Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

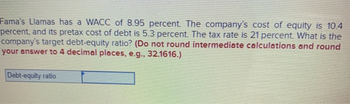

Transcribed Image Text:Fama's Llamas has a WACC of 8.95 percent. The company's cost of equity is 10.4

percent, and its pretax cost of debt is 5.3 percent. The tax rate is 21 percent. What is the

company's target debt-equity ratio? (Do not round intermediate calculations and round

your answer to 4 decimal places, e.g., 32.1616.)

Debt-equity ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please help me with this only texttt pleasearrow_forwardY3K, Incorporated, has sales of $6,389, total assets of $3,005, and a debt-equity ratio of 1.60. If its return on equity is 10 percent, what is its net income? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Net incomearrow_forward40. JoelEmbi, Inc. has an ROA (return on assets) of 15.2 percent, total assets of $4,500,000 and a net profit margin of 7.6 percent. What are JoelEmbi, Inc.'s annual sales? Enter your answer a whole number (i.e., rounded to zero decimal places. 41. JimmyButle, LLC. has a debt-to-total assets ratio of 39.6%. What is the company's debt-to-equity ratio? Enter your answer as a ratio (that is, do not convert to a percent), rounded to 2 decimal places. 42. JohCol, Inc has a debt ratio of 27.0% and ROE = 20.2%. What is JohCol, Inc.'s ROA? Enter your answer as a percent rounded to 1 decimal place. Enter 43. PauGeo, Inc. has an ROA of 18.2% and a debt/equity ratio of 0.83. The firm's ROE is answer as a percent rounded to 1 decimal place. 44. Assume that TraeYoung, Inc. has: Debt ratio 60% ● Net profit margin = 15.2% ● Return on assets (ROA) = 52% Find Trae Young's Total Asset Turnover ratio. Enter answer as a ratio (that is, do not convert to a percent), rounded to 2 decimal places.arrow_forward

- Andyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.8. Assuming the market value of debt equals its book value, what weights should it use for its WACC calculation? Assets $1,090 Liabilities & Equity Debt $460 Equity $630 The debt weight for the WACC calculation is __ % ? (Round to two decimal places.)arrow_forwardEdwards Construction currently has debt outstanding with a market value of $116,000 and a cost of 12 percent. The company has EBIT of $13,920 that is expected to continue in perpetuity. Assume there are no taxes. a-1. What is the value of the company's equity? (Do not round intermediate calculations. Leave no cell blank - be certain to enter "0" wherever required.) a- What is the debt-to-value ratio? (Do not round intermediate calculations and round 2. your answer to the nearest whole number, e.g., 32.) b. What are the equity value and debt-to-value ratio if the company's growth rate is 5 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) c. What are the equity value and debt-to-value ratio if the company's growth rate is 8 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) Answer is complete but not entirely correct. a-1. Value of equity…arrow_forwardLannister Manufacturing has a target debt-equity ratio of .85. Its cost of equity is 10 percent, and its cost of debt is 7 percent. If the tax rate is 23 percent, what is the company's WACC? (Do not round Intermedlate calculatlons and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACCarrow_forward

- Andyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.8. Assuming the market value of debt equals its book value, what weights should it use for its WACC calculation? Assets $1,090 Liabilities & Equity Debt $460 Equity $630 The equity weight for the WACC calculation is __ % ? (Round to two decimal places.)arrow_forwardSixx AM Manufacturing has a target debt-equity ratio of 2.5. Its cost of equity is 0.11, and its pretax cost of debt is 0.04. If the tax rate is 0.31, what is the company's WACC? Enter the answer with 4 decimals (e.g. 0.0123)arrow_forwardFama's Llamas has a WACC of 8.8 percent. The company's cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the company's target debt - equity ratio? Note: Do not round intermediate calculations and round your answer to 4 decimal places, e.g .. 32.1616.arrow_forward

- Question: Fama's Llamas has a weighted average cost of capital of 9.5%. The company's cost of equity is 11%, and its cost of debt is 7.5%. The tax rate is 40%. What is the company's debt- equity ratio? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.)arrow_forwardSubject:- financearrow_forwardA company finances its operations and growth opportunities, using common equity and debt. The debt-to-equity ratio of the CI Corp. is 0.3. If its cost of equity is 14%, and its pretax cost of debt is 5%, what comes closest to the company’s WACC? The tax rate is 21%. 6.7% 4.5% 7.1% 6.3% 5.8% The answer is not 7.1%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education