ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

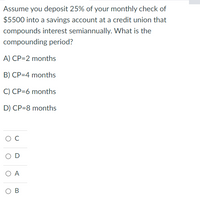

Transcribed Image Text:Assume you deposit 25% of your monthly check of

$5500 into a savings account at a credit union that

compounds interest semiannually. What is the

compounding period?

A) CP=2 months

B) CP=4 months

C) CP=6 months

D) CP=8 months

O D

O A

O B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Show complete solution and do not use excel.arrow_forwardSuppose that under the Plan of Repayment one should pay off the debt in a number of equal end-of-month installments (principal and interest). This is the customary way to pay off loans on automobiles, house mortgages, etc. A friend of yours has financed $15,000 on the purchase of a new automobile, and the annual interest rate is 6% (0.5% per month). a. Monthly payments over a 36-month loan period will be how much? b. How much interest and principal will be paid within three month of this loan?arrow_forward(3) Suppose we invested $20,000 at an annual rate of 5% where interest is compounded continuously. (a) Write down an IVP that describes the amount of money y(t) that you will have in your account after t years. Then, solve the IVP and compute how much money you expect to have in your account after 10 years. (b) Now suppose you want to have $100,000 in your account after those 10 years. In order to accomplish that, you will make yearly deposits of D dollars. Find D, so that y(10) = $100,000. Note that we still have y(0) = $20,000.arrow_forward

- 4. An engineering consultant wants to withdraw $16,000 per year for each of the next 10 years to purchase hardware and software upgrades. How much money must the consultant deposit initially in an account that earns 4% interest, compounded annually?arrow_forwardMany persons prepare for retirement by making monthly contributions to a savings program. Suppose that $2,200 is set aside each year and invested in a savings account that pays 20% interest per year, compounded continuously. a. Determine the accumulated savings in this account at the end of 24 years. b. In Part (a), suppose that an annuity will be withdrawn from savings that have been accumulated at the EOY 24. The annuity will extend from the EOY 25 to the EOY 34. What is the value of this annuity if the interest rate and compounding frequency in Part (a) do not change? Click the icon to view the interest and annuity table for continuous compounding when /-20% per year. CODE a. The accumulated savings amount at the end of 24 years will be $ (Round to the nearest dollar.)arrow_forwardPlease use this formula and show the complete solutionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education