FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

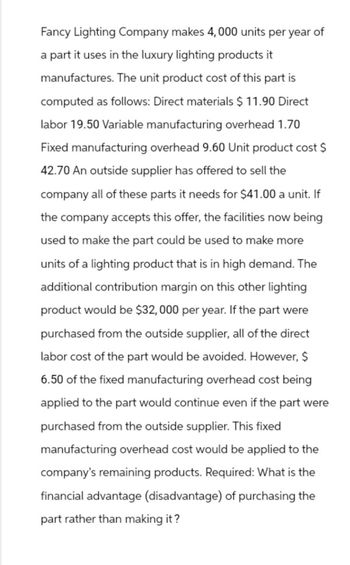

Transcribed Image Text:Fancy Lighting Company makes 4,000 units per year of

a part it uses in the luxury lighting products it

manufactures. The unit product cost of this part is

computed as follows: Direct materials $ 11.90 Direct

labor 19.50 Variable manufacturing overhead 1.70

Fixed manufacturing overhead 9.60 Unit product cost $

42.70 An outside supplier has offered to sell the

company all of these parts it needs for $41.00 a unit. If

the company accepts this offer, the facilities now being

used to make the part could be used to make more

units of a lighting product that is in high demand. The

additional contribution margin on this other lighting

product would be $32,000 per year. If the part were

purchased from the outside supplier, all of the direct

labor cost of the part would be avoided. However, $

6.50 of the fixed manufacturing overhead cost being

applied to the part would continue even if the part were

purchased from the outside supplier. This fixed

manufacturing overhead cost would be applied to the

company's remaining products. Required: What is the

financial advantage (disadvantage) of purchasing the

part rather than making it?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Clemente Inc. incurs the following costs to produce 10,000 units of a subcomponent: Direct materials $8,400 Direct labor Variable overhead Fixed overhead $150. O $7,350. An outside supplier has offered to sell Clemente the subcomponent for $2.85 a unit. If Clemente accepts the offer, it could use the production capacity to produce another product that would generate additional income of $3,600. The increase (decrease) in net income from accepting the offer would be $(150). $(3,600). ~ C 11,250 An 12,600 16,200 A W P s Öarrow_forwardThe Mighty Music Company produces and sells a desktop speaker for $200. The company has the capacity to produce 60,000 speakers each period. At capacity, the costs assigned to each unit are as follows: Unit-level costs Product-level costs Facility-level costs The company has received a special order for 11,000 speakers. If this order is accepted, the company will have to spend $20,000 on additional costs. Assuming that no sales to regular customers will be lost if the order is accepted, at what selling price will the company be indifferent between accepting and rejecting the special order? Multiple Choice O O $96.82 $146.82 $104.32 $95 $25 $15 $107.32arrow_forwardSan Clemente Inc. incurs the following costs to produce 10,000 units of a subcomponent: Direct materials $8,400 Direct labor 11,250 Variable overhead 12,600 Fixed overhead 16,200 An outside supplier has offered to sell San Clemente the subcomponent for $2.85 a unit. If San Clemente accepts the offer, by how much will net income increase (decrease)?arrow_forward

- InteliSystems manufactures an optical switch that it uses in its final product. InteliSystems incurred the following manufacturing costs when it produced 70,000 units last year as shown in the chart below: InteliSystems does not yet know how many switches it will need this year; however, another company has offered to sell InteliSystems the switch for $8.50 per unit. If InteliSystems buys the switch from the outside supplier, the manufacturing facilities that will be idle cannot be used for any other purpose; yet none of the fixed costs are avoidable. Requirements 1. Given the same cost structure, should InteliSystems make or buy the switch? Show your analysis. 2. Now, assume that InteliSystems can avoid $105,000 of fixed costs a year by outsourcing production. In addition, because sales are increasing, InteliSystems needs 75,000 switches a year rather than 70,000 switches. What should the company do now? 3. Given the last scenario, what is the most InteliSystems would be willing to…arrow_forwardVoltaic Electronics uses a standard part in the manufacture of different types of radios. The total cost of producing 30,000 parts is $100,000, which includes fixed costs of $40,000 and variable costs of $60,000. The company can buy the part from an outside supplier for $2 per unit and avoid 20% of the fixed costs. Assume that the company can use the freed manufacturing space to make another product that can earn a profit of $16,000. If Voltaic outsources, what will be the effect on operating income? A. decrease of $8,000 B. decrease of $24,000 C. increase of $16,000 D. increase of $24,000arrow_forwardCarver Company manufactures a component used in the production of one of its main products. The following cost information is available: Direct materials $420 Direct labor (variable) 110 Variable manufacturing overhead Fixed manufacturing overhead 90 30 A supplier has offered to sell the component to Carver for $650 per unit. If Carver buys the component from the supplier, the released facilities can be used to manufacture a product that would generate a contribution margin of $20,000 annually. Assuming that Carver needs 3,000 components annually and that the fixed manufacturing overhead is unavoidable, what would be the impact on operating income if Carver outsources? A. Operating income would decrease by $70,000. B. Operating income would increase by $20,000. C. Operating income would decrease by $20,000. O D. Operating income would increase by $90,000.arrow_forward

