Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

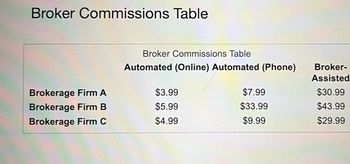

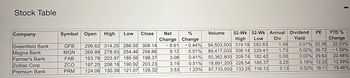

Find the cost, at the day's closing price, for the stock purchase below. Include typical discount broker commissions as described in the table, using Broker B.

Stock Symbol: ZCO

Number of Shares: 70

Transaction Type: Broker-Assisted

The cost for the stock purchase Is (Simplify your answer.)

Transcribed Image Text:Broker Commissions Table

Brokerage Firm A

Brokerage Firm B

Brokerage Firm C

Broker Commissions Table

Automated (Online) Automated (Phone)

$3.99

$5.99

$4.99

$7.99

$33.99

$9.99

Broker-

Assisted

$30.99

$43.99

$29.99

Transcribed Image Text:Stock Table

Company

Greenfield Bank

Magna Bank

Farmer's Bank

Zodiac Corp

Premium Bank

Symbol Open

GFB

MGN

FAB

ZCO

PRM

High

296.62 314.25 286.55 308.14

269.88 278.93 254.46 258.86

193.78 203.97 185.56 198.37

197.25 206.18 190.92 203.23

124.06 130.39 121.07 128.32

Low

Close Net

%

Change Change

-8.61

9.12

3.08

3.19

3.53

-0.44%

0.51%

0.41%

0.51%

1.23%

Volume

YTD%

52-WK 52-Wk Annual Dividend

High Low Div Yield

Change

1.39 0.01% 20.38 22.53%

94,503,500 319.18 282.83

1.73 0.02% 26.72 -1.59%

89,417,000 306.14 229.41

22.48%

0.00

50,362,800 209.74 182.42

12.59%

3.25

18,891,200 226.54 185.37

15.46%

3.13

97,733,500 133.25 116.12

0.00% 29.62

0.18% 12.22

0.02% 18.11

I

PE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If you place an order to buy or sell a share of an open-ended mutual fund during the trading day, the order will be executed at ____________. A. the NAV at the time you place the order B. the NAV calculated at the opening of the next day's trading C. the NAV delayed 15 minutes D. the NAV calculated at the market close on the day E. the market price at the time you place the orderarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardWhich of the following results in increasing basic earnings per share? Select one: a. Paying more than carrying value to retire outstanding bonds. b. Issuing cumulative preferred stock. c. Repurchase of common shares. d. Issuing a 2:1 stock split. e. All of these increase basic earnings per share.arrow_forward

- Calculate the total cost (in $), proceeds (in $), total gain (or loss) (in $), and return on investment for the mutual fund investment. The offer price is the purchase price of the shares, and the net asset value is the price at which the shares were later sold. (Round your return on investment to one decimal place.) Shares OfferPrice TotalCost Net AssetValue Proceeds Per ShareDividends Total Gain(or Loss) Return onInvestment% 500 $10.60 $ $12.80 $ $0.65 $ %arrow_forwardDo not give image formatarrow_forwardLike a share of stock, EFTs trade _____ A) on an exchange B) once per day C) at an average price and depending upon the broker used may be subject to a _____ A) front end load fee B) back end loan fee C) brokerage commissionarrow_forward

- Assume you are given the following abbreviated financial statement. (look at the picture sent) On the basis of this information, calculate as many liquidity, activity, leverage, profitability, and common stock measures as you can. (Note: Assume the current market price of the common stock is $75 per share.)arrow_forwardWhich of the following is a reason why an investor would place a stop buy order on a stock? To ensure a short position is closed out for profit To ensure that the broker executes immediately at the current market price To ensure the stock is sold before its price falls to a specified level To ensure the stock is purchased when its price is risingarrow_forwardPrepare a journal entry that summarizes the declaration and distribution of the stock split if it is not to be effected in the form of a stock dividend. What is the par per share after the split?arrow_forward

- The data of the listed company is attached as a screenshot.Ques) Explain carefully why the March calls are trading at higher prices than the December calls.arrow_forwardYou are given the following information concerning the trades made on a particular stock. Calculate the money flow for the stock based on these trades. Note: Leave no cells blank - be certain to enter "O" wherever required. A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest whole number. Price $ 30.33 Volume 30.36 3,600 30.34 3,100 30.33 3,500 29.34 3,650 30.33 4,400 30.24 4,700 Price Up or Down Price Times Volume Positive Money Flow Negative Money Flow Net Money Flow $ 30.33 30.36 30.34 30.33 29.34 30.33 30.24 Money flow at the end of the dayarrow_forward14) Consider the following 2 tables in Database: Investor and Positions with respective columns. Investor InvestorID InvestorName Country *Assume there is a primary key on InvestorID Positions StockSymbol InvestorID ReportingDate Qty *Assume there is a primary key on StockSymbol, InvestorID, Reportingdate Positions means Stock holdings. Write a queries to a) Find all investors that have positions in more than one stocks on any reporting date. b) Output investors with their positions (they have ever had) and respective dates when they acquired those positions c) Investors that never had a positionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education