FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

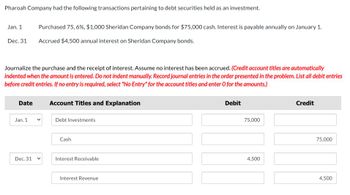

Transcribed Image Text:Pharoah Company had the following transactions pertaining to debt securities held as an investment.

Jan. 1

Dec. 31

Purchased 75, 6%, $1,000 Sheridan Company bonds for $75,000 cash. Interest is payable annually on January 1.

Accrued $4,500 annual interest on Sheridan Company bonds.

Journalize the purchase and the receipt of interest. Assume no interest has been accrued. (Credit account titles are automatically

indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries

before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date

Account Titles and Explanation

Jan. 1

Debt Investments

Cash

Dec. 31

Interest Receivable

Interest Revenue

Debit

75,000

4,500

Credit

75,000

4,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of the current season on April 1, the ledger of Riverbed's Discorama showed Cash $1,800, Inventory $2,400, and Owner's Capital $4,200. The following transactions were completed during April 2022. Apr. 5 7 9 10 12 14 17 20 21 27 30 Purchased golf discs, bags, and other inventory on account from Mumford Co. $1,200, FOB shipping point, terms 2/10, n/60. Paid freight on the Mumford purchase $50. Received credit from Mumford Co. for merchandise returned $100. Sold merchandise on account for $980, terms n/30. The merchandise sold had a cost of $588. Purchased disc golf shirts and other accessories on account from Saucer Sportswear $640, terms 1/10, n/30. Paid Mumford Co. in full, less discount. Received credit from Saucer Sportswear for merchandise returned $40. Made sales on account for $700, terms n/30. The cost of the merchandise sold was $400. Paid Saucer Sportswear in full, less discount. Granted an allowance to customers for clothing that did not fit $10. Received…arrow_forwardPlease do not give solution in image format ?arrow_forwardPronghorn Group has negotiated the purchase of a new piece of automatic equipment at a price of HK$6,160 plus trade-in, fo.b. factory. Pronghorn paid HK$6,160 cash and traded in used equipment. The used equipment had originally cost HK$54,560; it had a book value of HK$36,960 and a secondhand fair value of HK$40,320, as indicated by recent transactions involving similar equipment. Freight and installation charges for the new equipment required a cash payment of HK$960. (a) Your answer is correct. ress Prepare the general journal entry to record this transaction, assuming that the exchange has commercial substance. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. Include in your journal entry separate account entries for both the new and old equipment. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Account Titles and Explanation Equipment Accumulated Depreciation Equipment Equipment Cashi…arrow_forward

- Karanarrow_forwardOn August 1, 2021, the beginning of its current fiscal year, the following opening account balances, listed in alphabetical order, were reported by Sheridan Ltd. Accounts payable $2,330 Accounts receivable 4,470 Accumulated depreciation-equipment 1,990 Cash 6,190 Common shares 11,800 Deferred revenue 1,370 Equipment 11,000 Interest receivable 22 Note receivable, due October 31, 2021 4,400 Retained earnings 8,162 Salaries payable 1,540 Supplies 1,110 During August, the following summary transactions were completed. Aug. 1 Paid $410 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. (Hint: Use the Prepaid Advertising account.) 3 Paid August rent $400. (Hint: Use the Prepaid Rent account.) 6 Received $3,450 cash from customers in payment of accounts. 10 Paid $3,360 for salaries due employees, of which $1,820 is for August and $1,540 is for July salaries payable. 13 Received $3,850 cash for services performed…arrow_forwardPlease dont use any AI. It's strictly prohibited.arrow_forward

- Blossom Company purchases various types of beach toys for sale to consumers. Listed below are the transactions for the month of June. Blossom uses a perpetual inventory system. June 1 Purchased 25 water tubes for $260 each terms n/30 FOB destination. 8 Returned 4 tubes purchased on June 1 due to defects. Received a full refund for the defective tubes. 10 Freight charges of $100 for the June 1 transaction are paid by the responsible party. 11 Made a complaint about competitive pricing. Received a $400 credit for the water tubes purchased on June 1. 15 Purchased 110 water tubes for $235 each on account, terms 2/10 n/30. 18 Made payment for the amount owing for the June 1 transaction. 20 Made payment for the amount owing for the June 15 transaction.arrow_forwardJournalize the entry to record the receipt of the payment of the note at maturity. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Question not attempted. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3arrow_forwardJournalize the entries to correct the following errors: a. A purchase of supplies for $158 on account was recorded and posted as a debit to Supplies for $513 and as a credit to Accounts Receivable for $513. (Record the entry to reverse the error first.) If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - b. A receipt of $4,068 from Fees Earned was recorded and posted as a debit to Fees Earned for $4,068 and a credit to Cash for $4,068. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select -arrow_forward

- kai.3arrow_forwardSweet Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $91,000 Contribution to the plan 106,400 Prior service cost amortization 10,800 Actual and expected return on plan assets 65,200 Benefits paid 40,500 Plan assets at January 1, 2020 633,900 Projected benefit obligation at January 1, 2020 701,600 Accumulated OCI (PSC) at January 1, 2020 149,900 Interest/discount (settlement) rate 9 %arrow_forwardPlease Introduction and show work without plagiarism please i request please sir urgently help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education