total Assets Liabilities and Stockholders' Equity Current liabilities. Long-term liabilities. Total liabilities.. EVANS & SONS, INC. Balance Sheet December 31, 2019 and 2018 Stockholders' equity - common. Total Liabilities and Stockholders' Equity.. 2019 9,800 (5,500) 4,300 (2,800) 1,500 (300) $ 1,200 2019 100 900 500 400 2018 1,900 2,600 5,700 $10,200 9,300 (5,200) 4,100 (2,700) (220) (200) $980 $950 1,400 $ (250) 1,150 2018 300 800 650 250 2,000 2,500 5,900 $10,400…arrow_forward

- Below is financial information ($ values are in millions) in a model. Net income during the year for this company would be: Revenues SG&A Expenses Interest Expense Select one: OA. $4.5 million OB. $3.6 million O C. $16.6 million OD. $0.9 million $67.30 $4.70 $8.10 Cost of Goods Sold Depreciation Tax Rate $43.20 $6.80 20%arrow_forwardRequired information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity For Year Ended December 31 Sales Cost of goods sold Other operating expenses Current Year 1 Year Ago $ 31,099 $ 26,605 89, 200 114,500 62,900 85,000 8,568 221, 258 8,163 209,503 $ 460, 131 $ 396,665 Interest expense Income tax expense Total costs and expenses Net income Earnings per share $ 112,281 84,775 162,500 100,575 $ 460,131 $ 396,665 $ 65,696 89,408 162,500 79, 061 Current Year The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: $364,884 185,433 10, 169 7,776 $598,170 2 Years Ago 568, 262 $ 29,908 $ 1.84 $ 32,725 50,800…arrow_forwardNet sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets Total stockholders' equity Current liabilities Target Corporation Income Statement Data for Year $65,357 45,583 15,101 707 (94) 1,384 $ 2,488 $18,424 26,109 Balance Sheet Data (End of Year) $44,533 $11,327 17,859 15,347 Walmart Inc. $44,533 $408,214 304,657 79,607 10,512 2,065 (411) 7,139 $ 14,335 $48,331 122,375 $170,706 $55,561 44,089 71,056 $170,706 Beginning-of-Year Balances $44,106 13,712 $163,429 65,682 55,390arrow_forward

- Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes. Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Sin Comparative Income Statements For Years Ended December 31 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity Assets Current assets Long-term investments Plant assets, net. Total assets Liabilities and Equity Current liabaties Common stock Other paid-in capital Retained earnings Total liabilities and equity 2020 $ 321,775 202,718 KORBIN COMPANY Comparative Balance Sheets December 31 2021 119,057 44,405 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as answers to 2 decimal places.) 111.77 % 0.00 $ 37,003 700…arrow_forwardRefer to the following selected financial information from Texas Electronics. Compute the company's accounts receivable turnover for Year 2. Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold Year 2 Year 1 $ 38,300 $ 33,050 98,000 64,000 89,500 83,500 125,000 129,000 12,900 10,500 392,000 342,000 109,400 111,800 715,000 680,000 394,000 379,000arrow_forwardCrane Ltd. reported the following for the fiscal year 2021: Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Gain on sale of land Profit before income tax Income tax expense Profit Additional information: 1. 2. CRANE LTD. Income Statement Year Ended September 30, 2021 3. 4. 5. 6. $ 109,000 34,000 (44,000) $583,000 338,000 245,000 99,000 146,000 36,500 $109,500 Accounts receivable decreased by $16,300 during the year. Inventory increased by $7,800 during the year. Prepaid expenses decreased by $5,800 during the year. Accounts payable to suppliers increased by $11,300 during the year. Accrued expenses payable increased by $5,300 during the year. Income tax payable decreased by $7,100 during the year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education