FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

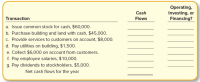

Below are several transactions for Meyers Corporation for 2021.

Required:

1. For each transaction, determine the amount of

2. Calculate net cash flows for the year.

3. Assuming the balance of cash on January 1, 2021, equals $5,400, calculate the balance of cash on December 31, 2021.

Transcribed Image Text:Operating,

Investing, or

Financing?

Cash

Transaction

Flows

a. Issue common stock for cash, $60,000.

b. Purchase building and land with cash, $45,000.

c. Provide services to customers on account, $8,000.

d. Pay utilities on building, $1,500.

e. Collect $6,000 on account from customers.

f. Pay employee salaries, $10,000.

g. Pay dividends to stockholders, $5,000.

Net cash flows for the year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hought Office Machines, Inc.'s accountants assembled the following selected data for the year ended December 31, 2018: E (Click the icon to view the current accounts.) E (Click the icon to view the transaction data.) Requirement 1. Prepare Hought Office Machines, Inc.'s statement of cash flows using the indirect method to report operating activities. List noncash investing and financing activities on an accompanying schedule. Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted.) Hought Office Machines, Inc. Data Table Statement of Cash Flows Year Ended December 31, 2018 Cash flows from operating activities: Transaction Data for 2018: Net income Net income..... $ 60,000 Adjustments to reconcile net income to net cash Purchase of treasury stock. 14,300 provided by (used for) operating activities: Issuance of common stock for cash. 36,600 Loss on sale of equipment. 6,000…arrow_forward125. accountigarrow_forwardPlease read through the questions carefully and enter answers carefully with the table providedarrow_forward

- Please don't give image formatarrow_forwardXYZ Corp. is selling furniture. The comparative balance sheet and income statement are summarized below. You are also given the following additional information:(see detail as attachements) Requirement: Prepare the statement of cash flows using the indirect method for the year ended December 31, current year. Prepare the Cash Flow from Operating Activities (CFO) using the direct method. Based on the cash flow statement, write a short paragraph explaining the major sources and uses of cash by XYZ Corp during the current year.arrow_forwardCromwell Company has the following trial balance account balances, given in no certain order, as of December 31, 2018. Using the information provided, prepare Cromwell’s annual financial statements (omitthe Statement of Cash Flows)arrow_forward

- Minibikes, Inc. identified the following selected transactions that occurred during the year ended December 31, 2024: (Click the icon to view the transactions.) Identify any non-cash transactions that occurred during the year, and show how they would be reported in the non-cash investing and financing Minibikes, Inc. Statement of Cash Flows (Partial) Year Ended December 31, 2024 Non-cash Investing and Financing Activities: Total Non-cash Investing and Financing Activitiesarrow_forwardUsing the information below, complete the operating cash flow section of the Statement of Cash Flows for Peter Ltd using direct method. Your presentation must be consistent with the requirements of AASB107. Ignore tax. Reporting date is 30 June. The balances of selected accounts of Peter Ltd at 30 June 2021 and 30 June 2022 were ($000): 2021 2022 Cash 3850 1200 Inventory 3750 4250 Accounts receivable 2800 3500 Allowance for doubtful debts 320 260 Land 5000 5000 Plant 2750 2800 Accumulated depreciation 490 450 Accounts payable 3200 3500 Rent payable 100 130 Salaries payable 120 190 Share capital 1000 1000 Sales (on credit) 7750 6550 Cost of goods sold 1250 1100 Doubtful debts expense 280 300 Rent expense 540 450 Salaries expense 800 750 Depreciation expense 260 180 Required: Peter Ltd’s operating cash flow section extracted from the Statement of Cash Flows for year ended 30 June 2022 (Direct Method)arrow_forwardThe statement of cash flows is normally a required basic financial statement for each period for which an earnings statement is presented. The statement should include a separate schedule listing the financing and investing activities not involving cash. Required: What are financing and investing activities not involving cash? What are two types of financing and investing activities not involving cash? Explain what effect, if any, each of the following seven items would have on the statement of cash flows. accounts receivable inventory depreciation deferred tax liability issuance of long-term debt in payment for a building payoff of current portion of debt sale of a fixed asset resulting in a loss or gainarrow_forward

- State the section(s) of the statement of cash flows prepared by the indirect method (operating activities, investing activities, financing activities, or not reported) and the amount that would be reported for each of the following transactions: Note: Only consider the cash component of each transaction. Use the minus sign to indicate amounts that are cash out flows, cash payments, decreases in cash, or any negative adjustments. If your answer is not reported in an amount box does not require an entry, leave it blank or enter "0". a. Received $120,000 from the sale of land costing $70,000. Investing activities $fill in the blank 2 Operating activities $fill in the blank 4 b. Purchased investments for $75,000. Investing activities $fill in the blank 6 c. Declared $35,000 cash dividends on stock. $5,000 dividends were payable at the beginning of the year, and $6,000 were payable at the end of the year. Financing activities $fill in the blank 8 d. Acquired equipment for…arrow_forwardHamburger Heaven's income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Income Statement Sales Revenue $1,860 Expenses: Cost of Goods Sold 850 Depreciation Expense Salaries and Wages Expense Rent Expense 150 450 200 Insurance Expense 75 Interest Expense Utilities Expense 45 Net Income 35 Selected Balance Sheet Accounts Current Year Prior Year 72 Inventory Accounts Receivable 55 355 400 Accounts Payable Salaries/Wages Payable Utilities Payable Prepaid Rent Prepaid Insurance 225 260 39 25 25 10 14 TIP: Prepaid Rent decreased because the amount taken out of Prepaid Rent (and subtracted from net income as Rent Expense) was more than the amount paid for rent in cash during the current year. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardUsing the Exhibit below, assume that the balance of Accounts Payable was $60,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $65,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education