SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

How much income should be recognized?

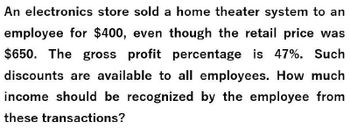

Transcribed Image Text:An electronics store sold a home theater system to an

employee for $400, even though the retail price was

$650. The gross profit percentage is 47%. Such

discounts are available to all employees. How much

income should be recognized by the employee from

these transactions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- After evaluating the information provided by the employees of La Nueva Era bookstore: Determine the amounts that must be reported in the employees' W2.Calculate the Social Security and Medicare payment that the employer must make.Calculate the state unemployment that the employer must pay at the rate of 6% of the first $ 10,000 the employee earns.Make the entries to the wage related to the debts contracted with the different agencies in contributions by the employer. Employee Name Weekly salary Retirement payment Juan del Pueblo $1,250.00 $21.93 Ramonita Ramírez $950.00 $37.12 Brenda Montalvo $1,100.00 $88.00 Camilo Monge $590.00 $23.02 Jorge Emmanueli $860.00 $92.00 Mariel Estrada $1,020.00 $48.00 Emanuel Reyes $750.00 $25.60 Ernesto Ramírez $640.00 $26.40 Daniela Morales $1,000.00 $32.68 Ángel Carrasquillo $860.00 $68.80arrow_forwardMary operates a wholesale business that distributes canned food. She receives a complaint from a customer and accepts $500 worth of product back from the customer that was billed on account. The cost of the product is $300. Which of the following entries is correct? Select one: a. Dr. Sales Returns and Allowances $500, Cr. A/R $500 and Dr. Merchandise Inventory $300, Cr. COGS $300 b. Dr. A/R $500, Cr. Sales Returns and Allowances $500 c. Dr. A/R $500, Cr. Sales Returns and Allowances $500 and Dr. Merchandise Inventory $300, Cr. COGS $300 d. Dr. Sales Returns and Allowances $500, Cr. A/R $500arrow_forwardA seller of goods has the following details of sales and collection during the month: Receivables, beginning P 500,000.00 Gross sales 700,000.00 Less: Collection 450,000.00 Receivables, end P 750,000.00 1. What is the amount subject to business tax? 2. Determine the amount subject to business tax if the taxpayer is a seller of services.arrow_forward

- Answer the question on the photo.arrow_forwardAn employee who earned a salary of $4,000 per month was startled at how low his net pay was. The Payroll Department provided the following information: CPP: $100 each (employee and employer EI: $80 re employee. $112 re emplyer Income tax $750 Union dues $50 Charitable donation $25 Vacation pay accrued $240 Calculate the employee’s net pay. Select answer from the options below $2,783 $2,995 $2,775 $2,543arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- Use the information below to complete the first quarter Employee Earnings Record for Linda Morris. Linda is a sales manager and she is a salaried employee. Her social security number is 345-44-8577. The weekly pay period ended February 15, 2009. Earnings Deductions United Employee Employee Marital No. of Regular Overtime Health Way Insurance No. Name Status Allowances Morris, $789.0 121 S 1 Linda 0 Moyer, $845.0 122 M 4 $36.00 $36.00 Elizabeth 0 Nethers, $978.0 123 M 2 $78.00 $48.00 Porter 0 Russ, 124 S 0 $576.0 0 $28.00 George EARNINGS RECORD FOR QUARTER ENDED Employee No. Marital Withholding Last Name First Social Security No. Position Rate of Pay Pay Period Earnings Accumulated Earnings 2,367.00 No Ended Overtime Total Medicare Other Total Federal Social Income Security Tax Tax Regular Status Deductions Deduction $15.00 $25.00 Allowances Net Payarrow_forwardHelp me fastarrow_forwardSaleem Enterprises is a graphic design company. The accountant needs to prepare the relative journal entries to determine items related to salaries, deductions, and contributions. a) On May 31, Saleem Enterprises had gross pay for employees of $49,000. Total employee contributions to the retirement savings plan is $1,700. The appropriate deduction rates are provided. Record the entry for salaries expense on May 31. Federal income tax rate 9.00% State income tax rate 6.00% FICA 7.65% FUTA 0.60% ISUTA 5.40% Do not enter dollar signs or commas in the input boxes. Round your answer to 2 decimal places. For transactions with more than one debit, enter the debit accounts in alphabetical order. For transactions with more than one credit, enter the credit accounts in alphabetical order. Date Account Title and Explanation Debit Credit May 31 Record salaries and deductions b) Using the data from above and assuming Saleem Enterprises contributes the same amount toward the employee retirement…arrow_forward

- Keiasia Coates Company sold merchandise for $2,000. The cost of the merchandise was $1,500. Five days later, the customer returns 20% of the merchandise, which is defective, and is not restored to Keasia Company’s merchandise inventory. On day 10, the customer sends a check for the amount due. Assuming the net method, indicate how these transactions combined would affect the following five financial statement items: assets, liabilities, owners equity, revenue, and expenses? Answer: assets:increase, Liabilities: decrease, owners equity:increase, revenue:increase, expenses: increase why and how would liabilites be decreased in this scenario? explain process to answer of this problemarrow_forwardNeed help with this accounting questionsarrow_forward1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT