FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

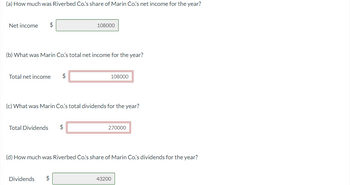

Transcribed Image Text:(a) How much was Riverbed Co.'s share of Marin Co's net income for the year?

Net income

$

(b) What was Marin Co's total net income for the year?

Total net income $

108000

Total Dividends $

(c) What was Marin Co's total dividends for the year?

Dividends $

108000

270000

(d) How much was Riverbed Co.'s share of Marin Co's dividends for the year?

43200

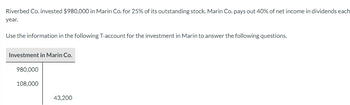

Transcribed Image Text:Riverbed Co. invested $980,000 in Marin Co. for 25% of its outstanding stock. Marin Co. pays out 40% of net income in dividends each

year.

Use the information in the following T-account for the investment in Marin to answer the following questions.

Investment in Marin Co.

980,000

108,000

43,200

Expert Solution

arrow_forward

Step 1

Calculation of above requirement are as follows

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For this question, please refer to the Fact Pattern below (Same fact pattern as previous question). Given the set of transactions above, what was Adjusted EBITDA in 2021? O $1,107.2 O $1,082.2. O $1,068.2 $1,092.2 Activities during the year: Capital expenditures Cost of Goods Sold (excluding D&A) Dividend Payout Ratio (dividends/ net income to common shareholders) Income Tax Net Interest Expense Net Revenues Non-controlling Interest Expense (After-Tax) Litigation Expense Other Operating Expenses (excluding D&A) Purchases of intangible assets Preferred dividends Research And Development (excluding D&A) Proceeds from sale of land with book value of $15 Selling, General, & Administrative (excluding D&A) Write-down of PP&E 2021 580.0 3,256.0 40% 35% 45.6 5,800.0 25.0 97.0 16.5 45.0 5.0 56.3 20.0 1,488.0 7.0arrow_forwardA-.Create the ratio of fixed assets to long-term liabilities B-. Create the ratio of liabilities to stockholders' equityarrow_forwardhow do I find the profarrow_forward

- Given the information below for ATH Corp., what was the amount of Dividends declared during the current period? Beginning Retained Earnings = $150,000. Increase in Cash = $40,000. Ending Retained Earnings = $250,000. Issuance of Common Stock = $50,000. Net Income = $250,000. Select one: a. $150,000 b. $60,000 c. $90,000 d. $200,000 e. $110,000arrow_forwardU6.arrow_forwardDetermine the following measures for 20Y2, rounding to one decimal place including, percentage, except for per-share amounts. 5. Number of days sales in receivables 7. number of days sale in inventory 12. return on total asset 14. return on common stockholders equity 17. dividends per share of common stock 18. dividend yield i need help on these questions i have provided please please pleasearrow_forward

- Wildwood, Inc. reports net income of $160,000, net sales of $380,000, average total assets of $940,000 and average total liabilities of $450,000. Calculate return on equity. a. 17.0% b. 32.7% c. 35.6% d. 77.6%arrow_forwardUsing the table below create SinCo's Income Statement and Balance Sheet for the Prior Year and Current Year, and then answer the questions that are below. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Prior Year Current Year Revenue $4,000 4431 Cost of Good Sold 1,600 1,861 Depreciation 500 534 Inventory 300 335 SG&A 500 573 Interest Expenses 150 177 Common Stock and Paid-in Capital 2,200 2,200 Federal and State Taxes (35% of EBT) 400 Accounts Payable 300 317 Accounts Receivable 400 455 Net Fixed Assets 5,000 5305 Retained Earnings (Balance Sheet) 1,000 Long-Term Debt 2,000 2661 Notes Payable 1,000 888 Dividends Paid 410 410 Cash 800 Income Statement Questions: What is SinCo's EBITDA for the current year? What is SinCo's EBIT for the current year? What is SinCo's Net Income for the current year? Balance Sheet Questions: What is SinCo's current year's Retained Earnings…arrow_forwardGiven the following information, what is the common-size growth in net income between Year 1 and Year 2? Yr1 Yr2 Sales $13,500 $15,000 COGS 8,100 9,000 Depreciation 1,200 1,500 Interest 1,000 1,100 Tax rate 35% 35% Dividend ratio 30% 30%arrow_forward

- Return on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $157,080 Interest expense 27,720 Average total assets 2,800,000 Determine the return on total assets? If required, round the answer to one decimal place.arrow_forwardRequired Assume that Taco Bell company reported operating income of $5.15 million, $0.7 million in other income and gains (except equity earnings), $1.65 million in other expenses and losses, and a tax rate of 40%. 1. Using the information given above for Wendy's company, what is the net income of the company? * O A) $2.925 million O B) $2.52 million C) $1.65 million D) $4.2 million E) None of the above Back Next Page 6 of 8 Clear formarrow_forwardA company reports earnings per share on common stock of $2.00 when the market price of per share of common stock is $50.000. What is the company’s price-earnings ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education