Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

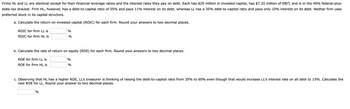

Transcribed Image Text:Firms HL and LL are identical except for their financial leverage ratios and the interest rates they pay on debt. Each has $29 million in invested capital, has $7.25 million of EBIT, and is in the 40% federal-plus-

state tax bracket. Firm HL, however, has a debt-to-capital ratio of 55% and pays 11% interest on its debt, whereas LL has a 35% debt-to-capital ratio and pays only 10% interest on its debt. Neither firm uses

preferred stock in its capital structure.

a. Calculate the return on invested capital (ROIC) for each firm. Round your answers to two decimal places.

ROIC for firm LL is

ROIC for firm HL is

b. Calculate the rate of return on equity (ROE) for each firm. Round your answers to two decimal places.

%

%

ROE for firm LL is

ROE for firm HL is

%

%

c. Observing that HL has a higher ROE, LL's treasurer is thinking of raising the debt-to-capital ratio from 35% to 60% even though that would increase LL's interest rate on all debt to 15%. Calculate the

new ROE for LL. Round your answer to two decimal places.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Fama's Llamas has a WACC of 9.8 percent. The company's cost of equity is 13 percent, and its pretax cost of debt is 7.5 percent. The tax rate is 21 percent. What is the company's target debt-equity ratio? Note: Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616. Debt-equity ratioarrow_forwardHaricot Corporation and Pinto Corporation both have operating profits of $155 million. Haricot is financed solely by equity, while Pinto has issued $205 million of 5% debt. If the corporate tax rate is 21%:Required:How much tax does each company pay? What is the total payout to investors (debtholders plus shareholders) of each company?arrow_forwardNorth Pole and South Pole are competitors in the same industry. Both companies face a 23 % income tax rate. Both companies are levered. (North Pole and South Pole had the same equity Betas, 1.18, when they were still unlevered.) Their capital structures look like this: North Pole South Pole Debt $3,030,000 $3,940,000 Equity $3,940,000 $3,030,000 For both companies, the Betas for their debt is zero. Additional information about the market: The market portfolio's expected return is 12.1 %. The T-bill rate is 4.1 %. a. What is the Beta of equity for North Pole and South Pole? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. In addition, calculate the required return on equity that would correctly reflect the level of systematic risk. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a. b. North Pole South Pole. North Pole South Pole % %arrow_forward

- ABC and XYZ are identical firms in all respects except for their capital structures. ABC is all-equity financed with $530,000 in stock. XYZ has the same total value but uses both stock and perpetual debt; its stock is worth $310,000 and the interest rate on its debt is 7.9 percent. Both firms expect EBIT to be $62,222. Ignore taxes. Compute the costs of equity for both ABC and XYZ.arrow_forwardContractual Engineering Incorporated (GEI) has a capital structure which is based on 40 percent debt, 5 percent preferred stock, and 55 percent common stock. The pre-tax cost of debt is 7.5 percent, the cost of preferred is 9 percent, and the cost of common stock is 13 percent. The company's tax rate is 39 percent. What is the company's WACC?arrow_forwardLannister Manufacturing has a target debt-equity ratio of .85. Its cost of equity is 10 percent, and its cost of debt is 7 percent. If the tax rate is 23 percent, what is the company's WACC? (Do not round Intermedlate calculatlons and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACCarrow_forward

- Barclay Corp is operating in a country K where the corporate tax is 40%, personal income tax on bond investment is 25% while the personal tax on stock is 29%. Assume the firm’s earnings before interest and taxes is $5,400,000 and cost of equity with zero debt is 9%. (Please Show Work) If Barclay current has $12 million total market value of debt financing, what would be the market value of the company of Barclay Corp in this country K?(Please Show Work) What is the proportion of debt (wd) and equity (ws) financing for Barclay Corp with financial leverage? (Please Show Work)arrow_forwardFama's Llamas has a WACC of 8.8 percent. The company's cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the company's target debt - equity ratio? Note: Do not round intermediate calculations and round your answer to 4 decimal places, e.g .. 32.1616.arrow_forwardKendall Corporation has no debt but can borrow at 6.5 percent. The firm’s WACC is currently 10 percent, and there is no corporate tax. What is the company’s cost of equity? Note: Do not round intermediate calculations and enter your answer as a percent rounded to the nearest whole number, e.g., 32. If the firm converts to 10 percent debt, what will its cost of equity be? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. If the firm converts to 45 percent debt, what will its cost of equity be? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. What is the company’s WACC in parts (b) and (c)? Note: Do not round intermediate calculations and enter your answers as a percent rounded to the nearest whole number, e.g., 32.arrow_forward

- Dollar General (DG) is choosing between financing itself with only equity or with debt and equity. Regardless of how it finances itself, the EBIT for DG will be $545.63 million. If DG does use debt, the interest expense will be $57.85 million. If DG‘s corporate tax rate is 0.30, how much will DG pay (in millions) in total to ALL investors if it uses both debt and equity? Instruction: Type ONLY your numerical answer in the unit of millionsarrow_forwardExplain well with proper step by step and type the answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education