Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

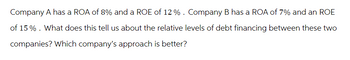

Transcribed Image Text:Company A has a ROA of 8% and a ROE of 12 % . Company B has a ROA of 7% and an ROE

of 15%. What does this tell us about the relative levels of debt financing between these two

companies? Which company's approach is better?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have the following information about two firms, Debt Free, Incorporated and Debt Spree, Incorporated. Both firms have the same prospects for sales and EBIT, and both have the same level of assets, tax rate and borrowing rate. They differ in their use of debt financing. Scenario Sales EBIT Bad year $ 200 $ 12 Normal year $ 275 $ 38 Good year $ 380 $ 46 Debt Free Debt Spree Total assets $ 250 $ 250 Tax rate 21% 21% Debt $ 0 $ 150 Equity $ 250 $ 100 Borrowing rate 16% 16% Required: a. Calculate the interest expense for each firm: Interest expense for Debt Free = $ Interest expense for Debt Spree = $ b. Calculate the following items for each firm for each scenario (bad year, normal year, good year): return on assets (ROA), net profit, and return on equity (ROE). (Use a minus sign to indicate negative answers. Round your answers to 2 decimal places.) Debt Free Debt Spree Scenario ROA Net Profit ROE ROA Net Profit ROE Bad…arrow_forwardFor a company holding significant net financial assets (NFO), after issuing some new debt, its risk in operation should be_____ as before issuing the debt; and its required rate of return of equity should be ______ as before. A. the same as .... the same as B. lower than ... lower than C. higher than ... higher than D. the same as ... higher than Please donot provide solution in image format and provide solution in step by step format and asaparrow_forwardThe financial manager of a firm determines the following schedules of cost of debt and cost of equity for various combinations of debt financing: Debt/Assets After-Tax Cost of Debt Cost of Equity 0 % 4 % 7 % 10 4 7 20 4 7 30 4 9 40 5 10 50 5 12 60 8 13 70 8 15 Find the optimal capital structure (that is, optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % Why does the cost of capital initially decline as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is than the cost of equity. Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and riskier, the cost of debt…arrow_forward

- In the Merton model of corporate equity which is based on the Black Scholes formula, what is the quantity (S0/KT)? Assume that interest rates are zero (r=0) so the time value of money can be ignored, therefore S0 = ST. (a) Debt-to-equity ratio. (b) Debt-to-assets ratio. (c) Assets-to-debt ratio. (d) Assets-to-equity ratio. (e) Equity-to-assets ratiarrow_forwardUsing the DuPont method, evaluate the effects of the following relationships for the Butters Corporation. A.Butters Corporation has a profit margin of 5.5 percent and its return on assets (investment) is 8.75 percent. What is its assets turnover? Round your answer to 2 decimal places. ______ times B.If the Butters Corporation has a debt-to-total-assets ratio of 65.00 percent, what would the firm’s return on equity be? Note: Input your answer as a percent rounded to 2 decimal places. C.What would happen to return on equity if the debt-to-total-assets ratio decreased to 60.00 percent? Input your answer as a percent rounded to 2 decimal places.arrow_forwardThe financial manager of a firm determines the following schedules of cost of debt and cost of equity for various combinations of debt financing: Debt/Assets After-Tax Cost of Debt Cost of Equity 0 % 4 % 8 % 10 4 8 20 4 8 30 5 9 40 6 10 50 8 12 60 10 14 70 12 16 Find the optimal capital structure (that is, optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % Why does the cost of capital initially decline as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is than the cost of equity. Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and riskier, the cost of…arrow_forward

- You have the following information about two firms, Debt Free, Incorporated and Debt Spree, Incorporated. Both firms have the same prospects for sales and EBIT, and both have the same level of assets, tax rate and borrowing rate. They differ in their use of debt financing. Scenario Sales EBIT Bad year $ 200 $ 16 Normal year $ 275 $ 36 Good year $ 380 $ 52 Debt Free Debt Spree Total assets $ 250 $ 250 Tax rate 21% 21% Debt $ 0 $ 150 Equity $ 250 $ 100 Borrowing rate 16% 16% Required: a. Calculate the interest expense for each firm: Interest expense for Debt Free = $ Interest expense for Debt Spree = $ b. Calculate the following items for each firm for each scenario (bad year, normal year, good year): return on assets (ROA), net profit, and return on equity (ROE). (Use a minus sign to indicate negative answers. Round your answers to 2 decimal places.) Debt Free Debt Spree Scenario ROA Net Profit ROE ROA Net Profit ROE Bad…arrow_forwardWhich statement is correct?a. The cost of debt is determined by taking the present value of the interest payments and principal times one minus the tax rate.b. The difference in computing the cost of capital between using the accumulated profits and issuance of new ordinary shares is the growth rate.c. Increase in flotation costs, increase in the company’s beta and increase in the expected inflation will all lead to d. increase the company’s weighted average cost of capital.e. Increasing the company’s dividend payout would mitigate the company’s need to raise new ordinary shares.f. none of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education