ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

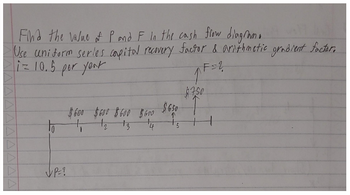

Transcribed Image Text:Find the value of P and F in the cash flow diagram.

Use uniform serles capital recovery factor & arithmetic gradient factor,

i=10.5

per year

F = 2

to

VP=?

$600 $600 $600 $600

¹4

$650

5

$750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 12. Compare the accumulated amount after 5 yrs of P1,000 invested at the rate of 10% compounded a. Annually; b. Semi-annually; c. Quarterly; d. Monthly; e. Daily; and f. Continuously.arrow_forwardQuestion 3 Equal end of year payments of $263.80 each are being made on a $1,000 loan at 15% per year compounded monthly. a. How many payments are required to repay the entire loan? Answer is Blank 1payments b. Immediately after the third payment, what lump sum amount would completely pay off the loan? Answer is $Blank 2 ROUND OFF INTEREST RATE TO 5 SIGNIFICANT PLACES AND YOUR FINAL ANSWER TO 2 DECIMAL PLACES Blank 1 Add your answer Blank 2 Add your answer FROM QUESTION 3: INCLUDE THE CASH FLOW DIAGRAM OF THIS PROBLEM AND ROUND OFF INTEREST RATE TO 5 SIGNIFICANT PLACES AND YOUR FINAL ANSWER TO 2 DECIMAL PLACES.arrow_forwardPlease solve for i, with steps please , thank youarrow_forward

- A friend of yours bought a new sports car with a $5,000 down payment plus a $26,000 car loan that is financed at an interest rate of 0.25% per month for60 months. a. Calculate the required monthly loan payment on the car. b. How much does your friend still owe on the car loan immediately after she makes the 24th monthly payment? c. If, after the 24th payment, she decides to pay $300 more each month, how many months will it take her to payoff the remaining loan she owes? a) The required monthly Payment is $ (round to nearest cent) b. Your friend still owes on the car loan. (Round to the nearest dollar.) c. It will take her months. (Round-up to the nearest month)arrow_forwardLeon and Heidi decided to invest $2,500 annually for only the first eight years of their marriage. The first payment was made at age 25. If the annual interest rate is 12 percentage, how much accumulated interest rate and principal will they have at age 65?arrow_forwardA bond with a face value of $10,000 pays interest of 8% per year. This bond will be redeemed at its face value at the end of ten years. How much should be paid now for this bond when the first interest payment is payable one year from now and a 9% yield is desired?arrow_forward

- N 1. You need $3,000 to buy a new stereo for your car in 3 years. What value you must have now if the compounded annually return is 10%. 2. Your grandfather placed $5,000 in a trust fund for you. In 12 years what will be the worth of the savings. If the estimated rate of return on the trust fund is 8%?+arrow_forwardAre the following cash flow diagrams economically equivalent if the interest rate is 8% per year? The left-hand diagram's discounted value at the EOY 0 is __ M. Please don't use excel and please show your work.arrow_forwardplease solve with full detail so I can understand, Engineering Econarrow_forward

- PLEASE ANSWER ASAP AND NEAT ONLY IF 100% CORRECT!arrow_forwardK 3 Occasionally a savings account may actually pay interest compounded continuously. For each deposit, find the interest earned if interest is compounded (a) semiannually, (b) quarterly, (c) monthly, (d) daily, and (e) continuously. Use 1 year = 365 days. Principal $1045 (a) The interest earned if interest is compounded semiannually is $. (Do not round until the final answer. Then pund to the nearest cent as needed.) (b) The interest earned if interest is compounded quarterly is $. (Do not round until the final answer. Then round to the nearest cent as needed.) Rate 1.6% (c) The interest earned if interest is compounded monthly is $. (Do not round until the final answer. Then round to the nearest cent as needed.). E (d) The interest earned if interest is compounded daily is $. (Do not round until the final answer. Then round to the nearest cent as needed.). Time 3 years (e) The interest earned if interest is compounded continuously is $. (Do not round until the final answer. Then…arrow_forwardOnly typed answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education