Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

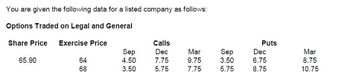

The data of the listed company is attached as a screenshot.

Ques) Explain carefully why the March calls are trading at higher prices than the December calls.

Transcribed Image Text:You are given the following data for a listed company as follows:

Options Traded on Legal and General

Share Price Exercise Price

Calls

Sep

Dec

Mar

65.90

64

4.50

7.75

9.75

68

3.50

5.75

7.75

Sep

3.50

5.75

Puts

Dec

6.75

8.75

Mar

8.75

10.75

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Another way to look at the concept of inventory turnover is by measuring sales per square foot. Taking the average inventory at retail and dividing it by the number of square feet devoted to a particular product will give you average sales per square foot. When you multiply this figure by the inventory turnover rate, you get the annual sales per square foot.arrow_forwardWhich one of the following is an advantage of LIFO? a. In periods of rising prices, less income taxes are paid b. In periods of rising prices, more holding gains are reported in net income c. Record keeping and financial statement preparation are easier d. Conservative income statement and balance sheet disclousures result from falling pricesarrow_forwardIf the bid and ask prices for Amazon.com are $37.79 and $37.85. If these quotes occur when a trade order is made, at what price would a market buy order execute? Would a limit sell order execute with a target price of $37.75?arrow_forward

- Classify this news event as systematic or unsystematic and indicate if prices will increase or decrease. From Marketwatch news on May 17th, 2022: Walmart's reports last quarter earning that are much lower than expected. Select one: a. Systematic; Decrease b. Unsystematic; Increase c. Unsystematic; Decrease d. Systematic; Increasearrow_forward10. When all investors correctly interpret and use their own information, as well as information that can be inferred from market prices or the trades of others, they are said to have: A) sensation seeking expectations. B) positive expectations. C) rational expectations. D) confident expectations.arrow_forwardThe NASDAQ market functions as which type of market? A. over-the-counter B. auction C. standard D. fixed locationarrow_forward

- What are the TRIN Statistics and Cofidence Index and what do their values describe about the bullish and bearish direction of the market?arrow_forwardAnother way to look at the concept of inventory turnover is by measuring sales per square foot. Taking the average inventory at retail and dividing it by the number of square feet devoted to a particular product will give you average sales per square foot. When you multiply this figure by the inventory turnover rate, you get the annual sales per square foot. It is important to know the amount of sales per square foot your merchandise is producing, both on average and annually. These figures should be tracked monthly and compared with industry standards for businesses of similar size and type. You own a large multi product electronics store in a regional mall. The store has 10,200 square feet of selling space divided into five departments. (a) From the table below, calculate the average and annual sales (in $) per square foot. Then calculate the annual sales (in $) for each department and the total sales (in $) for the entire store. (Round your average and annual sales per square…arrow_forwardBased on the diagram, which represents the EOQ model.Which line segment identifies the quantity of safety stock maintained? a. AB b. AE c. AC d. BC e. EFarrow_forward

- 1. Statement 1: Fundamentalists contend that past price movements will indicate future price movements. Statement 2: One of the potential advantages of technical analysis is that it is more accurate than the fundamental analysis because it gives earlier signals than what can be derived through fundamental data. Statement 3: Most technicians feel that since price patterns repeat themselves, a single trading rule is sufficient. Statement 4: Majority of technicians follows the same trading rules and attempt to arrive at a consensus among their rules. a. All statements are false c. Only statement 1 is true b. Only statements 1, 2 and 4 are correct d. Only statement 4 is correctarrow_forwardQuestions: Does a low return on sales indicate a weak company? (Y/N). Explain your answer. Do greater Net sales always result in greater net income? (Y/N) Why? Examine the financial information above and comment on the item that you find interesting.arrow_forwardAs you watch the simulation, please keep in mind that this is a scenario where the system flow rate is R = 9 passengers per minute and the flow time is T = 6 seconds. Question 1: Use Little’s Law to compute the average inventory in this system, measured in “passengers. Question 2: On the basis of this information, would you expect the average inventory to increase or decrease from your answer to question 1? Why? Explain briefly in words. Question 3: Now use Little’s Law to compute the correct inventory when R = 10 passengers per minute. State the new inventory, I. Were you correct in question 2?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education