Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

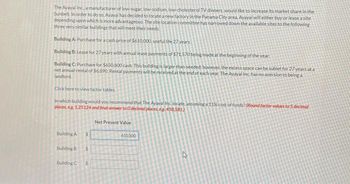

Transcribed Image Text:The Ayayal Inc, a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the

Sunbelt. In order to do so, Ayayai has decided to locate a new factory in the Panama City area. Ayayai will either buy or lease a site

depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following

three very similar buildings that will meet their needs.

Building A: Purchase for a cash price of $610,000, useful life 27 years

Building B: Lease for 27 years with annual lease payments of $71.570 being made at the beginning of the year.

Building C: Purchase for $650.800 cash. This building is larger than needed: however, the excess space can be sublet for 27 years at a

net annual rental of $6,890. Rental payments will be received at the end of each year. The Ayayal Inc has no aversion to being a

landlord.

Click here to view factor tables

In which building would you recommend that The Ayayal Inc locate, assuming a 11% cost of funds? (Round factor values to 5 decimal

places, eg. 1.25124 and final answer to 0 decimal places, es 458,581)

Building A

Building B

Building C

$

$

S

Net Present Value

610,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Finisterra, S.A. Finisterra, S.A., located in the state of Baja California, Mexico, manufactures frozen Mexican food which enjoys a large following in the U.S. states of California and Arizona to the north. In order to be closer to its U.S. market, Finisterra is considering moving some of its manufacturing operations to southern California. Operations in California would begin in year 1 for three years and have the following attributes: E The operations in California will pay 81% of its accounting profit to Finisterra as an annual cash dividend. Mexican taxes are calculated on grossed up dividends from foreign countries, with a credit for host-country taxes already paid. The corporate income tax rate in U.S. is 28% (the tax rate in Mexico is lower than the rate in the U.S.), the current spot exchange rate is Ps10.00/$, and the exchange rates for the next three years will be Ps11.00/S, Ps12.00/S, and Ps13.00/S, respectively. Assume the after-tax dividends received by the parent in years…arrow_forwardMad Scientist, Inc. is considering investing into the nanotechnology business. After conducting a detailed due diligence process, the company's board decided that the current cost of entry into the nanotechnology business is too high. The board also thinks that the commercialization of technological advancements will eventually drive costs down and the company should get into the nanotech business one or two years from now, when they can realize a higher NPV on their investment. Given the above, the board has chosen the option to: Expand Abandon Delayarrow_forwardThe cost of introducing the products in selected geographic areas for gauging consumer response is $150K. If the company decides to introduce the product this way, it would need to see the responses to the products before they decide to launch the product line nationally. The probability of a favorable response in the selected geographical areas is estimated at O.60. La Comida can also decide not to go for the launching in the product in selected geographical areas and go ahead with the nationwide launch or not. If La Comida Foods decides to go full-blast in launching the products nationally and are a success, the company estimates that they will gain an annual income of $1.6 million. If the products are not a hit, the company will realize losses to the tune of $700K. La Comida estimates the probability of success for the sauces and marinades to be 0.50, if these are introduced without gauging consumer response.arrow_forward

- Kim Inc. must install a new air-conditioning unit in its main plant. Kim must install one or the other of the units; otherwise, the highly profitable plant would have to shut down. Two units are available, HCC and LCC (for high and low capital costs, respectively). HCC has a high capital cost but relatively low operating costs, while LCC has a low capital cost but higher operating costs because it uses more electricity. The costs of the units are shown here. Kim's WACC is 5%. HCC LCC 0 1 2 3 5 -$590,000 -$110,000 -$45,000 -$170,000 -$45,000 -$45,000 -$170,000 -$170,000 -$45,000 -$170,000 -$45,000 -$170,000 a. Which unit would you recommend? 1. Since all of the cash flows are negative, the NPV's cannot be calculated and an alternative method must be employed. II. Since all of the cash flows are negative, the NPV's will be negative and we do not accept any project that has a negative NPV. III. Since we are examining costs, the unit chosen would be the one that had the lower NPV of costs.…arrow_forwardMohave Corporation makes several varieties of beach umbrellas and accessories. It has been approached by a company called Lost Mine Industries about producing a special order for a custom umbrella called the Ultimate Shade (US). The special-order umbrellas with the Lost Mine Company logo would be distributed to participants at an upcoming convention sponsored by Lost Mine. Lost Mine offered to buy 3,200 US umbrellas at a price of $33 each. Mohave currently has the excess capacity necessary to accept the offer. The following information is related to the production of the US umbrella: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost Regular sales price Required: 1. Compute the incremental profit (or loss) from accepting the special order. 2. Should Mohave accept the special order? 3. Suppose the special order had been to purchase 3,700 umbrellas for $29.00 each. Recompute the incremental profit (or loss) from accepting the special…arrow_forwardA component of the direct materials cost requires the nectar of a specific plant in South America. If the company could eliminate this special ingredient, the materials cost would decrease by 25%. However, this would require design changes of $300,000 to engineer a chemical equivalent of the ingredient. Will this design change allow the product to meet its target cost?arrow_forward

- Peter Billington Stereo, Inc., supplies car radios to auto manufacturers and is going to open a new plant. The company is undecided between Detroit and Dallas as the site. The fixed costs in Dalles are lower due to cheaper land costs, but the variable costs in Dallas are higher because shipping distances would increase Detroit $780,000 $22radio Based on the analysis of the volume, after rounding the numbers to the nearest whole number, Dallas is best below and Detroit is best above Fixed costs Variable costs. Dallas $640,000 $30/adio radiosarrow_forwardThe owner of Barb’s Burgers has suggested the firm should invest in more moderntechnology and created a list of potential changes she thinks may be helpful as aninvestment. She has asked you to analyze the four potential choices and comment onwhat this would change in terms of cost: Allow Barb’s Burgers to be delivered via the pre-existing food delivery systems.For example, allow people from Doordash/Uber Eats to pick-up orders and deliverthem. This would require the firm to make some minor changes and result in fewerparking spaces for customers dining at the restaurant. • Question: Argue how each of these is likely to change the cost of the firm once implemented (i.e. are any of these a fixed cost or a variable cost). How this adjust the amount of labour and/or capital currently necessary for the firm? Would the technology be a general technology, labour-saving, or capital-saving? Also mention the parking space.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education