Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I need this question answer financial accounting

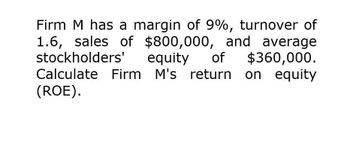

Transcribed Image Text:Firm M has a margin of 9%, turnover of

1.6, sales of $800,000, and average

stockholders' equity of $360,000.

Calculate Firm M's return on equity

(ROE).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Selected information for Berry Company is as follows: Berrys return on equity rounded to the nearest percentage point is: a. 20%. c. 28%. b. 21%. d. 40%.arrow_forwardFirm M has a margin of 12%, turnover of 1.5, sales of $870,000, and average stockholders' equity of $360,000. Calculate Firm M’s average total assets, net income, return on investment (ROI), and return on equity (ROE).arrow_forwardCalculate a and b ?? General accountingarrow_forward

- Helparrow_forwardO'Brien Inc. has the following data: rRF = 5.00%; RPM = 6.00%; and b = 1.70. What is the firm's cost of equity from retained earnings based on the CAPM? 15.20% 15.05% 17.33% 13.68% 15.35%arrow_forwardO'Brien Inc. has the following data: r RF=5.00%; RP M=6.00%; and b=1.10. What is the firm's cost of equity from retained earnings based on the CAPM? A. 11.83% B. 13.22% C. 11.25% D. 8.93% E. 11.60%arrow_forward

- Gardial & Son has an ROA of 12%, a 4% profit margin, and a return on equity equal to 11%. What is the company's total assets turnover? Round your answer to two decimal places. What is the firm's equity multiplier? Round your answer to two decimal places.arrow_forwardNeed answer pleasearrow_forwardGIVE ME ANSWERarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT