ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

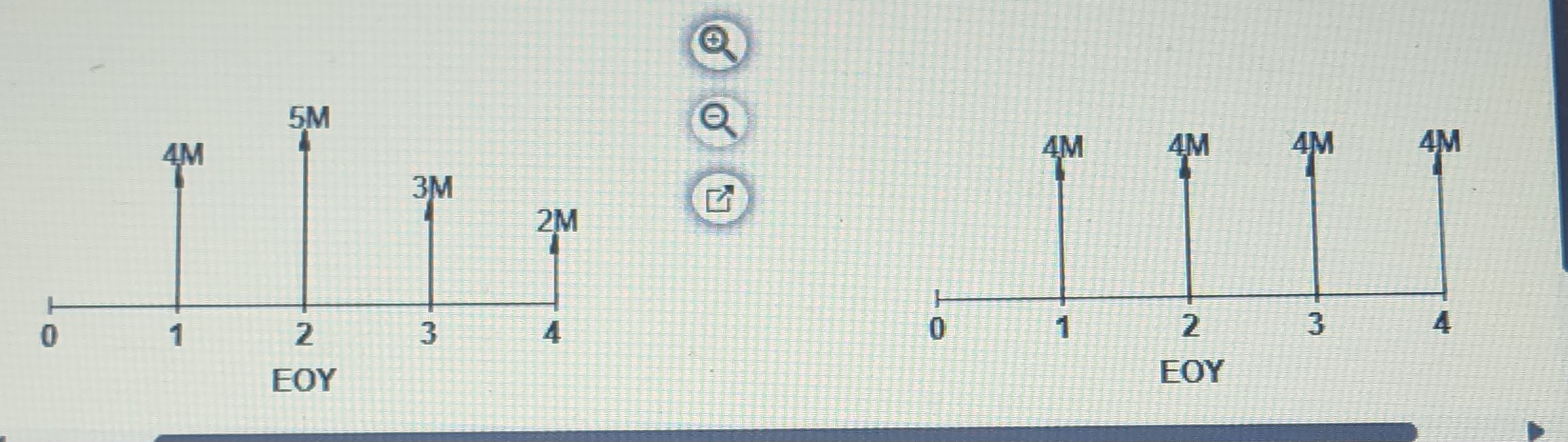

Are the following cash flow diagrams economically equivalent if the interest rate is 8% per year?

The left-hand diagram's discounted value at the EOY 0 is __ M.

Please don't use excel and please show your work.

Transcribed Image Text:Worth Factor

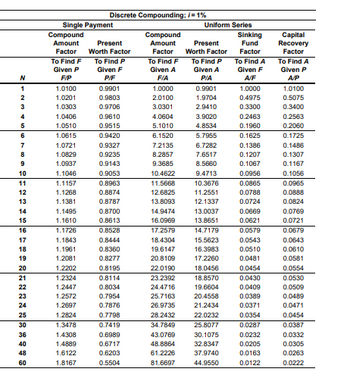

Discrete Compounding;/=1%

Single Payment

Compound

Amount

Factor

Present

Compound

Amount

Uniform Series

Sinking

Factor

Present

Worth Factor

Fund

Factor

To Find F

To Find P

To Find F

To Find P

Given P

Given F

Given A

Given A

Given F

To Find A

Capital

Recovery

Factor

To Find A

Given P

N

F/P

P/F

F/A

P/A

A/F

A/P

1

1.0100

0.9901

1.0000

0.9901

1.0000

1.0100

2

1.0201

0.9803

2.0100

1.9704

0.4975

0.5075

3

1.0303

0.9706

3.0301

2.9410

0.3300

0.3400

4

1.0406

0.9610

4.0604

3.9020

0.2463

0.2563

5

1.0510

0.9515

5.1010

4.8534

0.1960

0.2060

6

1.0615

0.9420

6.1520

5.7955

0.1625

0.1725

7

1.0721

0.9327

7.2135

6.7282

0.1386

0.1486

8

1.0829

0.9235

8.2857

7.6517

0.1207

0.1307

9

1.0937

0.9143

9.3685

8.5660

0.1067

0.1167

10

1.1046

0.9053

10.4622

9.4713

0.0956

0.1056

11

1.1157

0.8963

11.5668

10.3676

0.0865

0.0965

12

1.1268

0.8874

12.6825

11.2551

0.0788

0.0888

13

1.1381

0.8787

13.8093

12.1337

0.0724

0.0824

14

1.1495

0.8700

14.9474

13.0037

0.0669

0.0769

15

1.1610

0.8613

16.0969

13.8651

0.0621

0.0721

16

1.1726

0.8528

17.2579

14.7179

0.0579

0.0679

17

1.1843

0.8444

18.4304

15.5623

0.0543

0.0643

18

1.1961

0.8360

19.6147

16.3983

0.0510

0.0610

19

1.2081

0.8277

20.8109

17.2260

0.0481

0.0581

20

1.2202

0.8195

22.0190

18.0456

0.0454

0.0554

21

1.2324

0.8114

23.2392

18.8570

0.0430

0.0530

22

1.2447

0.8034

24.4716

19.6604

0.0409

0.0509

23

1.2572

0.7954

25.7163

20.4558

0.0389

0.0489

24

1.2697

0.7876

26.9735

21.2434

0.0371

0.0471

25

1.2824

0.7798

28.2432

22.0232

0.0354

0.0454

30

1.3478

0.7419

34.7849

25.8077

0.0287

0.0387

36

1.4308

0.6989

43.0769

30.1075

0.0232

0.0332

40

1.4889

0.6717

48.8864

32.8347

0.0205

0.0305

48

1.6122

0.6203

61.2226

37.9740

0.0163

0.0263

60

1.8167

0.5504

81.6697

44.9550

0.0122

0.0222

Transcribed Image Text:0

1

4M

5M

3M

2M

2

EOY

3

Q

4M

4M

4M

4M

H

4

0

1

2

EOY

لی

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- ☐ Your company plans to buy a new vehicle, with a loan payment of $400 per month for 60 months. You estimate that the cost of gas will be $50 in the first month and increase by 1% each month. What is the present equivalent of the loan and gas costs for the vehicle over the 60 months of the loan, assuming an interest rate of 8%? Typed numeric answer will be automatically saved.arrow_forwardPlease explain step by step (Engineering Econ)arrow_forwardWhat are the Methods for Finding Rate of Return?arrow_forward

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education