SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

23

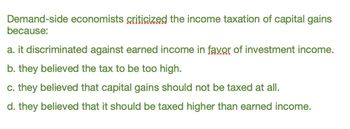

Transcribed Image Text:Demand-side economists criticized the income taxation of capital gains

because:

a. it discriminated against earned income in favor of investment income.

b. they believed the tax to be too high.

c. they believed that capital gains should not be taxed at all.

d. they believed that it should be taxed higher than earned income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can the effective rate of tax be negative? Why? or Why not?arrow_forwardThe good creates a negative externality to producers. The government taxes producers exactly at the size of the external harm created by the externality. Which of the following is true: The tax will result in under provision of the good compared to the optimum The tax will result in over provision of the good compared to the optimum The tax will result in an optimal production of the goodarrow_forwardWhich of the following types of income is not subject to the "kiddie tax"? a.Capital gains on stock sales b.Dividend income c.Interest income d.Salary income e.All of these choices are subject to the "kiddie tax".arrow_forward

- Explain the significance of Lucas v. Earl and Helvering v. Horst. C O A. Lucas v. Earl, the Supreme Court held that earnings from labor are taxed to the person who performs the services rather than the person who receives the income. In Helvering v. Horst, the Supreme Court held that income from property is taxed to the person who owns the property rather than the person who receives the income. One cannot assign income by arranging to have payment made to another person. O B. Lucas v. Earl, the Supreme Court held that income from property is taxed to the person who owns the property rather than the person who receives the income. Helvering v. Horst, the Supreme Court held that earnings from labor are taxed to the person who performs the services rather than the person who receives the income. OC. Helvering v. Horst, the Supreme Court held that earnings from labor are taxed to the person who performs the services rather than the person who receives the income. Lucas v. Earl, the…arrow_forwardTaxation can be used to reduce the welfare loss arising from a negative externality. Select one: O True O Falsearrow_forwardWhat are the advantages of an indirect tax such as the VAT compared with an income tax?arrow_forward

- Which of the following might discourage covered interest arbitrage even if interest rate parity does not exist? A. transaction costs. B. political risk. C. differential tax laws. D. all of the above. E. none of the above.arrow_forwardWhich of the following statements is NOT true? A) A progressive tax system should increase the incentive for people to take low paid jobs. B) With a progressive tax system, the more a person earns, the higher the average rate of tax will be. C) A progressive tax is a type of tax that is assessed regardless of income. D) A progressive tax takes a higher percentage of tax from people with higher incomes.arrow_forwardThe money you receive back because you have overpaid your taxes is called a tax return. a. true b. falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage