Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Hi expert provide correct option general accounting

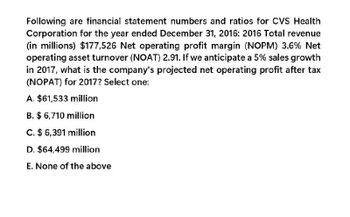

Transcribed Image Text:Following are financial statement numbers and ratios for CVS Health

Corporation for the year ended December 31, 2016: 2016 Total revenue

(in millions) $177,526 Net operating profit margin (NOPM) 3.6% Net

operating asset turnover (NOAT) 2.91. If we anticipate a 5% sales growth

in 2017, what is the company's projected net operating profit after tax

(NOPAT) for 2017? Select one:

A. $61,533 million

B. $ 6,710 million

C. $ 6,391 million

D. $64,499 million

E. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Following are financial statement numbers and ratios for Lockheed Martin Corp. for the year ended December 31, 2016. If we expected revenue growth of 3.5% in the next year, what would projected revenue be for 2017? Total revenue (in millions) $47,248 Net operating profit margin (NOPM) 8.8% Net operating asset turnover (NOAT) 3.3arrow_forwardKrogen Grocer’s 2016 financial statements show net income of $1,680 million, sales of $153,466 million, and average total assets of $46,350 million.How much is Krogen Grocer’s return on sales for the year? Question 22 options: A) 1.09% B) 30.20% C) 3.62% D) 6.42%arrow_forwardJones Enterprises reported sales revenue totaling $672,000, $668,000, and $708,000 in the years, 2015, 2016, and 2017, respectively.Performing trend analysis, with 2015 serving as the base year, what is the percentage for 2017? Question 15 options: A) 19.08% B) 28.21% C) 105.36% D) 105.99%arrow_forward

- Hello, just need help on net income and return on equityarrow_forwardZoobilee Inc. reported the following sales and net income amounts: (in thousands) 2020 2019 2018 2017 9,180 $ 8,990 $ 8,770 $ 8,550 Net income 520 500 460 400 Show Zoobilee's trend percentages for sales and net income. Use 2017 as the base year. Sales.... $ (Round your answers to the nearest percent.) Sales.. Net income.. 2020 % % 2019 % % 2018 % % 2017 100 % 100 %arrow_forwardIn fiscal year 2021, Walmart Inc. (WMT) reported annual revenue of $572.75 billion, gross profit of $143.75 billion, and net income of $13.67 billion. Costco Wholesale Corporation (COST) had revenue of $195.9 billion, gross profit of $25.25 billion, and net income of $5.01 billion. a. Compare the gross margins for Walmart and Costco. b. Compare the net profit margins for Walmart and Costco. c. Which firm was more profitable in 2021?arrow_forward

- Evaluate Aritzia’s profitability for 2022 compared with 2021. In your analysis, compute the following ratios and then comment on what those ratios indicate. 1. Return on sales 2. Asset turnover 3. Return on assets 4. Leverage ratio 5. Return on equity 6. Gross profit percentage 7. Earnings per share (show computation) 8. Book value per shareOperational and Financial Summaryarrow_forwardA. Wally asks you to create an Income Statement for 2020 using the information below. 1. 2020 sales were 150% of last year’s sales2. Gross profit margin was 55%3. Operating profit margins were 15% 4. Interest expense fell to 7%, given a change in interest rates 5. The tax rate was 30% B. Based on the change in Income between 2020 and 2019, how would you say AndrewCo is doing?arrow_forwardFor the year ended December 31, 2022, Settles Incorporated earned an ROI of 8.8 %. Sales for the year were $9 million, and average asset turnover was 2.2. Average stockholders' equity was $2.9 million. Required: a. Calculate Settles Incorporated's margin and net income. Note: Round "Margin" answer to 1 decimal place. Enter the net income answer in dollars, i.e., $5 million should be entered as 5,000,000. b. Calculate Settles Incorporated's return on equity. Note: Round your answer to 1 decimal place. a. Margin a. Net income % b. Return on equity %arrow_forward

- Following are income statements for Hossa Corporation for 2017 and 2016. Percentage of sales amounts are also shown for each operating expense item. Hossa’s income tax rate was 38% in 2016 and 40% in 2017. How do you calculate the cause of change analysis past sales?arrow_forward8. Trend Ratios, Application of some Financial Ratios and their Interpretation Some of the balance sheet and income statement figures of Sapphire Mfg. CO. for 2016, 2017 and 20181 are as follows. 2018 P30,000 2016 2017 Quick assets P40,000 P48,000 65,000 25,000 80,000 50,000 Current assets 50,000 40,000 110,000 200,000 Investments 160,000 135,000 Plants, property and equipment, net Total assets 250,000 265,000 Current liabilities 45,000 50,000 100,000 75,000 Long Term debt Total stockholders' equity 40,000 50,000 105,000 125,000 125,000 Total liabilities and stockholders' Equity 200,000 400,000 240,000 250,000 265,000 Sales 375,000 500,000 Cost of goods sold Operating expenses (including Depreciation of P10,000) 255,000 290,000 110,000 95,000 105,000 Net income 50,000 50,000 130,000 a) Compute for the trend ratios based on the above given data and give your interpretation of the 2017 and 2018 figures.arrow_forwardIn fiscal year 2018, Wal-Mart Stores (WMT) had revenue of $514.41 billion, gross profit of $129.10 billion, and net income of $6.67 billion. Costco Wholesale Corporation (COST) had revenue of $141.6 billion, gross profit of $18.42 billion, and net income of $3.13 billion. a. Compare the gross margins for Walmart and Costco. b. Compare the net profit margins for Walmart and Costco. c. Which firm was more profitable in 2018? a. Compare the gross margins for Walmart and Costco. The gross margin for Walmart is enter your response here %. (Round to two decimal places.) The gross margin for Costco is enter your response here %. (Round to two decimal places.) Part 3 b. Compare the net profit margins for Walmart and Costco. The net profit margin for Walmart is enter your response here %. (Round to two decimal places.) Part 4 The net profit margin for Costco is enter your response here %. (Round to two decimal places.) c. Which firm was more profitable in 2018? (Select from the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning