ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

A bond with a face value of $10,000 pays interest of 8% per year. This bond will be redeemed at its face value at the end of ten years. How much should be paid now for this bond when the first interest payment is payable one year from now and a 9% yield is desired?

Transcribed Image Text:To Find P

Given F

N

PIF

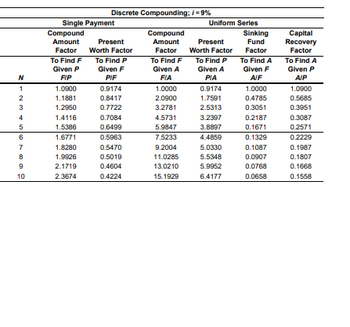

Discrete Compounding; /=9%

Single Payment

Compound

Amount

Factor

To Find F

Given P

FIP

Present

Worth Factor

Compound

Amount

Uniform Series

Sinking

Capital

Factor

Present

Worth Factor

Fund

Factor

Recovery

Factor

To Find F

To Find P

To Find A

To Find A

Given A

Given A

Given F

Given P

FIA

PIA

AIF

AIP

1

1.0900

0.9174

1.0000

0.9174

1.0000

1.0900

2

1.1881

0.8417

2.0900

1.7591

0.4785

0.5685

3

1.2950

0.7722

3.2781

2.5313

0.3051

0.3951

4

1.4116

0.7084

4.5731

3.2397

0.2187

0.3087

5

1.5386

0.6499

5.9847

3.8897

0.1671

0.2571

6

1.6771

0.5963

7.5233

4.4859

0.1329

0.2229

7

1.8280

0.5470

9.2004

5.0330

0.1087

0.1987

8

1.9926

0.5019

11.0285

5.5348

0.0907

0.1807

9

2.1719

0.4604

13.0210

5.9952

0.0768

0.1668

10

2.3674

0.4224

15.1929

6.4177

0.0658

0.1558

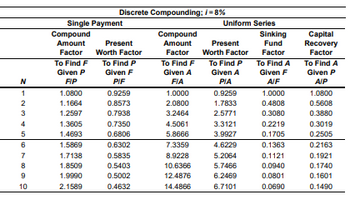

Transcribed Image Text:Compound

Discrete Compounding; /=8%

Single Payment

Compound

Uniform Series

Sinking

Amount

Factor

Present

Worth Factor

Amount

Present

Fund

Capital

Recovery

Factor

Worth Factor

Factor

To Find F

To Find P

To Find F

To Find P

To Find A

Given P

Given F

Given A

Given A

Given F

Factor

To Find A

Given P

N

FIP

PIF

FIA

PIA

AIF

AIP

1

1.0800

0.9259

1.0000

0.9259

1.0000

1.0800

2

1.1664

0.8573

2.0800

1.7833

0.4808

0.5608

3

1.2597

0.7938

3.2464

2.5771

0.3080

0.3880

4

1.3605

0.7350

4.5061

3.3121

0.2219

0.3019

5

1.4693

0.6806

5.8666

3.9927

0.1705

0.2505

6

1.5869

0.6302

7.3359

4.6229

0.1363

0.2163

7

1.7138

0.5835

8.9228

5.2064

0.1121

0.1921

8

1.8509

0.5403

10.6366

5.7466

0.0940

0.1740

9

1.9990

0.5002

12.4876

6.2469

0.0801

0.1601

10

2.1589

0.4632

14.4866

6.7101

0.0690

0.1490

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- The Stafford plan now offers student loans at 4% annual interest. After two years the interest rate will increase to 7% per year. If you borrow $5,500 now and $5,500 each year thereafter for a total of four installments of $5,500 each, how much will you owe at the end of year 4? Interest is computed at the end of each year. Click the icon to view the interest and annuity table for discrete compounding when i= 4% per year. Click the icon to view the interest and annuity table for discrete compounding when i = 7% per year. At the end of year 4 you will owe (Round to the nearest dollar.)arrow_forwardSuppose you borrow $5,000 at 7.25% interest for 14 months. What is the maturity value?arrow_forwardPLEASE ANSWER ASAP AND NEAT ONLY IF 100% CORRECT!arrow_forward

- Joel borrows $60,000 at 7% interest per year for a 10-year period. He can make payments of $450 at the beginning of each month until the loan is closed. He plans on making a balloon payment at the end of the period. What is the expected size of the balloon payment?arrow_forwardFill in the table below when P= $10,000, S= $2,000 (at the end of four years), and i= 15% per year. What is the equivalent uniform CR? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15per year. Complete the accompanying table. (Round to the nearest dollar.) Opportunity Cost of Interest (i=15%) $ Year Investment at Beginning of Year $10,000 Loss in Value of Asset During Year $3,000 Capital Recovery Amount for Yeararrow_forwardYou invest $10,000 in a fund that pays 7% per year for 5 years. How much is in the fund at the end of 5 years if (forgetting leap years and making “convenient” assumptions): a. Compounding is annual? b. Compounding is quarterly? c. Compounding is monthly? d. Compounding is daily?arrow_forward

- How long will it take money to double if it is invested at (A) 11% compounded continuously? (B) 13% compounded continuously? (A) At 11% compounded continuously, the investment doubles in years. (Round to one decimal place as needed.) (B) At 13% compounded continuously, the investment doubles in years. (Round to one decimal place as needed.)arrow_forwardSuppose you start saving for retirement when you are 45 years old. You invest $5,200 the first year and increase this amount by 2% each year to match inflation for a total of 15 years. The interest rate is 7% per year. How much money will you have saved when you are 60 years old? Click the icon to view the interest and annuity table for discrete compounding when i = 2% per year. Click the icon to view the interest and annuity table for discrete compounding when i = 7% per year. When you are 60 years old, you will have saved $. (Round to the nearest dollar.)arrow_forwardDon’t use excel Use formula or factorarrow_forward

- You borrow $20,000 to purchase a car and will repay the loan in uniform monthly payments for the next 48 months. The first payment is due one month after the purchase of the car. If the interest rate is 1% per month, determine the amount of your monthly car payment. Assuming you make each payment as scheduled, how much total interest will you pay over the four-year period?arrow_forwardGurpreet already had a balance of $1700 on her credit card when she used it to purchase items worth another $335. The minimum monthly payment is 3% of the outstanding balance or $30 dollars, whichever is greater, and the interest rate is 19.7%, compounded daily. If Gurpreet pays only the minimum each month, how long will it take her to pay off the balance? How much interest would she end up paying?arrow_forward*Any help with this question would be appreciated, thanks!*arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education