FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

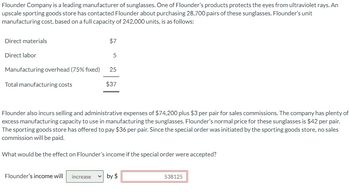

Transcribed Image Text:Flounder Company is a leading manufacturer of sunglasses. One of Flounder's products protects the eyes from ultraviolet rays. An

upscale sporting goods store has contacted Flounder about purchasing 28,700 pairs of these sunglasses. Flounder's unit

manufacturing cost, based on a full capacity of 242,000 units, is as follows:

Direct materials

Direct labor

Manufacturing overhead (75% fixed)

Total manufacturing costs

$7

5

25

$37

Flounder also incurs selling and administrative expenses of $74,200 plus $3 per pair for sales commissions. The company has plenty of

excess manufacturing capacity to use in manufacturing the sunglasses. Flounder's normal price for these sunglasses is $42 per pair.

The sporting goods store has offered to pay $36 per pair. Since the special order was initiated by the sporting goods store, no sales

commission will be paid.

What would be the effect on Flounder's income if the special order were accepted?

Flounder's income will increase ✓ by $

538125

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently: Direct material Direct labor Manufacturing overhead Total The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. PLEASE NOTE: Costs per unit are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). All other dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). 1. What is Oat Treats' relevant cost? $14,000 6,000 8,000 $28,000 2. What does Simmons Cereal's offer cost? 3. If Oat Treats accepts the offer, what will the effect on profit be? o Incremental dollar amount = o Increase or Decrease? no quotes. Please note: Your answer is either "Increase" or…arrow_forwardRooney Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* $ 5,200 6,500 3,600 9,300 26,600 Allocated facility-level costs *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Rooney for $2.70 each. Required a. Calculate the total relevant cost. Should Rooney continue to make the containers? b. Rooney could lease the space it currently uses in the manufacturing process. If leasing would produce $11,500 per month, calculate the total avoidable costs. Should Rooney continue to make the containers? a. Total relevant cost Should Rooney continue to make the containers? b. Total avoidable cost Should Rooney continue to make the containers?arrow_forwardEach year, Giada Company produces 20,000 units of a component part used in tablet computers. An outside supplier has offered to supply the part for $1.39. The unit cost is: Direct materials $0.83 Direct labor 0.34 Variable overhead 0.13 Fixed overhead 2.55 Total unit cost $3.85 1. What are the alternatives for Giada Company? a. Make the part in house b.Buy the part externally c.Make the part in house or buy the part externally d.None 2. Assume that none of the fixed cost is avoidable. List the relevant cost(s) of internal production. a.Direct materials, direct labor and variable and fixed overhead b.Direct materials, direct labor and variable overhead c.Direct materials, direct labor and fixed overhead d.None List the relevant cost(s) of external purchase. a.Purchase price b.Sales price c.Material price d.None 3. Which alternative is more cost effective and by how much? a. Making the part in house b. Buying the part from the external supplier by $___________ 4. What if…arrow_forward

- Hawkins Audio Video, Inc. manufactures digital cameras. Hawkins is considering whether it should outsource production of a part used in the manufacturing of its cameras. 60,000 units of the part were made by Hawkins last year. At this production level, the company incurred the following direct product costs: Direct Materials $250,000 Direct Labor $104,000 Manufacturing Overhead incurred during the same period for production of the part is represented by the following cost behavior equation: y = $0.10x + $50,000. If the part were purchased from an outside supplier, 80% of the total fixed manufacturing overhead cost would continue, and the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional income from this other product would be $12,600 per year. A supplier has been identified who can sell the part to Hawkins at a price of $7.80 per unit. Which of…arrow_forwardCane Company manufactures two products called Alpha and Beta that sell for $155 and $115, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 110,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Alpha Beta Direct materials $ 24 $ 12 Direct labor 23 26 Variable manufacturing overhead 22 12 Traceable fixed manufacturing overhead 23 25 Variable selling expenses 19 15 Common fixed expenses 22 17 Total cost per unit $ 133 $ 107 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Required: 1. What is the total amount of traceable fixed manufacturing overhead for each of the two products? what is the alpha and betaarrow_forwardVisnoarrow_forward

- Cane Company manufactures two products called Alpha and Beta that sell for $155 and $115, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 110,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Alpha Beta Direct materials $ 24 $ 12 Direct labor 23 26 Variable manufacturing overhead 22 12 Traceable fixed manufacturing overhead 23 25 Variable selling expenses 19 15 Common fixed expenses 22 17 Total cost per unit $ 133 $ 107 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 2. What is the company’s total amount of common fixed expenses? 3. Assume that Cane expects to produce and sell 87,000 Alphas during the current year. One of Cane's sales representatives has found a…arrow_forwardJordan electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly costs of producing 9,100 containers follow Unit-level material $6,000 Unit-level labor $6,700 unit-level overhead $3,300 product-level costs* $11,700 Allocated facility-level costs $26,500 *one-third of these costs can be avoided by purchasing the containers. Russo container company has offered to sell comparable containers to Jordan for $2.80 each. Required a) Calculate the total relevant cost should Jordan continue to make the containers. b) Jordan could lease the space it currently uses in the manufacturing process if leasing would produce $11,700 per month, and calculate the total avoidable costs. Should Jordan continue to make the containers? a) Total relevant cost should Jordan continue to make the containers? Total avoidable cost Should Jordan continue to make the containers?arrow_forwardVishnuarrow_forward

- Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows: Direct materials Direct labor Variable manufacturing overhead. Fixed manufacturing overhead Unit product cost $ 17.80 19.00 1.00 17.10 $ 54.90 An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.…arrow_forwardPlease help me with this questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education