- Wings Incorporated manufactures machine parts for aircraft engines. The CEO, Chucky Valters, was considering an offer from a subcontractor that would provide 2,400 units of product PQ107 for Valters for a price of $150,000. If Wings does not purchase these parts from the subcontractor it must produce them in-house with the following unit costs: Direct materials Direct labor Variable overhead Cost per Unit $31 19 8 In addition to the above costs, if Wings produces part PQ107, it would have a retooling and design cost of $9,800. The relevant costs of producing 2,400 units of product PQ107 internally are:arrow_forwardAdams Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials $ 5,400 Unit-level labor 6,400 Unit-level overhead 3,900 Product-level costs* 10,500 Allocated facility-level costs 28,200 *One-third of these costs can be avoided by purchasing the containers.Russo Container Company has offered to sell comparable containers to Adams for $2.80 each.Required Calculate the total relevant cost. Should Adams continue to make the containers? Adams could lease the space it currently uses in the manufacturing process. If leasing would produce $12,500 per month, calculate the total avoidable costs. Should Adams continue to make the containers?arrow_forwardTroy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the parts for its engines, including the carburetors. An outside supplier offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $35 per unit. To evaluate this offer, Troy Engines, Limited, summarized the cost of producing the carburetor internally as follows: Per Unit 15,000 Units Per Year Direct materials $ 14 $ 210,000 Direct labor 10 150,000 Variable manufacturing overhead 3 45,000 Fixed manufacturing overhead, traceable 6* 90,000 Fixed manufacturing overhead, allocated 9 135,000 Total cost $ 42 $ 630,000 *One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value). Required: If the company has no alternative use for the facilities being used to produce the carburetors, what would be the financial advantage (disadvantage) of buying 15,000 carburetors from the outside supplier?…arrow_forward

- Riders, Ltd. is a manufacturer that produces motorized scooters. Currently, it is producing the motor used to power the scooter, but is considering buying the motor from an outside supplier. The manufacturing costs for Riders to make 20,000 motors are as follows: Cost per motor Direct material $28.50 Direct labor $13.25 Overhead $18.00 An outside supplier offers to supply Riders with all the motors it needs at $55.00 per unit. If Riders buys the motors from the supplier, it will still incur 80% of its overhead costs. Based on the above information, the financial advantage (disadvantage) of buying the 20,000 motors from the outside supplier is: a. ($265,000) b. None of the other answers are correct c. $95,000 d. ($193,000) e. $23,000arrow_forwardLakeside Inc. produces a product that currently sells for $60 per unit. Current production costs per unit include direct materials, $16; direct labor, $18; variable overhead, $11; and fixed overhead, $11. Product engineering has determined that certain production changes could refine the product quality and functionality. These new production changes would increase material and labor costs by 20% per unit. Lakeside has received an offer from a nonprofit organization to buy 9,200 units at $46 per unit. Lakeside currently has unused production capacity. Required: a. Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization. Increase in operating incomearrow_forwardAdams Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,300 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $5,900 6,200 3,500 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Adams for $2.60 each. Required X Answer is complete but not entirely correct. $ 19,300 Yes $ 24,180 X No 11,100 26,900 a. Calculate the total relevant cost. Should Adams continue to make the containers? b. Adams could lease the space it currently uses in the manufacturing process. If leasing would produce $11,800 per month, calculate the total avoidable costs. Should Adams continue to make the containers? a. Total relevant cost a. Should Adams continue to make the containers? b. Total avoidable cost b. Should Adams continue to make the containers?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education