FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Evaluate and comment on businesses financial performance by calculating and analysing 2 profitability, liquidity and solvency ratios based on the information from financial statements Consider whether certain aspects (profitability, liquidity or solvency) can be improved and if so, how? (300 words)

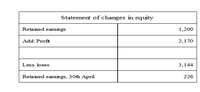

Transcribed Image Text:Statement of changes in equity

Retained eanings

1,200

Add: Proft

2,170

Less: loses

3,144

Retained eanings, 30th April

226

Transcribed Image Text:S tatement of financial position

Statem ent of cash flows

Cash fows from operating activities:

Curert asset:

Cash received

4,910

Cash

1,406

Cash paid

5,504

Recevables

1,460

Net discrease in cash

594

Ivertories

1,880

S tatement of pro fit or loss

Total curent assets

4,746

Revenues:

Servike revenu

1,420

Total 2sseb

4,746

Expenses:

Curent liabilties:

Advertis ing expense

150

Accourts payable

1,840

Rentexpense

450

Accural Account

230

Insurance

210

Total curent liabilities

2,070

Gas expense

125

Net Assets

Electricity expense

256

2,676

Fquity

Depreciation expense

80

Share captal

2,450

Totalexperse

1,271

Profit

149

Retaired eamirgs

226

Total eouity

2.676

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Which of the following is referred to as the Accounting Equation? Assets Liabilities + Equity Equity Liabilities + Assets Liabilities Assets + Equity Assets = Liabilities - Equity = 2. Which of the following make up the Finance Equation? (select all that apply) Revenues = Price x Volume Costs = Fixed + Variable Profit Revenues-Costs Income Sales - COGSarrow_forwarddescribe the roles of the key fi nancial statements (statement of fi nancial position, statementof comprehensive income, statement of changes in equity, and statement of cash fl ows) inevaluating a company’s performance and fi nancial positionarrow_forwardThe profitability of the business will be shown in which of the following print-outs? Question 46 options: Profitablity report Statement of cash flow Income statement Statement of retained earningsarrow_forward

- Which of the basic financial statements is best used to answer the question, "How profitable is the business?" a. Income statement O b. Statement of shareholder's equity O c. Accounts receivable aging schedule O d. Balance sheetarrow_forwardWhat single item on a financial statement of a business do you think has the most impact on growth?arrow_forwardPlease explain why solvency ratios, such as, debt, debt/equity, and time interest earned ratios are important to businesses. Please explain what information is provided by each ratio.arrow_forward

- Mastery Problem: Financial Statement Analysis Question Content Area Liquidity and Solvency Measures Your friend, another accountant, has bet you that with your knowledge of accounting and just the computations for common analytical measures, you can figure out many aspects of a company's financial statements. You take the bet! Match each computation to one of the liquidity and solvency measures in the table. (Hint: Begin by looking for simple computations and identifying the amounts in those computations. Look for other measures that use those amounts.)arrow_forwardNeed helparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education