FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

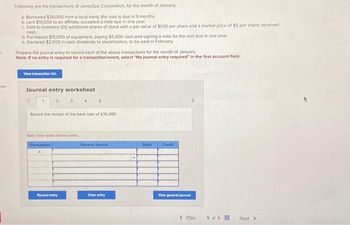

Transcribed Image Text:Following are the transactions of JonesSpa Corporation, for the month of January.

a Borrowed $30,000 from a local bank; the loan is due in 9 months.

b. Lent $10,000 to an affiliate; accepted a note due in one year.

c. Sold to investors 100 additional shares of stock with a par value of $0.10 per share and a market price of $5 per share; received

cash.

d. Purchased $15,000 of equipment, paying $5,000 cash and signing a note for the rest due in one year.

e. Declared $2,000 in cash dividends to stockholders, to be paid in February.

Prepare the journal entry to record each of the above transactions for the month of January,

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

Record the receipt of the bank loan of $30,000.

Note: Enter debits before credits

Transaction

5

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

< Prev

5 of 9

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During Year 11, Pacilio Security Services experienced the following transactions: Paid the sales tax payable from Year 10. Paid the balance of the payroll liabilities due for Year 10 (federal income tax, FICA taxes, and unemployment taxes). Issued 5,000 additional shares of the $5 par value common stock for $8 per share. Issued 1,000 shares of $50 stated value, 5 percent cumulative preferred stock for $52 per share. Purchased $500 of supplies on account. Purchased 190 alarm systems at a cost of $310. Cash was paid for the purchase. After numerous attempts to collect from customers, wrote off $3,670 of uncollectible accounts receivable. Sold 210 alarm systems for $600 each plus sales tax of 5 percent. All sales were on account. Record the cost of goods sold related to the sale from Event 8 using the FIFO method. Billed $125,000 of monitoring services for the year. Credit card sales amounted to $58,000, and the credit card company charged a 4 percent fee. The remaining $67,000 were…arrow_forwardPrepare Hertog Company's journal entries to record the following transactions for the current year. May 7 Purchases Kraft bonds as a short-term investment in trading securities at a cost of $10,990. June 6 Sells its entire investment in Kraft bonds for $11,510 cash. View transaction list Journal entry worksheet 1 2 Purchases Kraft bonds as a short-term investment in trading securities at a cost of $10,990. Note: Enter debits before credits. Date May 07 Record entry General Journal Clear entry Debit Credit View general journal >arrow_forwardOn January 1, Jim Shorts Corporation issued bonds for $580 million. This bond issue was originally issued at premium. During the same year, $1,500,000 of the bond premium was amortized. On a statement of cash flows prepared using the indirect method, Jim Shorts Corporation should report: O that $1.5 million to be added to net income O An investing activity of $580 million. O A financing activity of $300 million. O that $1.5 million to be deducted from net incomearrow_forward

- A company issues 20,000 common shares for $15 each. Later in the year, the same company issues another 35,000 common shares for $27 each. Two weeks later, it repurchases 5,000 shares for 19 per share. The entry to record the repurchase would be which of the following? Debit Cash for $95,000 & Contributed Capital - Retirement of Common Shares for $18,200, credit Common Shares for $113,200. Debit Common Shares for $95,000 & Retained Earnings for $18,200, credit Cash for $113,200. Debit Common Shares for $95,000, credit Cash for $95,000. Debit Common Shares for $113,200, credit Contributed Capital - Retirement of Common Shares for $18,200 & Cash for $95,000.arrow_forwardThe following transactions occurred last year at Jost Company: Issuance of shares of the company’s own common stock $170,000 ; Dividends paid to the company’s own shareholders $7,000; Dividends received from investments in other companies’ shares $4,000; Interest paid on the company’s own bonds $11,000; Repayment of principal on the company’s own bonds $40,000; Proceeds from sale of the company’s used equipment $23,000; Purchase of land $120,000 . Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows would be: a.$112,000 b. $123,000 c. $375,000 d. $19,000arrow_forwardBinomial Tree Farm's financing includes $5 million of bank loans. Its common equity is shown in Binomial's Annual Report at $6.67 million. It has 500,000 shares of common stock outstanding, which trade on the Wichita Stock Exchange at $18 per share. What debt ratio should Binomial use to calculate its company cost of capital or asset beta? Note: Enter your answer as a percent rounded to 2 decimal places. Debt ratio %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education