FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

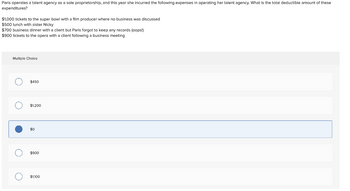

Transcribed Image Text:Paris operates a talent agency as a sole proprietorship, and this year she incurred the following expenses in operating her talent agency. What is the total deductible amount of these

expenditures?

$1,000 tickets to the super bowl with a film producer where no business was discussed

$500 lunch with sister Nicky

$700 business dinner with a client but Paris forgot to keep any records (oops!)

$900 tickets to the opera with a client following a business meeting

Multiple Choice

о

$450

$1,200

$0

$900

$1,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Samantha, who is single and has MAGI of $41,400, was recently employed by an accounting firm. During the year, she spends $1,200 for a CPA exam review course and begins working on a law degree in night school. Her law school expenses were $4,140 for tuition and $720 for books (which are not a requirement for enrollment in the course). Click here to access Concept Summary 9.2. If an amount is zero, enter "0". Assuming no reimbursement, how much of these expenses can Samantha deduct?arrow_forwardRocky repairs TV sets in the basement of his personal residence. Rocky uses 450 square feet (20%) of his residence exclusively for the repair business. Business profit is $4,000 before any office-in-home expenses are deducted. Expenses relating to the residence are as follows: Real property taxes $5,500 Interest on home mortgage 7,000 Operating expenses of residence 3,000 Depreciation (100% amount) 5,000 The maximum home office expense deduction he can take in 2020 using the regular (actual expense) method is _____. The amount of expenses Rocky would carryover to 2021 if he uses the regular method is _____. The amount of home office expense deduction he can take in 2021 using the simplified method is _____. The amount of expenses Rocky would carryover to 2021 if he uses the simplified method is ____. Rocky should use the regular method or the simplified method? _____arrow_forwardJordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for five days. She incurred the following expenses: Airfare $ 500 Lodging 3,000 Meals 750 Entertainment of clients 600 Required: How much of these expenses can Jordan deduct? **wrong answers will get 10 dislikes,need a genuine and correct answer. do not copy from others.arrow_forward

- Hannah is a teacher, single, had gross income of $50,000, and incurred the following expenses: Charitable contribution Taxes and interest on home Legal fees incurred in a tax dispute Medical expenses Supplies for her third grade class Her AGI is: X a. $49,700. b. $39,750. c. $39,700. d. $40,000. $2,000 7,000 1,000 3,000 350arrow_forwardManjiarrow_forwardLast year, lana purchased a $100,000 account receivable for $90,000. During the current year, Lucy collected $97,000 on the account. What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected. a.$7,000 gain b.$3,000 loss c.$13,000 loss d.$2,000 gainarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education