FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

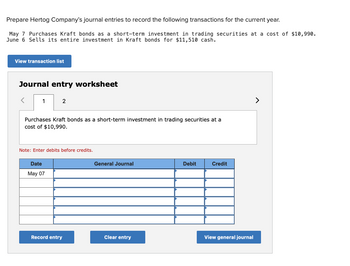

Transcribed Image Text:Prepare Hertog Company's journal entries to record the following transactions for the current year.

May 7 Purchases Kraft bonds as a short-term investment in trading securities at a cost of $10,990.

June 6 Sells its entire investment in Kraft bonds for $11,510 cash.

View transaction list

Journal entry worksheet

1

2

Purchases Kraft bonds as a short-term investment in trading securities at a

cost of $10,990.

Note: Enter debits before credits.

Date

May 07

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

>

Expert Solution

arrow_forward

Step 1

Short-term investments refer to highly liquid investments that have been made with the intention to convert into cash within twelve months of acquisition. Common short-term investments include certificates of deposits, treasury bills, municipal bonds, and so on. These investments have lower rates of returns, however, they have lower risk associated with them, which makes them an attractive investment.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare Natura Company's journal entries to record the following transactions involving its short-term investments in held-to-maturity debt securities, all of which occurred during the current year. a. On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. b. On September 16, received a check from Remed in payment of the principal and 90 days' interest on the debt securities purchased in transaction a. Note: Use 360 days in a year. Do not round your intermediate calculations. View transaction list Journal entry worksheet < 1 2 On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardAssume that on July 1, Jerome, Incorporated, paid $100,000 to buy Potter's 8 percent, two-year bonds with a $ bonds pay interest semiannually on December 31 and June 30. Jerome intends to hold the bonds until they ma Complete the necessary December 31 entry to record receipt of interest by selecting the account names from and entering dollar amounts in the debit and credit columns. View transaction list Journal entry worksheet 1 Assume that on July 1, Jerome, Inc., paid $100,000 to buy Potter's 8 percent, two-year bonds with a $100,000 par value. The bonds pay interest semiannually on December 31 and June 30. Jerome intends to hold the bonds until they mature. Complete the necessary December 31 entry to record Note: Enter debits before credits. Date Dec. 31 General Journal Debit Creditarrow_forwardCampbell, Inc. produces and sells outdoor equipment. On July 1, Year 1. Campbell issued $25,000,000 of 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving cash of $26,625,925. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds.* 2. Journalize the entries to record the following:* a. The first semiannual interest payment on December 31, Year 1, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) b. The interest payment on June 30, Year 2, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) 3. Determine the total interest expense for Year 1. *Refer to the Chart of Accounts for exact wording of account titlesarrow_forward

- On the first day of the fiscal year, a company issues a $8,300,000, 10%, 8-year bond that pays semiannual interest of $415,000 ($8,300,000 × 10% × ½), receiving cash of $9,267,140. Journalize the first interest payment and the amortization of the related bond premium, round to the nearest dollar. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardAssume that on July 1, Jerome, Inc., paid $100,000 to buy Potter's 8 percent, two-year bonds with a $100,000 par value. The bonds pay interest semiannually on December 31 and June 30. Jerome intends to hold the bonds until they mature. Complete the necessary December 31 entry to record receipt of interest by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.arrow_forwardDoyle Company issued $362,000 of 10-year, 5 percent bonds on January 1, Year 1. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was leased for an annual $52, 500 of cash revenue, which was collected on December 31 of each year, beginning December 31, Year 1. Journal entry worksheet Note: Enter debits before credits. 4 Date Dec 31 5 ü 6 Record the interest expense for bonds payable for Year 2. General Journal C 7 8 Debit Credit >arrow_forward

- 1.Prepare Hertog Company’s journal entries to record the following transactions for the current year. May 7 Purchases Kraft bonds as a short-term investment in trading securities at a cost of $10,830. June 6 Sells its entire investment in Kraft bonds for $11,330 casharrow_forwardOn May 1, Knox Inc. purchases $100,000 of 10-year, 6% Madison Corporation bonds dated March 1 at 100 plus accrued interest. Journalize the entry to record the bond purchasearrow_forwardShunda Corporation wholesales parts to appliance manufacturers. On January 1, Shunda issued $30,000,000 of five-year, 10% bonds at a market (effective) interest rate of 8%, receiving cash of $32,433,150. Interest is payable semiannually. Shunda’s fiscal year begins on January 1. The company uses the interest method. a. Journalize the entries to record the following: 1. Sale of the bonds. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Cash fill in the blank f63d02049fd306d_2 fill in the blank f63d02049fd306d_3 Premium on Bonds Payable fill in the blank f63d02049fd306d_5 fill in the blank f63d02049fd306d_6 Bonds Payable fill in the blank f63d02049fd306d_8 fill in the blank f63d02049fd306d_9 2. First semiannual interest payment, including amortization of premium. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense fill in the blank…arrow_forward

- Campbell Inc. produces and sells outdoor equipment. On July 1, 20Y1, Campbell issued $30,000,000 of 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving cash of $31,951,110. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, 20Y1.* 2. Journalize the entries to record the following:* a. The first semiannual interest payment on December 31, 20Y1, and the amortization of the bond premium, using the straight-line method. (Round to the nearest dollar.) b. The interest payment on June 30, 20Y2, and the amortization of the bond premium, using the straight-line method. (Round to the nearest dollar.) 3. Determine the total interest expense for 20Y1. 4. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is greater than the market rate of…arrow_forwardOn Jan. 1, Year 1, Foxcroft Inc. issued 90 bonds with a face value of $1,060 for $99,400. The bonds had a stated rate of 5% and paid interest semiannually. What is the journal entry to record the first payment to the bondholders? If an amount box does not require an entry, leave it blank. Jun. 30 Interest Expense Interest Expense Cash Casharrow_forwardGodoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education