EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

None

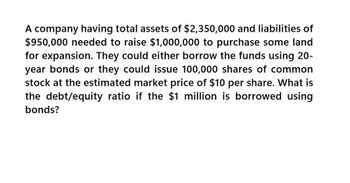

Transcribed Image Text:A company having total assets of $2,350,000 and liabilities of

$950,000 needed to raise $1,000,000 to purchase some land

for expansion. They could either borrow the funds using 20-

year bonds or they could issue 100,000 shares of common

stock at the estimated market price of $10 per share. What is

the debt/equity ratio if the $1 million is borrowed using

bonds?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ?? Financial accountingarrow_forwardA company needed ghc 1000 to finance its activities. The firm can financed this expenditure either by bonds or equity. Interest rate on bonds is 10%. The company can earn ghc 160 in good years and ghc80 in bad years. Assuming the firm faces equal probability of good and bad years; i What will be the stream of returns on both bonds and equity if the company chooses the following financing options a 100% equity financing b 50% equity financing c 20% equity financing d 0% equity financing ii Estimate the equity risk associated with each option in (i) iii As an investor who wants to purchase a share in the company, which financing option will make you purchase the stock. Why????arrow_forwardA firm has 4000m in balance sheet debt (book value is equal to market value in this case) and 1000m in capitalized leases. Market value of equity is 10000m. You can use book value of debt to approximate its market value. If you were to use this information in the calculation of WACC, what is Wd? O 40.00% O 28.57% O 33.33% O 50.00%arrow_forward

- Suppose that the assets of a bank consists of $100 million of loans to A rated corporations. The PD for the corporations is estimated as 0,1% and LGD is 60%. The average maturity is 2.5 years for corporate loans. What is RWA?.arrow_forwardMontclair Company is considering a project that will require a $500,000 loan. It presently has total liabilities of $220,000 and total assets of $620,000. 1. Compute Montclair’s (a) current debt-to-equity ratio and (b) the debt-to-equity ratio assuming it borrows $500,000 to fund the project. 2. If Montclair borrows the funds, does its financing structure become more or less risky?arrow_forwardWhat is the Minimum return in pesosarrow_forward

- A company has raised $90 million to finance their business, with a 50/50 debt to equity ratio. If they want to raise debt to reach a 70/30 D/E ratio, how much debt would they need to raise? options: $40 million $15 million $60 million $35 millionarrow_forwardMontclair Company is considering a project that will require a $520,000 loan. It presently has total liabilities of $210,000 and total assets of $630,000. 1. Compute Montclair's (a) current debt-to-equity ratio and (b) the debt-to-equity ratio assuming it borrows $520,000 to fund the project. 2. If Montclair borrows the funds, does its financing structure become more or less risky? 1. (a) 1. (b) 2. 1 Choose Denominator: 1 1 1 If Montclair borrows the funds, does its financing structure become more or less risky? Choose Numerator: Debt-to-Equity Ratioarrow_forwardTrue answer?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning